Get the free Portfolio investment partnership

Show details

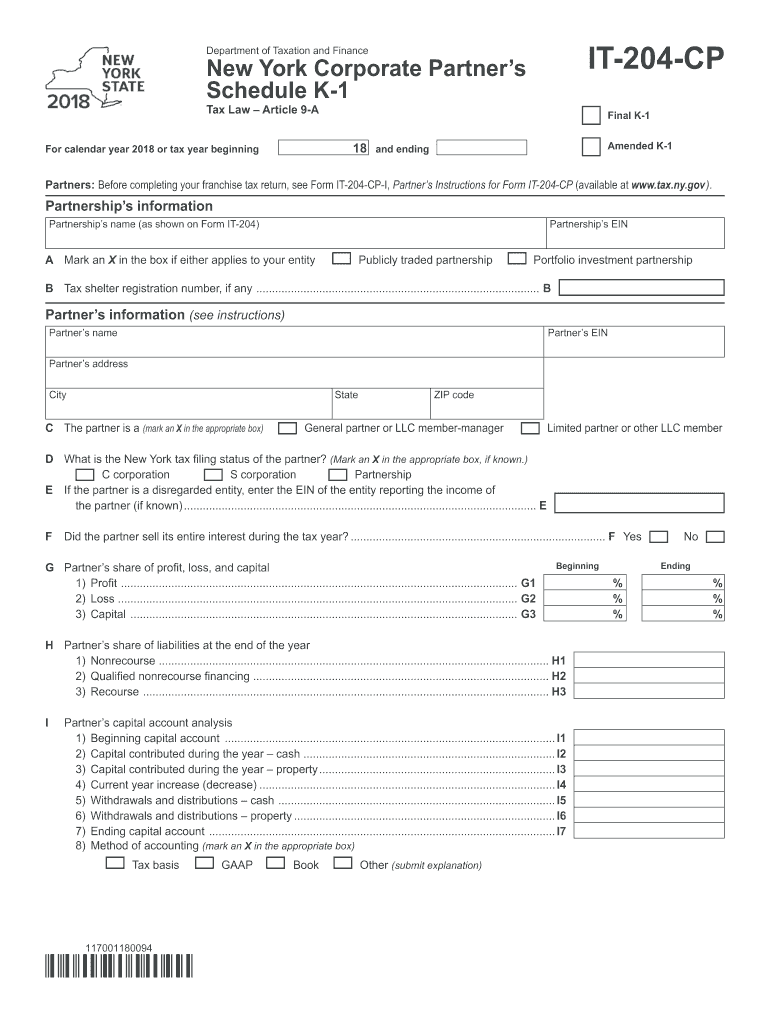

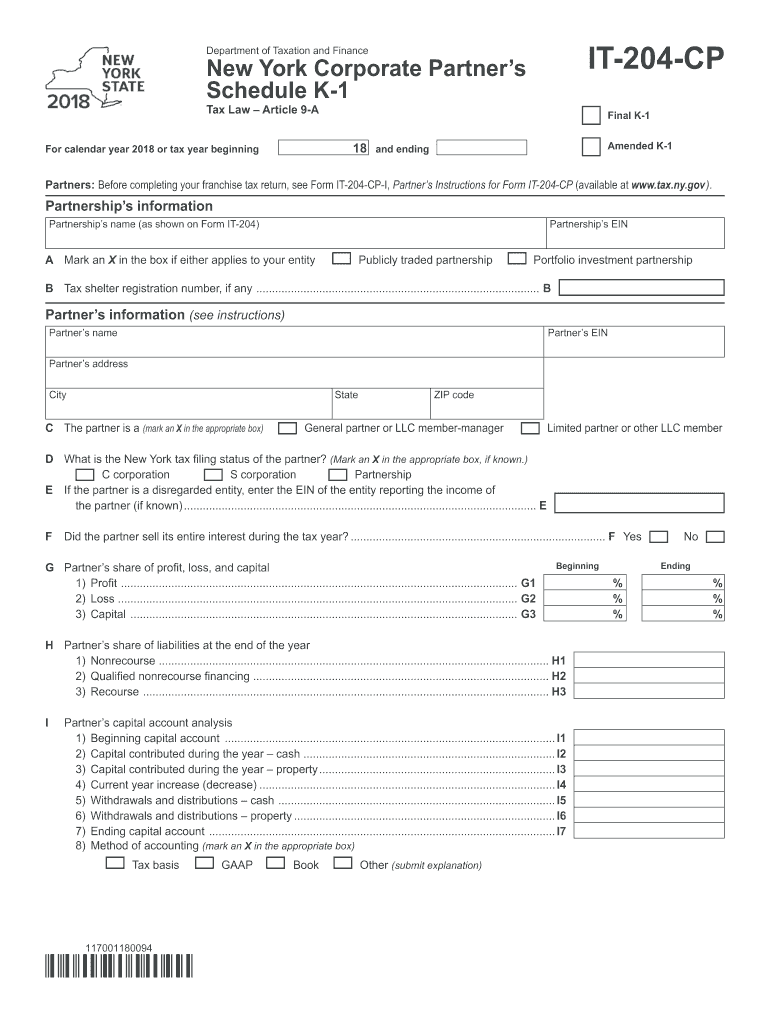

IT204CPDepartment of Taxation and Finance York Corporate PartnersSchedule K1 Tax Law Article 9A18For calendar year 2018 or tax year beginning and endingFinal K1Amended K1Partners: Before completing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign portfolio investment partnership

Edit your portfolio investment partnership form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your portfolio investment partnership form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit portfolio investment partnership online

Follow the steps down below to benefit from a competent PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit portfolio investment partnership. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out portfolio investment partnership

How to fill out portfolio investment partnership

01

Step 1: Determine the purpose of your portfolio investment partnership and set specific investment goals.

02

Step 2: Conduct market research to identify investment opportunities and potential partners.

03

Step 3: Establish a legal entity for your portfolio investment partnership, such as a limited partnership or limited liability company.

04

Step 4: Create a partnership agreement that outlines the roles, responsibilities, and profit-sharing arrangements among the partners.

05

Step 5: Develop an investment strategy that aligns with your goals and risk tolerance.

06

Step 6: Conduct thorough due diligence on potential investments to assess their viability and potential returns.

07

Step 7: Make investment decisions based on your research and due diligence.

08

Step 8: Monitor the performance of your investments regularly and make necessary adjustments to optimize your portfolio.

09

Step 9: Maintain proper record-keeping and adhere to all legal and regulatory requirements.

10

Step 10: Regularly review and evaluate the performance and progress of your portfolio investment partnership.

Who needs portfolio investment partnership?

01

Portfolio investment partnerships are suitable for individuals or entities looking to pool their financial resources with others to maximize investment opportunities.

02

High-net-worth individuals, institutional investors, and private equity firms often utilize portfolio investment partnerships to diversify their investment portfolios and access specialized investment opportunities.

03

Entrepreneurs and businesses seeking to raise capital for expansion or strategic initiatives can also benefit from portfolio investment partnerships.

04

Investors who prefer a collective decision-making process and shared risk in their investment endeavors may find portfolio investment partnerships appealing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete portfolio investment partnership online?

pdfFiller has made filling out and eSigning portfolio investment partnership easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for signing my portfolio investment partnership in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your portfolio investment partnership and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I edit portfolio investment partnership straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing portfolio investment partnership.

What is portfolio investment partnership?

A portfolio investment partnership is a type of investment vehicle where multiple investors pool their resources together to invest in a portfolio of assets.

Who is required to file portfolio investment partnership?

Partnerships that meet certain criteria set by tax regulations are required to file a portfolio investment partnership form with the appropriate authorities.

How to fill out portfolio investment partnership?

To fill out a portfolio investment partnership form, detailed information about the partnership, its assets, income, and expenses must be provided according to the instructions provided by the tax authorities.

What is the purpose of portfolio investment partnership?

The purpose of a portfolio investment partnership is to allow multiple investors to pool their resources and benefit from investing in a diversified portfolio of assets.

What information must be reported on portfolio investment partnership?

Information such as the partnership's assets, income, expenses, and any relevant tax information must be reported on the portfolio investment partnership form.

Fill out your portfolio investment partnership online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Portfolio Investment Partnership is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.