Get the free Texas Hotel Occupancy Tax Exemption Certificate

Show details

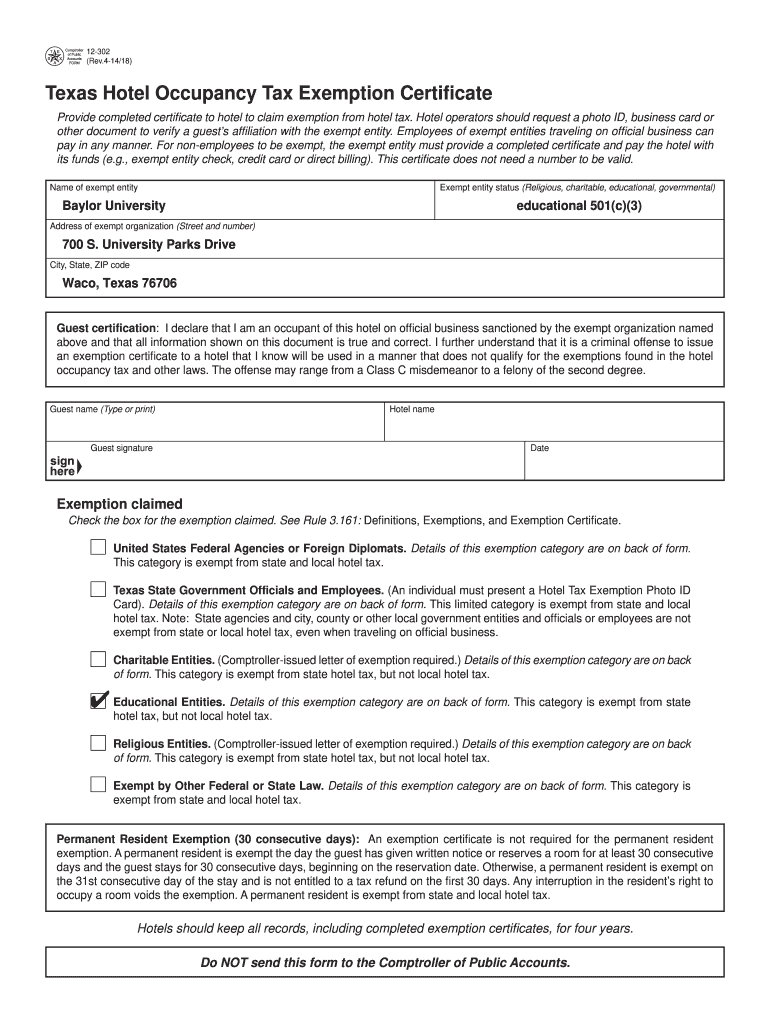

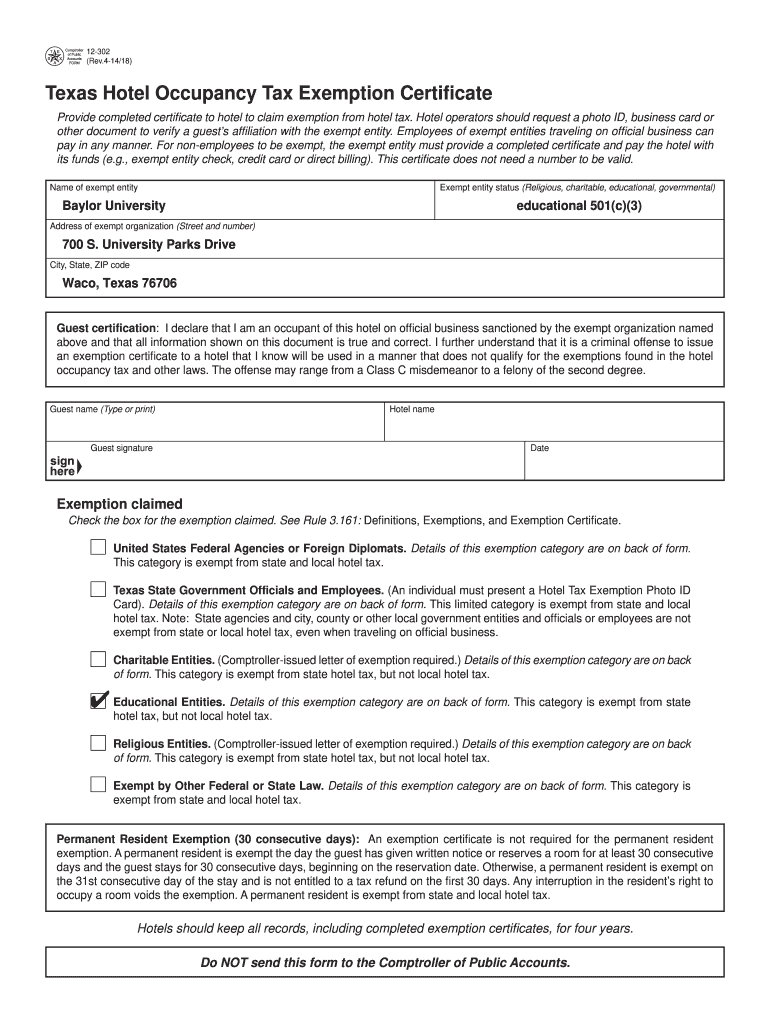

PRINT FORMER FORM12302(Rev.414/18)Texas Hotel Occupancy Tax Exemption Certificate

Provide completed certificate to hotel to claim exemption from hotel tax. Hotel operators should request a photo

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign texas hotel occupancy tax

Edit your texas hotel occupancy tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas hotel occupancy tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas hotel occupancy tax online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit texas hotel occupancy tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas hotel occupancy tax

How to fill out a blowjob:

01

Start by ensuring both you and your partner are comfortable and have consented to engage in this activity.

02

Begin by focusing on foreplay, such as kissing, touching, and caressing your partner, to create arousal and build anticipation.

03

Communication is key - ask your partner for feedback, establish their boundaries, and find out what they enjoy or prefer during oral stimulation.

04

Take it slow and gradually build up intensity - use your hands, tongue, and mouth to stimulate different areas, paying attention to the clitoris, shaft, or other sensitive spots.

05

Experiment with different techniques, such as using varying pressures, speeds, or suction to find what feels pleasurable to your partner.

06

Don't forget to maintain good hygiene - ensure you are clean and fresh before engaging in oral activities.

07

Remember, each person may have different preferences, so communication and focusing on your partner's pleasure is crucial for an enjoyable experience.

Who needs a blowjob:

01

Any consenting adult who enjoys receiving oral stimulation.

02

People who want to add variety and pleasure to their sexual experiences.

03

Individuals who have communicated a desire or interest in receiving oral sex.

04

Couples or partners who want to explore new ways of intimacy and sexual pleasure.

05

People who enjoy giving pleasure to their partner and find it arousing or satisfying.

06

Ultimately, it depends on personal preferences and desires within a consensual and respectful sexual relationship.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the texas hotel occupancy tax electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your texas hotel occupancy tax in minutes.

How do I edit texas hotel occupancy tax straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit texas hotel occupancy tax.

Can I edit texas hotel occupancy tax on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign texas hotel occupancy tax. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is texas hotel occupancy tax?

The Texas hotel occupancy tax is a tax imposed on the rental of rooms in hotels, motels, and similar establishments within Texas. It is typically calculated as a percentage of the room rate charged to guests.

Who is required to file texas hotel occupancy tax?

Anyone who operates a hotel, motel, or similar establishment and rents rooms in Texas is required to file the Texas hotel occupancy tax. This includes businesses that rent out short-term lodging.

How to fill out texas hotel occupancy tax?

To fill out the Texas hotel occupancy tax, you need to complete the appropriate state tax form, report your total revenue from room rentals, and calculate the tax due based on the percentage rate applicable. Ensure all sections of the form are accurately filled with the required information.

What is the purpose of texas hotel occupancy tax?

The purpose of the Texas hotel occupancy tax is to generate revenue for local and state governments, which can be used for various public services, including tourism promotion and infrastructure development.

What information must be reported on texas hotel occupancy tax?

Information that must be reported includes total revenue from room rentals, the amount of occupancy tax collected, the name and address of the hotel or lodging establishment, and details of the filing period.

Fill out your texas hotel occupancy tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Hotel Occupancy Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.