Get the free LUMP SUM ADDITIONAL INVESTMENT FORM 5 APPLICATION FORM

Show details

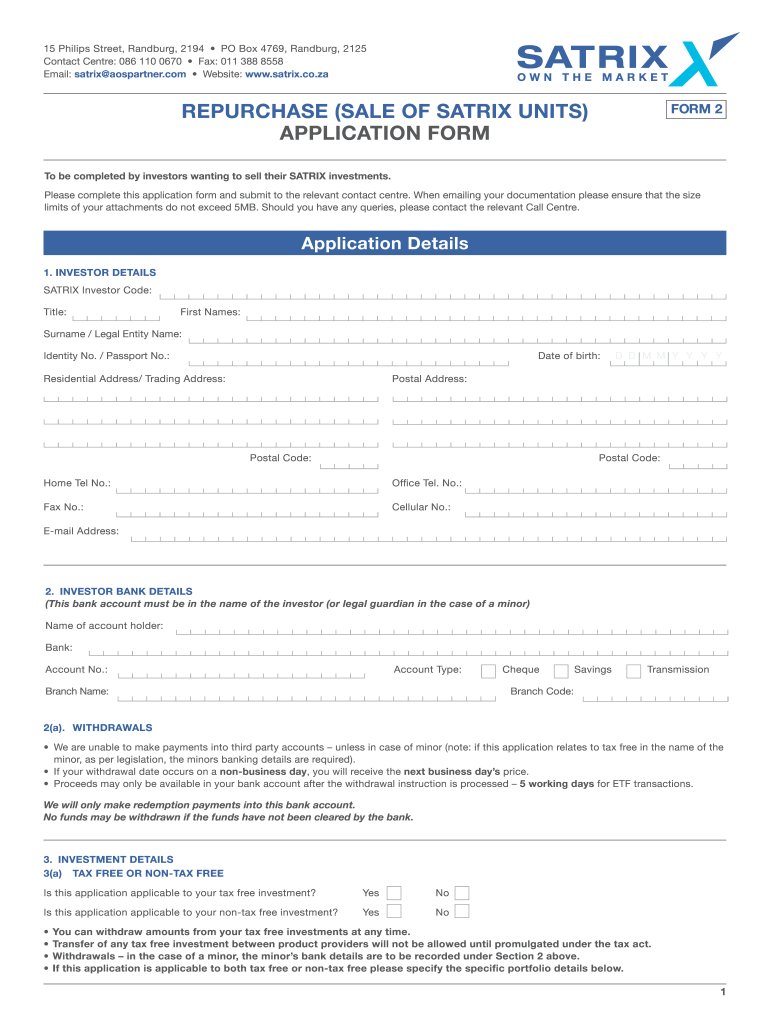

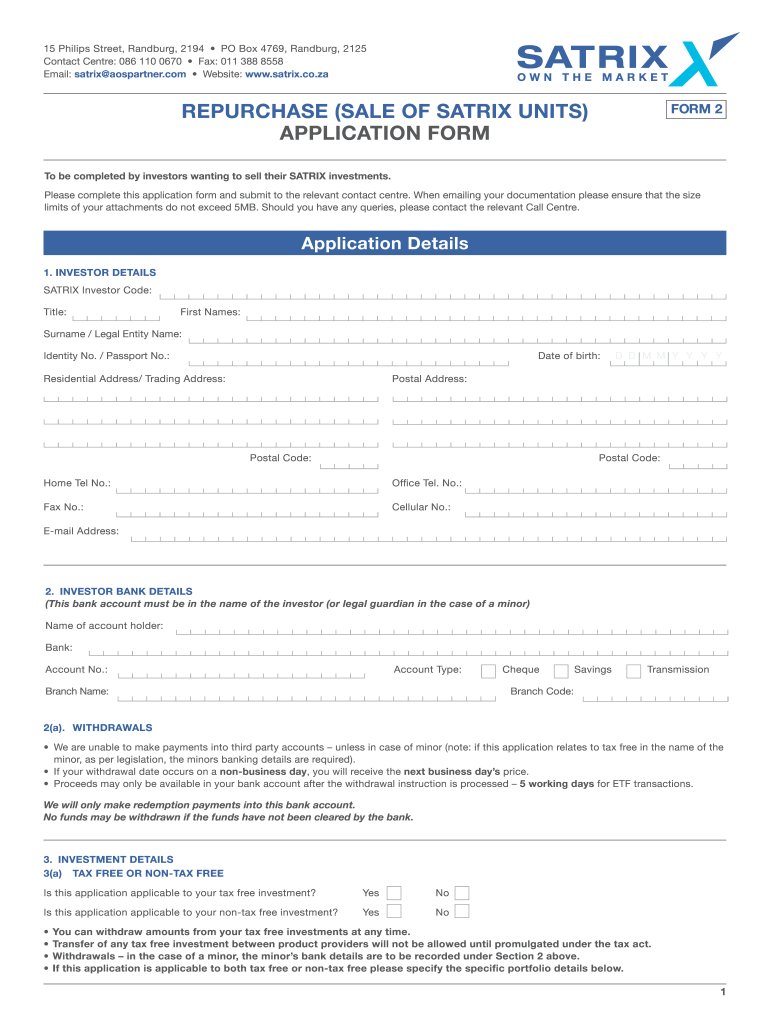

15 Philips Street, Sandburg, 2194 PO Box 4769, Sandburg, 2125 Contact Center: 086 110 0670 Fax: 011 388 8558 Email: matrix aospartner.com Website: www.satrix.co.zaREPURCHASE (SALE OF MATRIX UNITS)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lump sum additional investment

Edit your lump sum additional investment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lump sum additional investment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lump sum additional investment online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit lump sum additional investment. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

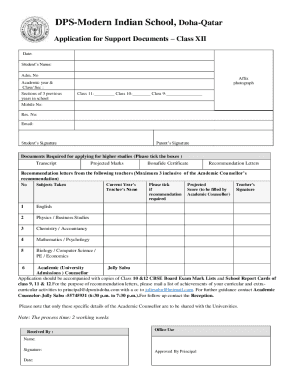

How to fill out lump sum additional investment

How to fill out lump sum additional investment

01

Start by gathering all the necessary information such as the amount you want to invest, the investment options available, and any required documents or forms.

02

Research and evaluate the investment options to determine which one aligns with your financial goals and risk tolerance.

03

Consider consulting with a financial advisor to get personalized advice and guidance on making the best investment decision.

04

Once you have chosen the investment option, complete any required forms or applications accurately and legibly.

05

Make sure to provide all the necessary information, including your personal details, investment amount, and any additional instructions or preferences.

06

Double-check the completed forms for any errors or missing information before submitting them to the appropriate investment provider.

07

If required, arrange for the transfer of funds from your bank account to the investment account. Follow the instructions provided by the investment provider.

08

Keep copies of all the submitted documents and forms for your records.

09

Monitor and review the performance of your investment periodically to ensure it continues to meet your financial objectives.

10

Consider seeking professional advice for any changes or adjustments needed to optimize your investment portfolio.

Who needs lump sum additional investment?

01

Individuals who have a lump sum of money and want to invest it for potential growth or income can benefit from a lump sum additional investment.

02

It is suitable for those who have a financial goal in mind, such as saving for retirement, purchasing a home, funding education expenses, or building wealth over the long term.

03

Lump sum additional investment may also be suitable for individuals who have received an inheritance, a work bonus, or a significant windfall and want to put that money to work for their future financial security.

04

It is important to consider individual circumstances, risk tolerance, investment objectives, and timeframe before making any investment decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete lump sum additional investment online?

Filling out and eSigning lump sum additional investment is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I edit lump sum additional investment on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing lump sum additional investment right away.

How do I complete lump sum additional investment on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your lump sum additional investment. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is lump sum additional investment?

Lump sum additional investment is a one-time extra contribution made to an existing investment account.

Who is required to file lump sum additional investment?

Individuals or entities who want to make a large lump sum contribution to their investment account.

How to fill out lump sum additional investment?

To fill out a lump sum additional investment, one must complete the necessary form provided by the investment company and specify the amount of the additional contribution.

What is the purpose of lump sum additional investment?

The purpose of lump sum additional investment is to boost the value of an existing investment account by making a larger, one-time contribution.

What information must be reported on lump sum additional investment?

The amount of the additional investment, the name of the investment account, and any specific instructions regarding the allocation of the funds.

Fill out your lump sum additional investment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lump Sum Additional Investment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.