Get the free Savings account application - Ulster Bank

Show details

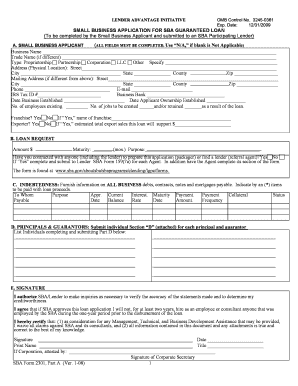

Your Banking Requirements Additional Business Accounts Please note when filling out this form, please use the tab and arrow keys to move between the relevant fields. Ensure you do not use the return

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign savings account application

Edit your savings account application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your savings account application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit savings account application online

Follow the steps down below to benefit from a competent PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit savings account application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out savings account application

How to fill out a savings account application:

01

Begin by gathering the necessary information and documents. This typically includes your personal identification (such as a driver's license or passport), social security number, and proof of address (such as a utility bill or lease agreement).

02

Research different banks or financial institutions that offer savings accounts and choose the one that best fits your needs. Consider factors such as interest rates, fees, and customer reviews.

03

Visit the bank's website or branch to obtain the savings account application form. Some institutions may also provide the option to fill out the application online.

04

Carefully read through the application form and ensure that you understand all the sections and requirements. Pay attention to details such as minimum deposit amounts, account fees, and any specific terms and conditions.

05

Begin filling out the application by providing your personal information, including your full name, date of birth, and contact details. Be sure to double-check that all information is accurate and spelled correctly.

06

Complete the section on employment information, including your current occupation, employer's name, and address. If you are self-employed, provide details about your business.

07

Provide your social security number, as this is required for account identification and to comply with regulatory requirements.

08

Specify the type of savings account you are applying for. This might include options such as a basic savings account, high-interest savings account, or a specialized account for specific goals like retirement or education.

09

If requested, indicate the initial deposit amount you wish to make, keeping in mind any minimum requirements set by the bank or institution.

10

Read and understand the terms and conditions of the savings account, including the rules regarding withdrawals, interest rates, and any associated fees. It is important to be aware of any limitations or restrictions that may apply.

11

Review the completed application form to ensure all the information is accurate and complete. Make any necessary corrections or additions before submitting it to the bank or financial institution.

Who needs a savings account application?

01

Individuals who want to save money and earn interest on their savings can benefit from a savings account. It allows them to set aside funds for future goals, emergencies, or large purchases.

02

Students can open savings accounts to start building their financial foundation. They can deposit money earned from part-time jobs, scholarships, or allowances, helping them develop good money management habits.

03

Parents often open savings accounts for their children, teaching them the importance of saving and helping them accumulate funds for education, future endeavors, or long-term financial security.

04

Businesses and organizations may also require a savings account for various purposes, such as setting aside funds for specific projects, managing cash flow, or earning interest on surplus funds.

05

Individuals planning for retirement can open a savings account to accumulate funds over time, which can then be transferred to a retirement account or used to supplement other retirement savings.

06

Savvy savers who want to take advantage of compound interest can use savings accounts as a tool for growing their wealth over time. By consistently making deposits and earning interest, their savings can grow significantly.

07

Individuals who want to separate their savings from their everyday spending money can benefit from a savings account. It provides a dedicated space for savings and can help them track their progress towards financial goals.

08

Those who value the security of insured deposits may choose to open a savings account at a bank or credit union affiliated with the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA). These organizations provide insurance that safeguards customers' funds up to a certain amount in case of bank failure.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get savings account application?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the savings account application in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit savings account application online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your savings account application to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out savings account application using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign savings account application and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is savings account application?

Savings account application is a form that individuals fill out to open a savings account at a bank or financial institution.

Who is required to file savings account application?

Any individual who wants to open a savings account at a bank or financial institution is required to file a savings account application.

How to fill out savings account application?

To fill out a savings account application, individuals need to provide personal information such as name, address, contact details, and identification documents.

What is the purpose of savings account application?

The purpose of a savings account application is to open a savings account and start saving money in a secure and interest-bearing account.

What information must be reported on savings account application?

Information such as personal details, identification documents, source of funds, and nominee details may need to be reported on a savings account application.

Fill out your savings account application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Savings Account Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.