Get the free consolidated tax relief form

Show details

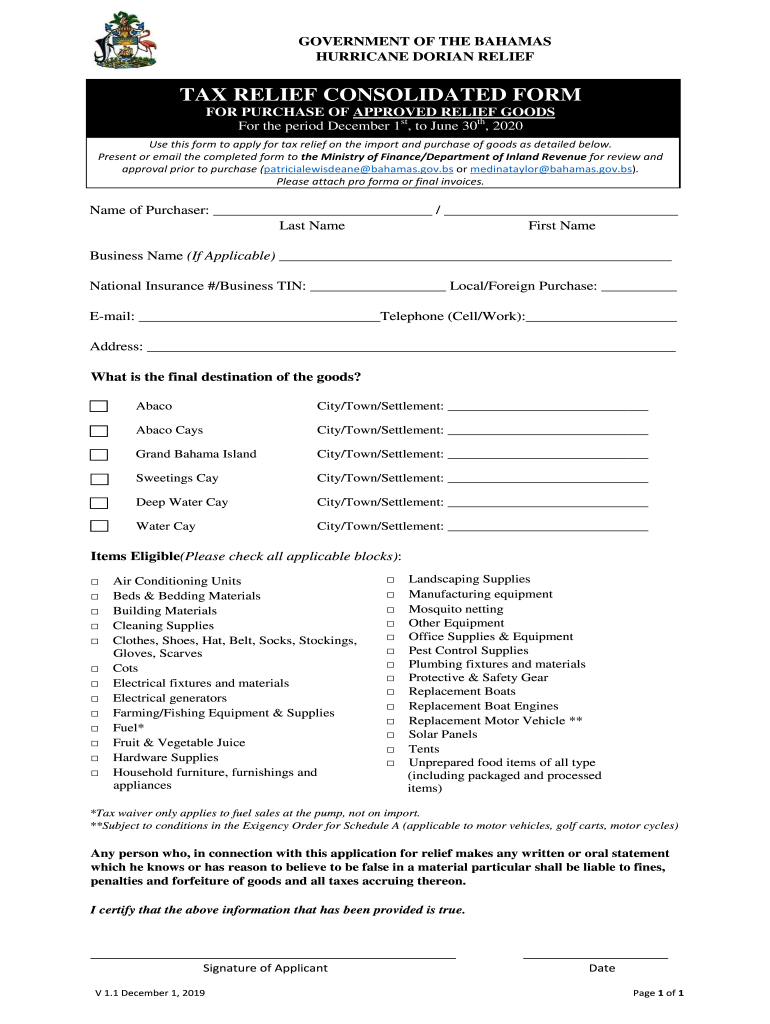

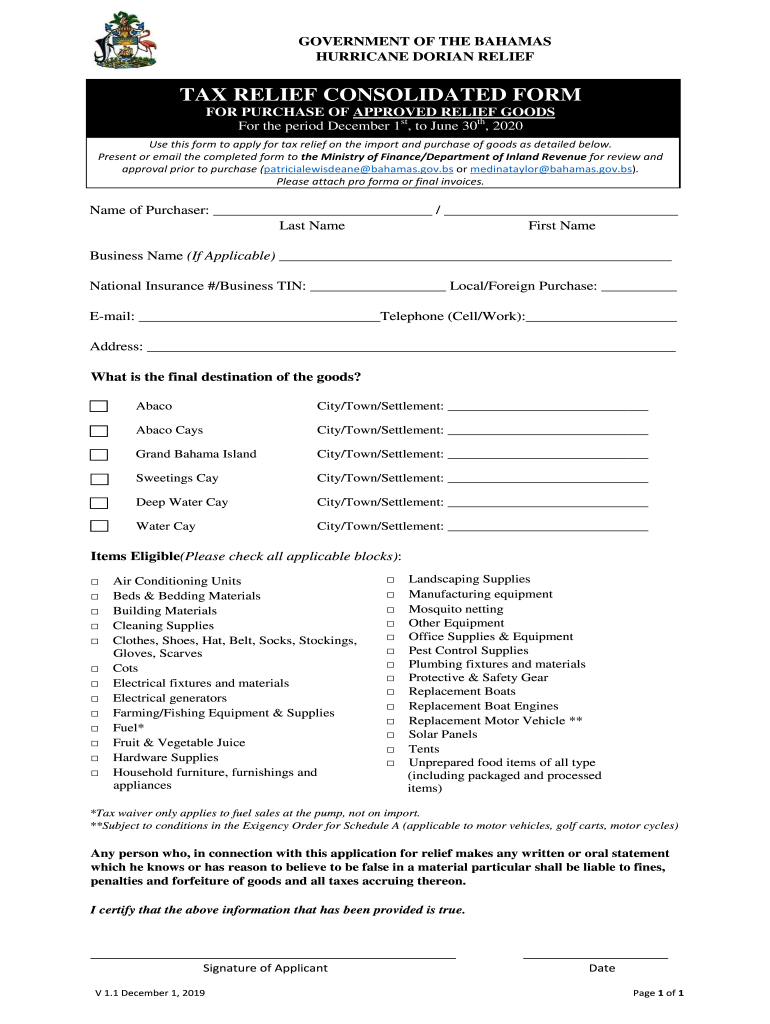

GOVERNMENT OF THE BAHAMAS

HURRICANE DORIAN RELIEF CONSOLIDATED FORM

FOR PURCHASE OF APPROVED RELIEF GOODS

For the period December 1st, to June 30th, 2020

Use this form to apply for tax relief on the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consolidated tax relief form

Edit your consolidated tax relief form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consolidated tax relief form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consolidated tax relief form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit consolidated tax relief form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consolidated tax relief form

How to fill out bahamas consolidated tax relief:

01

Gather all relevant financial documents, including income statements, expense records, and tax forms.

02

Familiarize yourself with the instructions and requirements for completing the bahamas consolidated tax relief form.

03

Determine your eligibility for the relief program based on the specified criteria.

04

Begin filling out the form by entering your personal information, such as name, address, and Social Security number.

05

Provide accurate details regarding your income sources and amounts earned during the relevant tax period.

06

Deduct any allowable expenses or deductions from your total income to calculate your taxable income.

07

Follow the instructions to determine the tax relief amount you are eligible to claim.

08

Review the completed form and ensure all information is accurate and properly entered.

09

Sign and date the form before submitting it to the appropriate tax authorities.

10

Retain a copy of the completed form and any supporting documents for your records.

Who needs bahamas consolidated tax relief:

01

Individuals or businesses in the Bahamas who are experiencing financial hardship and need assistance in fulfilling their tax obligations.

02

Taxpayers who meet the specified eligibility criteria for the bahamas consolidated tax relief program.

03

Individuals or businesses looking to reduce their tax liability and alleviate the financial burden associated with taxes.

04

Those who have experienced significant income loss or financial setbacks and require relief to meet their tax obligations.

05

Any individual or business that wishes to take advantage of the benefits provided by the bahamas consolidated tax relief program.

Fill

form

: Try Risk Free

People Also Ask about

What do you have to declare at Customs Bahamas?

Bahamian Customs allows you to bring in 200 cigarettes, or 50 cigars, or 1 pound (. 45 kg) of tobacco, plus 1 quart (1L) of spirits (hard liquor). You can also bring in items classified as "personal effects" and all the money you wish.

What is a c44 form?

STANDING AUTHORITY IN RESPECT OF SIGNING. DECLARATION OF VALUE. To The Comptroller of Customs, Nassau.

Does Bahamas Customs check bags?

On landing in Nassau, your first processing point is Bahamas Immigration. Collect your checked luggage and then it's off to Bahamas Customs. That's the last step standing between you and your vacation!

What is prohibited to bring into the Bahamas?

Meat, provisions, fruits and vegetables, and any articles intended for human food, which are unfit for human consumption. Indecent or obscene prints, paintings, photographs, books, cards, lithographic or other engravings, or any other indecent or obscene article.

How much is Bahamas customs exemption?

INTERNATIONAL VISITORS All valid receipts for declared items are required. All visitors to the Bahamas are entitled to an exemption of $100.00 on any dutiable article being brought into the Bahamas. Any value in excess of this, the necessary custom duties and taxes will be applicable.

How do I get a customs form?

If you didn't complete your customs form online or are using postage stamps on a package that requires a customs form, visit your local Post Office™ branch, fill out form PS 2976-R, and present your package at the counter to have the clerk create your label.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my consolidated tax relief form in Gmail?

consolidated tax relief form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify consolidated tax relief form without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including consolidated tax relief form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an electronic signature for signing my consolidated tax relief form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your consolidated tax relief form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is bahamas consolidated tax relief?

Bahamas consolidated tax relief refers to a tax benefit system in the Bahamas that allows companies to offset their tax liabilities through various deductions and incentives.

Who is required to file bahamas consolidated tax relief?

Companies operating in the Bahamas that are eligible for tax relief must file for Bahamas consolidated tax relief, particularly those with multiple subsidiaries or within a consolidated group.

How to fill out bahamas consolidated tax relief?

To fill out Bahamas consolidated tax relief, eligible companies must complete the prescribed forms, detailing their subsidiaries, tax computations, and any qualifying deductions. These forms are often available from the Bahamian tax authority or online.

What is the purpose of bahamas consolidated tax relief?

The purpose of Bahamas consolidated tax relief is to promote business growth and investment by allowing companies to manage their tax obligations more efficiently, encouraging reinvestment and economic activity.

What information must be reported on bahamas consolidated tax relief?

Companies must report information including total income, expenses, details of subsidiaries, tax credits claimed, and any other relevant financial data that supports their tax relief claim.

Fill out your consolidated tax relief form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consolidated Tax Relief Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.