UT TC-301 2019 free printable template

Show details

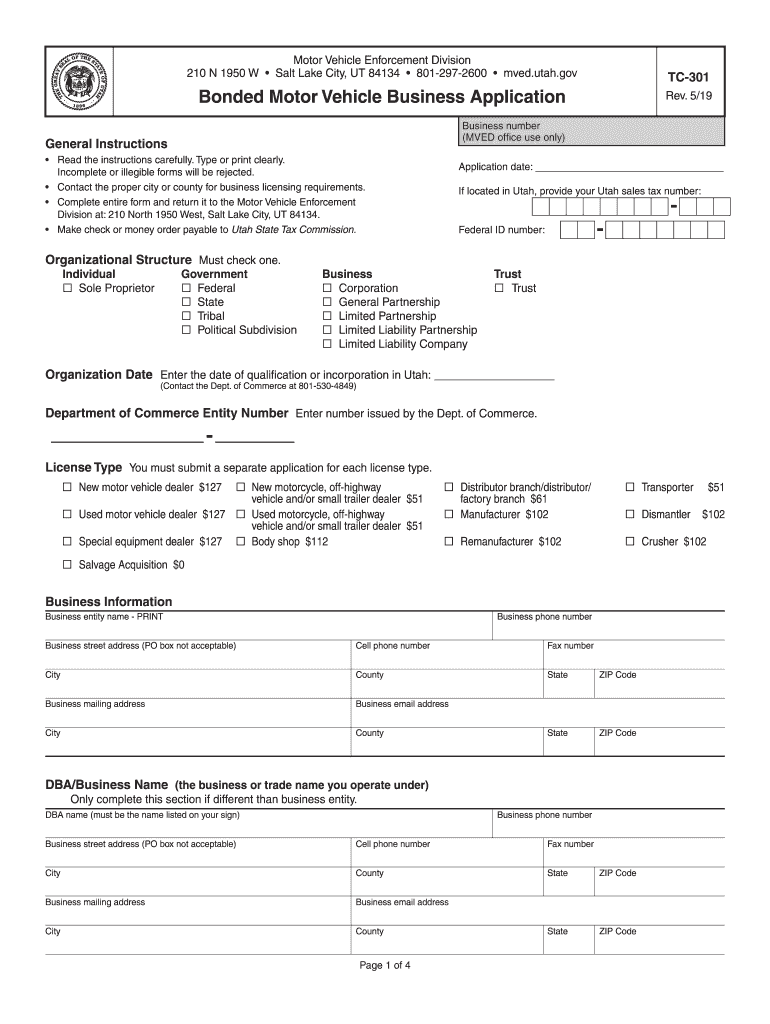

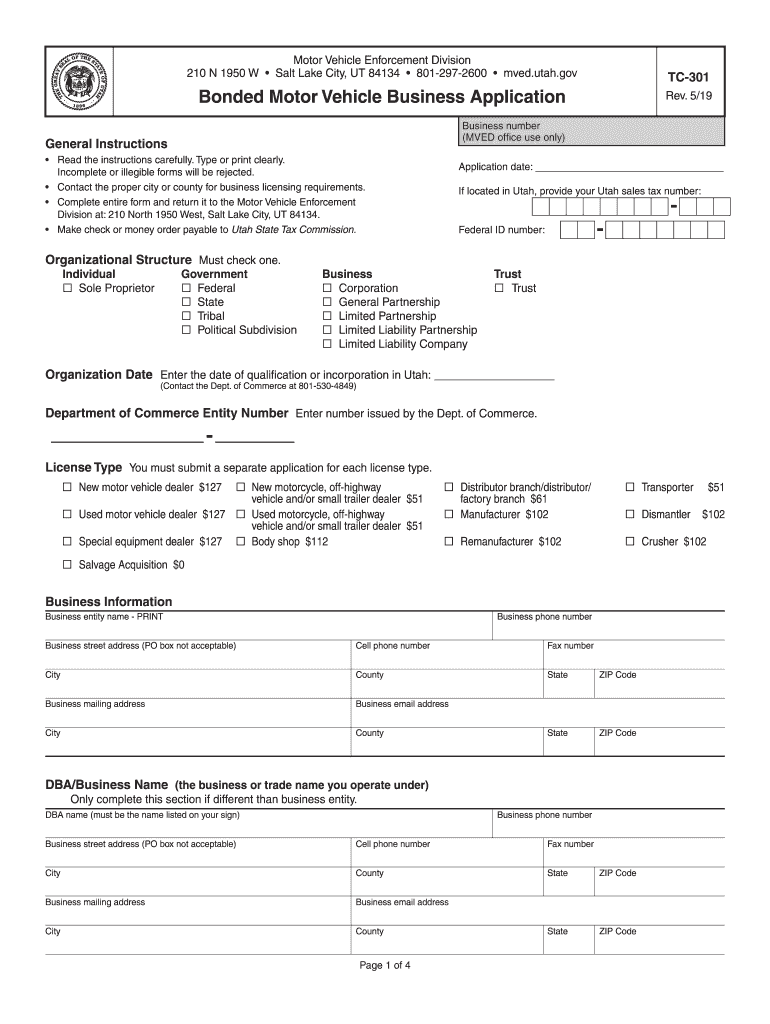

Motor Vehicle Enforcement Division 210 N 1950 W Salt Lake City, UT 84134 8012972600 moved. Utah.govTC301Bonded Motor Vehicle Business Application Rev. 5/19Business number (MOVED office use only)General

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-301

Edit your UT TC-301 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-301 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UT TC-301 online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UT TC-301. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-301 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-301

How to fill out UT TC-301

01

Obtain the UT TC-301 form from the official website or relevant office.

02

Begin filling in your personal information at the top of the form, including your name, address, and contact information.

03

Provide details about the reason for filing the UT TC-301, ensuring clarity and accuracy.

04

Complete any required financial information or supporting documentation as instructed in the form.

05

Review the form for any errors or omissions before submitting.

06

Submit the completed form as directed, either by mail or electronically.

Who needs UT TC-301?

01

Individuals or businesses who are seeking a tax credit or refund.

02

Taxpayers in need of documentation for adjusting their tax obligations.

03

Those who have experienced changes in their financial situation that require official reporting.

Fill

form

: Try Risk Free

People Also Ask about

How to fill out a bill of sale for a car in Utah?

2:16 4:07 How to fill out a Utah car title when selling - YouTube YouTube Start of suggested clip End of suggested clip So this whole section right here needs to be filled out by the seller all this information should beMoreSo this whole section right here needs to be filled out by the seller all this information should be aside. From the signature printed. Then this section here is filled out by the buyer. It's all

Does Utah have a state tax form?

These 2021 forms and more are available: Utah Form TC-40 – Personal Income Tax Return for Residents. Utah Form TC-40A – Income Tax Supplemental Schedule. Utah Form TC-40B – Nonresident or Part-Year Resident Income Schedule.

How many cars can you sell in Utah?

How many cars you can sell in every state/province: South Dakota5Utah2Vermont11Virginia5Washington415 more rows

Does Utah require bill of sale for car?

Although not legally required, the Utah DMV advises and provides private sellers with a bill of sale (form TC-843) to use when selling your car on your own. The bill of sale provides proof the seller has legally transferred ownership of the vehicle to the buyer.

How do I get a sales license in Utah?

Salesperson License Application. Application Form TC-303 must be filled out completely, signed by the dealer and salesperson. Fingerprint Card. All applicants must submit a completed fingerprint card. Fees. Salesperson licenses are renewed annually at the conclusion of the Tax Commission fiscal year, June 30. Waiver.

How do I write a bill of sale for a car in Utah?

The bill of sale should contain: name and address of the buyer; name, address and signature of the seller; complete vehicle description, including the Vehicle Identification Number (VIN); description of trade-in, if any; purchase price of the vehicle; trade-in allowance, if applicable; and. net purchase price.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute UT TC-301 online?

pdfFiller has made it easy to fill out and sign UT TC-301. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit UT TC-301 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your UT TC-301 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my UT TC-301 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your UT TC-301 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is UT TC-301?

UT TC-301 is a tax form used in the state of Utah for reporting certain types of taxes owed by businesses, specifically to detail various transactions and sales.

Who is required to file UT TC-301?

Businesses operating in Utah that engage in sales and certain transactions are typically required to file UT TC-301, particularly those registered for sales and use tax.

How to fill out UT TC-301?

To fill out UT TC-301, businesses must gather information about their taxable sales, exemptions, and any applicable deductions. They should enter this information in the designated fields on the form and ensure all calculations are accurate.

What is the purpose of UT TC-301?

The purpose of UT TC-301 is to provide the Utah State Tax Commission with necessary details related to sales tax owed and to ensure compliance with state tax regulations.

What information must be reported on UT TC-301?

UT TC-301 must report information such as gross sales, taxable sales, non-taxable sales, exemptions claimed, and the total amount of tax due for the reporting period.

Fill out your UT TC-301 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-301 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.