NY F266 2016 free printable template

Show details

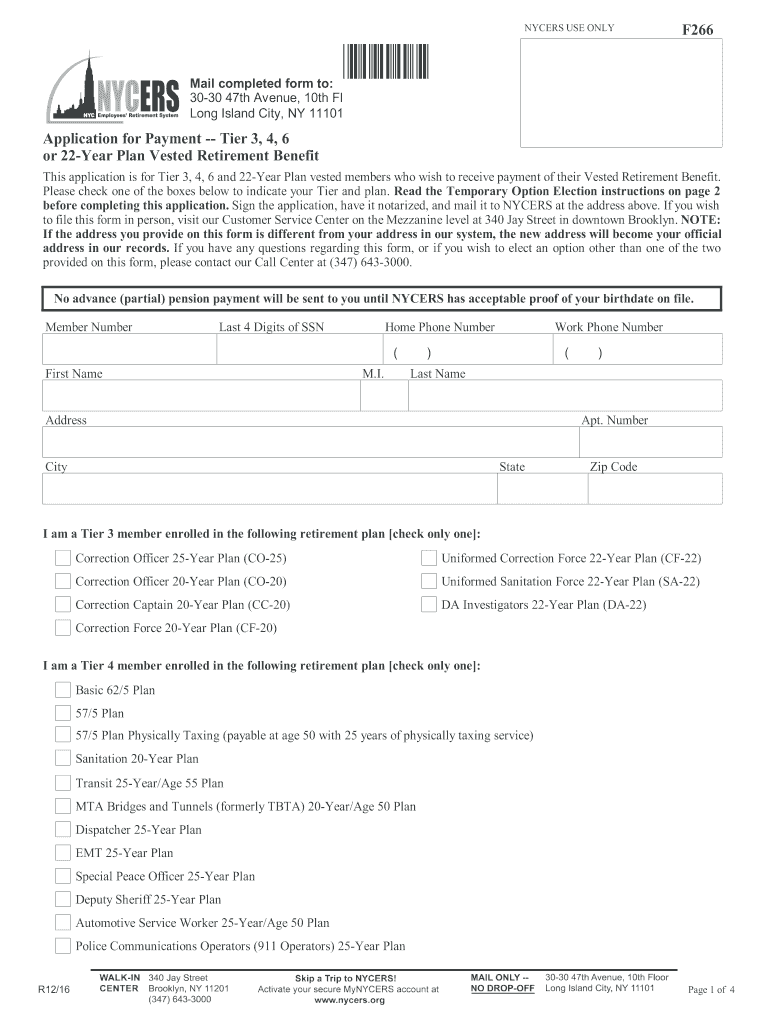

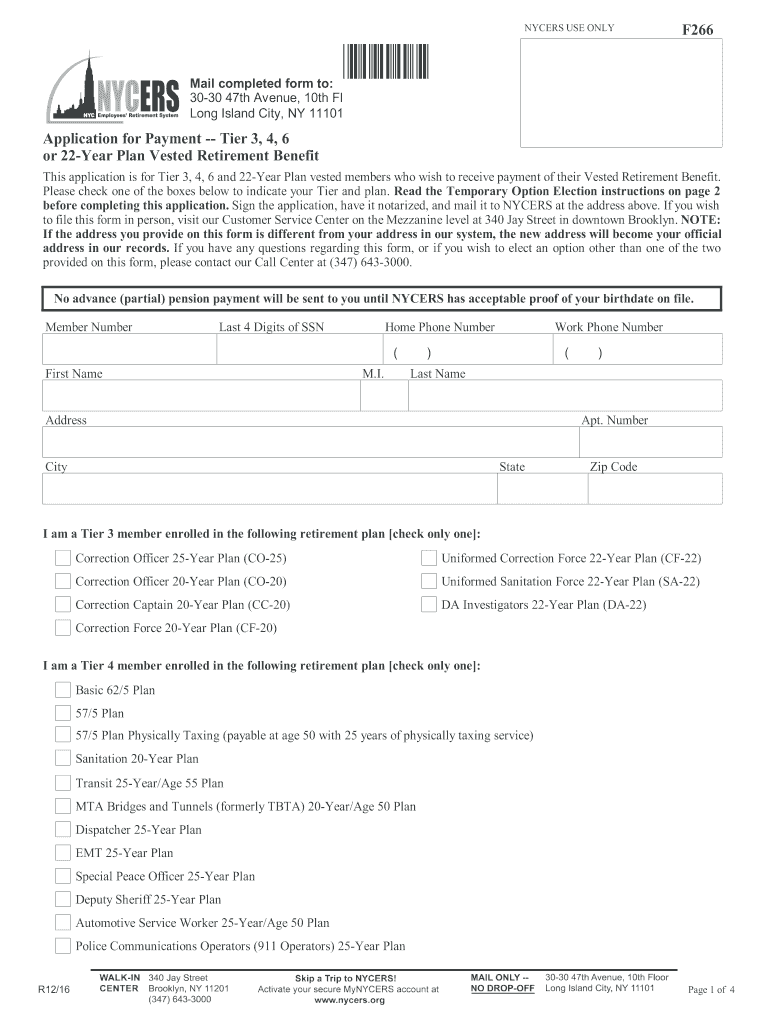

NYC ERS USE ONLYF266×266×Mail completed form to: 3030 47th Avenue, 10th Fl Long Island City, NY 11101Application for Payment Tier 3, 4, 6 or 22Year Plan Vested Retirement Benefit This application

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY F266

Edit your NY F266 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY F266 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY F266 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NY F266. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY F266 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY F266

How to fill out NY F266

01

Obtain the NY F266 form from the New York State Department of Taxation and Finance website.

02

Carefully read the instructions provided with the form.

03

Fill in your personal information, including your name, address, and taxpayer identification number.

04

Provide details about the specific tax issue or request you are addressing with this form.

05

Complete any required schedules or additional forms if applicable.

06

Review your entries for accuracy and completeness.

07

Sign and date the form.

08

Submit the form according to the provided instructions, either by mail or electronically.

Who needs NY F266?

01

Individuals or businesses in New York seeking to address a specific tax issue or request a certain action from the tax authority.

02

Tax professionals or accountants assisting clients with their tax matters in New York.

Fill

form

: Try Risk Free

People Also Ask about

What is the Tier 6 death benefit for NYCERS?

The annual benefit equals 50% of the wages you earned during your last year of service, or your annual wage rate if you had less than one year of service. The deceased member's contributions are not refunded to the beneficiaries.

What is a typical pension payout?

In most states, a final average salary — also called final average compensation — is the average of the last five years of work, or the last three years. Other states use the three or five highest years of salary, rather than the years at the end of your career.

How is NYCERS Tier 4 pension calculated?

Tier 4 Transit 25/55 1.5% times FAS times the number of years of Allowable Service in the Transit Authority in excess of 30 years of such service. In addition to these percentages, a key factor in the calculation of your retirement benefit is your FAS. In general, your FAS is a three-year average of wages earned.

How do I make an appointment with the NYCERS?

If you prefer to meet with an NYCERS Representative in person, you must call the Call Center at (347) 643-3000 to schedule an appointment. Phone and video consultations are also available.

What is the average pension in the NYCERS?

The average pension received was $57,516, compared to $53,539 for last year's retirees; Those who had been employed by the Department of Corrections (DOC) had the highest average pension (among the ten largest agencies), with 400 individuals being paid an average of $82,947.

What is the retirement age for the NYCERS?

Tier 6 Basic Plan members must have a minimum of five years of Credited Service and be at least age 63 to retire and collect an unreduced Service Retirement Benefit. Can I retire earlier than age 63 under the Tier 6 Basic Plan?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NY F266 online?

Filling out and eSigning NY F266 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in NY F266 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit NY F266 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit NY F266 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as NY F266. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is NY F266?

NY F266 is a tax form used in New York for the reporting of certain income and tax credits.

Who is required to file NY F266?

Individuals or entities that have income subject to New York state tax and are claiming specific credits or deductions must file NY F266.

How to fill out NY F266?

To fill out NY F266, taxpayers should gather their income information, tax credits, and deductions, and follow the instructions provided on the form for accurate reporting.

What is the purpose of NY F266?

The purpose of NY F266 is to provide a means for taxpayers to report their income and claim eligible tax credits or deductions to reduce their tax liability.

What information must be reported on NY F266?

NY F266 requires the reporting of income details, tax liability, any applicable credits or deductions, and personal identification information.

Fill out your NY F266 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY f266 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.