Get the free Form W-5 - rider

Show details

Use Form W-5 if you are eligible to get part of the earned income credit (EIC) in advance with your pay and choose to do so. This form is used to inform your employer about your eligibility for advance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form w-5 - rider

Edit your form w-5 - rider form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form w-5 - rider form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form w-5 - rider online

Follow the guidelines below to benefit from the PDF editor's expertise:

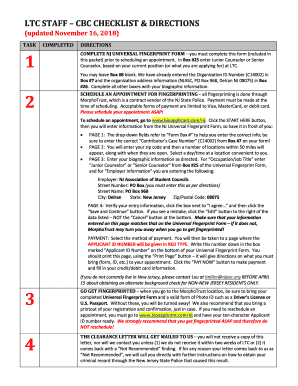

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form w-5 - rider. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form w-5 - rider

How to fill out Form W-5

01

Obtain a copy of Form W-5 from the IRS website or your employer.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate your filing status (single, married, etc.) in the appropriate section.

04

Complete the worksheet on the second page to determine your eligibility for the advance payment.

05

Provide information about your employment and other sources of income.

06

Sign and date the form to certify its accuracy.

07

Submit the completed Form W-5 to your employer or the designated authority.

Who needs Form W-5?

01

Workers with qualifying children who are eligible for the Earned Income Tax Credit (EITC).

02

Individuals who want to receive advance payments of the EITC.

03

Low-income earners who wish to reduce their tax withholding.

Fill

form

: Try Risk Free

People Also Ask about

What is the W-5 form?

The IRS Form W-5 is also known as the Earned Income Credit Advance Payment Certificate. This form was previously used by employees who wanted to get a portion of their Earned Income Credit (EIC) in advance, along with their pay. While IRS Form W-5 was once commonly used, it's no longer in use.

What is a 4506 T form used for?

Use Form 4506-T to request tax return information. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year) must file Form 4506-T to request a return transcript.

What disqualifies you from earned income credit?

If you received more than $11,600 in investment income or income from rentals, royalties, or stock and other asset sales during 2024, you can't qualify for the EIC. This amount increased from $11,000 in 2023. You have to be 25 or older but under 65 to qualify for the EIC.

What is a W-4 form used for?

The W-4 form is the IRS document you complete for your employer to determine how much should be withheld from your paycheck for federal income taxes and sent to the IRS. Accurately completing your W-4 will help you avoid overpaying your taxes throughout the year or owing a large balance at tax time.

Where can I get a W4 V form?

Download Form W-4V: Voluntary Withholding Request from the IRS' website. Then, find the Social Security office closest to your home and fax or mail us the completed form.

What qualifies you for the earned income credit?

Key Takeaways. If you earned less than $66,819 (if Married Filing Jointly) or $59,899 (if filing as Single, Qualifying Surviving Spouse or Head of Household) in tax year 2024, you may qualify for the Earned Income Credit (EIC). These amounts increased from $63,398 and $56,838, respectively, for 2023.

What is a 4506 T form used for?

Use Form 4506-T to request tax return information. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year) must file Form 4506-T to request a return transcript.

What is the form 5 for income tax return?

What is ITR 5? This ITR is meant for Association of Persons (AOPs), LLPs, firms, Body of Individuals (BOIs), Estate of deceased, Artificial Juridical Person (AJP), Business Trust, Estate of Insolvent, and Investment Fund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form W-5?

Form W-5 is used to apply for advance payment of the Earned Income Tax Credit (EITC) for eligible low-income workers.

Who is required to file Form W-5?

Individuals who qualify for the Earned Income Tax Credit and wish to receive advance payments during the year are required to file Form W-5.

How to fill out Form W-5?

To fill out Form W-5, you need to provide personal information such as your name, address, Social Security number, and information about your qualifying children, if any.

What is the purpose of Form W-5?

The purpose of Form W-5 is to enable eligible taxpayers to receive advance payments of the EITC throughout the year rather than waiting until they file their tax return.

What information must be reported on Form W-5?

Form W-5 requires reporting your personal details, including your filing status, number of qualifying children, and income information to determine eligibility for the advance EITC.

Fill out your form w-5 - rider online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form W-5 - Rider is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.