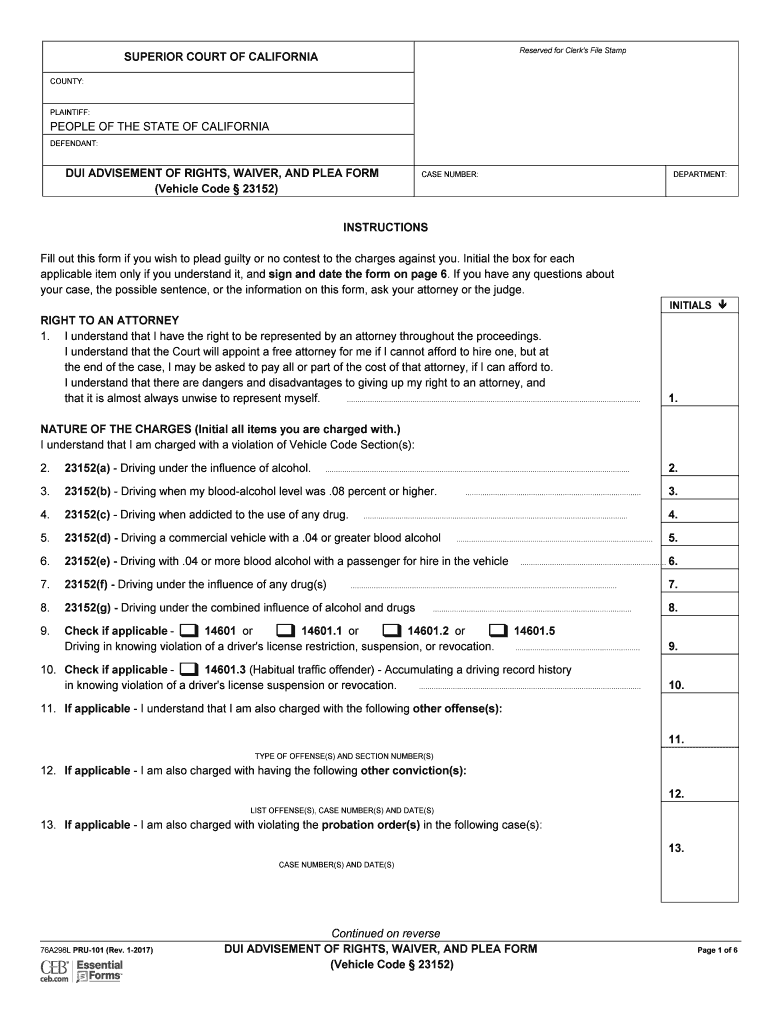

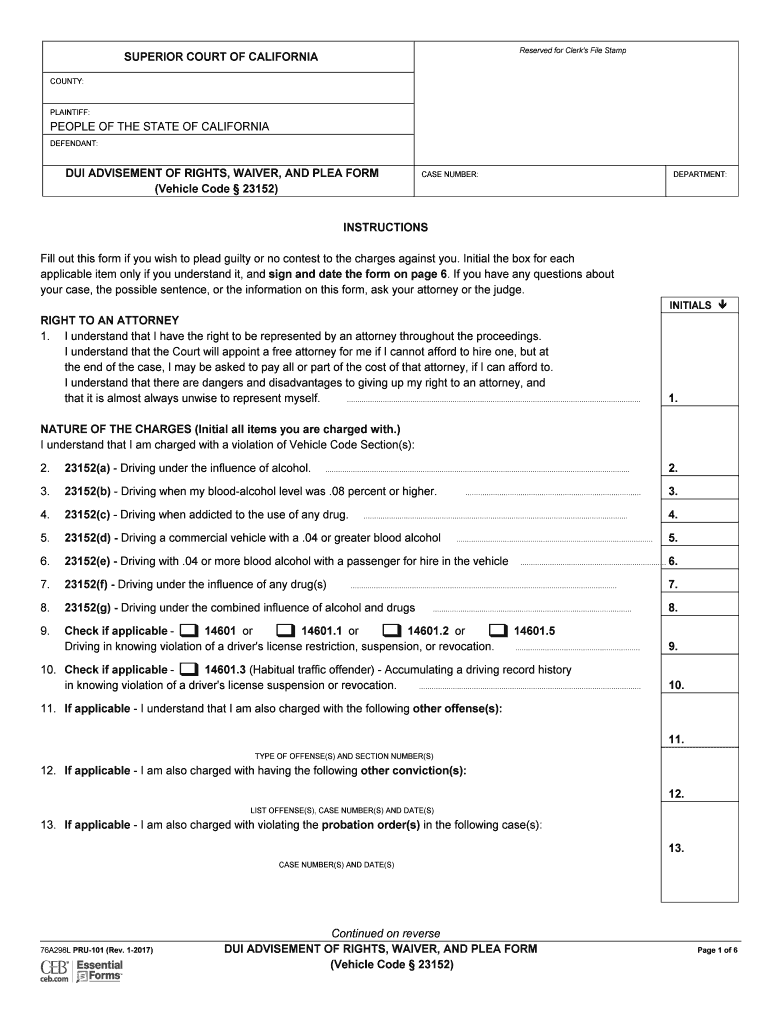

Get the free PRU-101 - DUI Advisement of Rights, Waiver, and Plea Form (Vehicle Code23152)

Show details

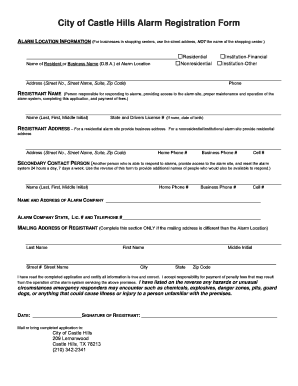

Reserved for Clerk's File StampSUPERIOR COURT OF CALIFORNIA COUNTY: PLAINTIFF:PEOPLE OF THE STATE OF CALIFORNIA DEFENDANT:DUI ADVISEMENT OF RIGHTS, WAIVER, AND PLEA FORM (Vehicle Code 23152)DEPARTMENT:CASE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pru-101 - dui advisement

Edit your pru-101 - dui advisement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pru-101 - dui advisement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pru-101 - dui advisement online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pru-101 - dui advisement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pru-101 - dui advisement

How to fill out CA PRU-101

01

Gather all necessary personal information, including your name, address, and Social Security number.

02

Provide detailed information about your income sources, including employment, investments, and other earnings.

03

Complete the sections related to your deductions and credits, being sure to include any relevant documentation.

04

Review the form for accuracy, ensuring all information is correctly filled out.

05

Sign and date the form before submission.

06

Submit the completed CA PRU-101 to the appropriate agency by the deadline.

Who needs CA PRU-101?

01

Individuals who are filing a California income tax return.

02

California residents seeking tax credits or deductions.

03

Those who have specific income sources that require additional information.

Fill

form

: Try Risk Free

People Also Ask about

Is 23152 a felony or misdemeanor?

Vehicle Code section 23152(b) VC states that it is a misdemeanor to drive with . 08% or more of alcohol in your blood6.

What is the vehicle code 23102 in California?

California Vehicle Code section 23102 (a)(b) makes it unlawful to drive a motor vehicle while under the influence of alcohol. A person who is arrested for driving under the influence must take a chemical test to determine the level of alcohol in the blood.

What is the vehicle code for DUI in California?

California Vehicle Code Section 23152(b) This code states that it is unlawful to operate a motor vehicle with a blood alcohol content (BAC) of 0.08 percent or higher in one's system. Prosecutors will attempt to substantiate this charge by way of chemical test results.

What is the Code vc23152 B 1sp?

(b) It is unlawful for any person who has 0.08 percent or more, by weight, of alcohol in his or her blood to drive a vehicle.

What is the difference between DUI A and DUI B?

23152(a) prohibits driving under the influence of alcohol and/or drugs. V.C. 23152(b) prohibits driving with a blood alcohol content of . 08% or greater.

What is the difference between 23152 A and 23152 B?

23152(a) prohibits driving under the influence of alcohol and/or drugs. V.C. 23152(b) prohibits driving with a blood alcohol content of . 08% or greater.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pru-101 - dui advisement to be eSigned by others?

pru-101 - dui advisement is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I edit pru-101 - dui advisement on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign pru-101 - dui advisement right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete pru-101 - dui advisement on an Android device?

Complete your pru-101 - dui advisement and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CA PRU-101?

CA PRU-101 is a form used by the California Department of Tax and Fee Administration to report and pay personal use tax owed by individuals or businesses for the use of tangible personal property in California.

Who is required to file CA PRU-101?

Individuals or businesses that have purchased items for use in California without having paid the applicable sales tax are required to file CA PRU-101.

How to fill out CA PRU-101?

To fill out CA PRU-101, you need to provide your personal or business information, details of the items purchased, the amount spent, and the use tax owed. Follow the instructions provided on the form for specific guidance.

What is the purpose of CA PRU-101?

The purpose of CA PRU-101 is to enable the reporting and remitting of use tax owed to the State of California for items purchased outside the state and used within California.

What information must be reported on CA PRU-101?

CA PRU-101 requires reporting of the purchaser's information, purchase details, description of the items, amounts paid, and the calculated use tax owed.

Fill out your pru-101 - dui advisement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pru-101 - Dui Advisement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.