Get the free Intermediate Accounting Chapter 8 Practice Exercises ...

Show details

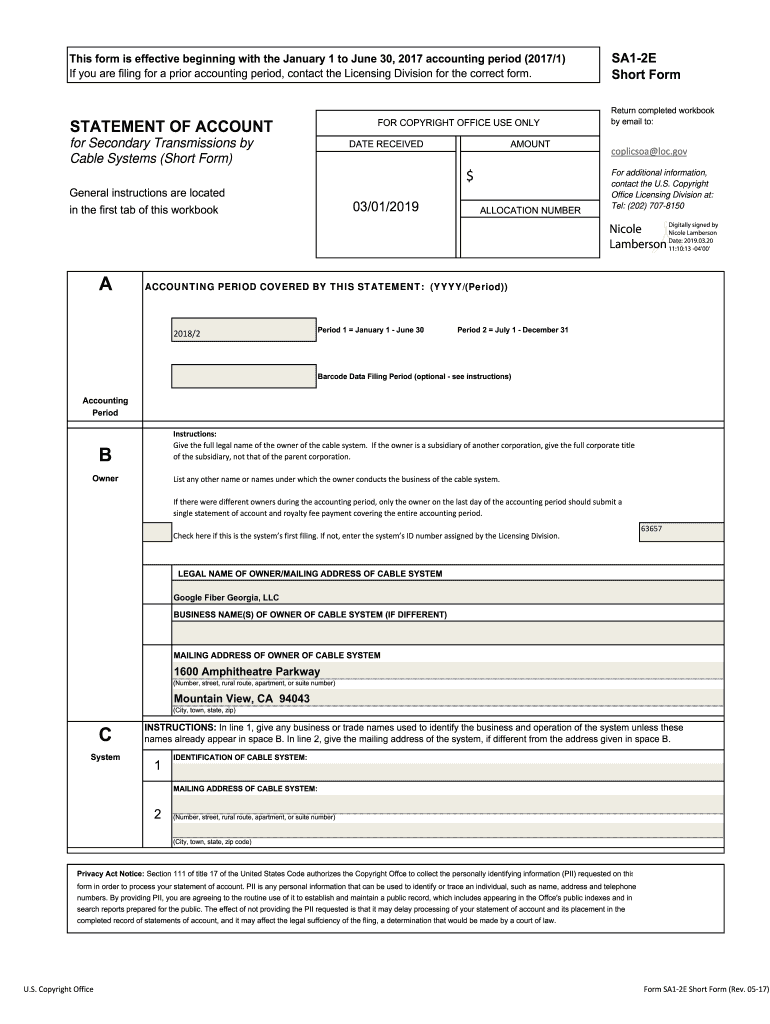

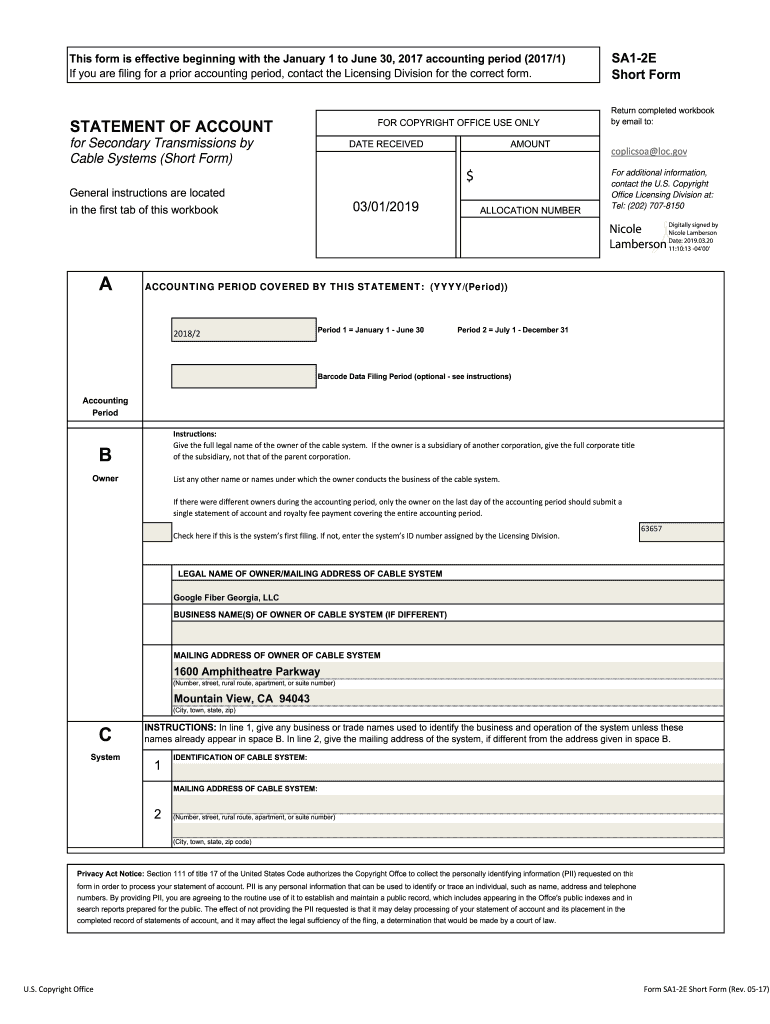

This form is effective beginning with the January 1 to June 30, 2017, accounting period (2017/1)

If you are filing for a prior accounting period, contact the Licensing Division for the correct form.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign intermediate accounting chapter 8

Edit your intermediate accounting chapter 8 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your intermediate accounting chapter 8 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit intermediate accounting chapter 8 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit intermediate accounting chapter 8. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out intermediate accounting chapter 8

How to fill out intermediate accounting chapter 8

01

To fill out intermediate accounting chapter 8, follow these points:

02

Start by reading the chapter thoroughly to understand the concepts and principles discussed.

03

Take notes and highlight important information while reading to help with comprehension and retention.

04

Review any related class lectures or materials provided by your instructor.

05

Work through the practice problems and exercises at the end of each section to reinforce your understanding.

06

Refer to additional resources such as textbooks, online tutorials, or study guides for further clarification if needed.

07

Seek help from your instructor or classmates if you encounter any difficulties or have questions.

08

Plan a study schedule to cover the chapter in manageable portions and allocate sufficient time for revision.

09

Review and summarize the main concepts and key points after completing the chapter.

10

Practice applying the learned concepts through solving additional problems, case studies, or simulations.

11

Prepare for any upcoming assessments or exams by revisiting the chapter materials and practicing previous exam questions.

Who needs intermediate accounting chapter 8?

01

Intermediate accounting chapter 8 is beneficial for the following individuals:

02

Accounting students studying intermediate accounting as part of their curriculum.

03

Accounting professionals who want to refresh their knowledge or deepen their understanding of intermediate accounting principles.

04

Individuals preparing for professional accounting examinations or certifications that cover intermediate accounting topics.

05

Business owners or managers who want to gain a better understanding of financial reporting and analysis.

06

Investors or stakeholders who wish to interpret financial statements and make informed decisions based on accounting information.

07

Anyone interested in learning about advanced accounting concepts, including the recognition and measurement of various financial instruments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my intermediate accounting chapter 8 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign intermediate accounting chapter 8 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit intermediate accounting chapter 8 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your intermediate accounting chapter 8 into a dynamic fillable form that you can manage and eSign from anywhere.

How can I edit intermediate accounting chapter 8 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing intermediate accounting chapter 8, you need to install and log in to the app.

What is intermediate accounting chapter 8?

Intermediate accounting chapter 8 typically covers topics related to financial statement analysis, bonds, and long-term liabilities.

Who is required to file intermediate accounting chapter 8?

Students studying intermediate accounting in a university or college course are typically required to complete and file chapter 8 assignments.

How to fill out intermediate accounting chapter 8?

To fill out intermediate accounting chapter 8, students usually need to solve problems related to bond valuation, interest calculations, and financial ratio analysis.

What is the purpose of intermediate accounting chapter 8?

The purpose of intermediate accounting chapter 8 is to help students understand and apply the principles of accounting related to bonds, long-term liabilities, and financial statement analysis.

What information must be reported on intermediate accounting chapter 8?

Information related to bond valuation, interest expense recognition, amortization of premiums or discounts, and financial ratios must typically be reported on intermediate accounting chapter 8.

Fill out your intermediate accounting chapter 8 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Intermediate Accounting Chapter 8 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.