FL DoR F-1065 2019 free printable template

Show details

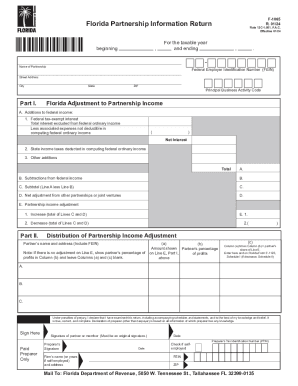

Use parts I and II of the Florida Partnership Information Return to determine each partner s share of the Florida partnership income adjustment. F-1065 R. 01/16 Florida Partnership Information Return Rule 12C-1. 051 Florida Administrative Code Effective 01/16 beginning For the taxable year and ending. A Florida partnership is a partnership doing business earning income or existing in Florida. Note A foreign out-of-state corporation that is a partner in a Florida partnership or a member of a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DoR F-1065

Edit your FL DoR F-1065 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DoR F-1065 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL DoR F-1065 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit FL DoR F-1065. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR F-1065 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DoR F-1065

How to fill out FL DoR F-1065

01

Gather all necessary financial documents and records for the business.

02

Download or obtain the FL DoR F-1065 form from the Florida Department of Revenue website.

03

Fill out the information regarding the business name, address, and federal employer identification number (EIN).

04

Provide the details of each partner's information including their names, addresses, and Social Security numbers or EINs.

05

Input the income, deductions, and other relevant financial data on the form as per the instructions provided.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form, ensuring that all partners have agreed to the information submitted.

08

Submit the form by the due date, either electronically or by mailing it to the appropriate address.

Who needs FL DoR F-1065?

01

Any partnership operating in Florida that needs to report its income and pay taxes.

02

Partnerships with income that must file an informational return for tax purposes.

03

Partners in a partnership looking to report their respective shares of income or loss.

Fill

form

: Try Risk Free

People Also Ask about

Who Must File Florida form F-1120?

Corporations or other entities subject to Florida corporate income tax must file Florida Form F-1120 unless qualified to file Florida Corporate Short Form Income Tax Return, Florida Form F-1120A.

Do I need to file a 1065 and k1?

Only one Form 1065 is required per partnership or LLC, but each member of the entity must complete their own Schedule K-1 to file with the 1065 tax form, as well as their personal tax returns.

Is a 1065 the same as a K-1?

Schedule K-1 is a schedule of IRS Form 1065, U.S. Return of Partnership Income. It's provided to partners in a business partnership to report their share of a partnership's profits, losses, deductions and credits to the IRS.

Who must file form 1065?

Who Needs to File Form 1065? All business partnerships must file Form 1065. A partnership is a legal entity type formed by two or more individuals who sign a partnership agreement to run a business as co-owners.

Who needs form 1065?

Partnerships use Schedule B-1 (Form 1065) to provide information applicable to certain entities, individuals, and estates that own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership.

What is the Form 1065?

Partnerships use Schedule B-1 (Form 1065) to provide information applicable to certain entities, individuals, and estates that own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership.

Does everyone have a Schedule K-1 form 1065?

If you're a partner in a partnership that is required to file a tax return for the year, then you will receive a K-1 that lists your portion of the partnership reportable items.

Do I have to pay Florida income tax?

Florida Tax Rates, Collections, and Burdens Florida does not have a state individual income tax. Florida has a 5.50 percent corporate income tax. Florida has a 6.00 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 7.01 percent.

What happens if you don't file taxes in Florida?

Tax Penalties in Florida If you don't owe any tax, the late filing penalty is $50 per month, up to a total of $300. If you have an unpaid tax bill for 90 days, the FL DOR will add an administrative collection processing fee of 10% of the balance.

What is form F 1065?

Form 1065. 2021. U.S. Return of Partnership Income. Department of the Treasury. Internal Revenue Service.

What is the difference between a K-1 and a 1065?

The K-1 form is also used to report income distributions from trusts and estates to beneficiaries. A Schedule K-1 document is prepared for each relevant individual (partner, shareholder, or beneficiary). A partnership then files Form 1065, the partnership tax return that contains the activity on each partner's K-1.

Do I need to file a Florida income tax return?

Since Florida does not collect an income tax on individuals, you are not required to file a FL State Income Tax Return. However, you may need to prepare and e-file a Federal Income Tax Return.

Who must file Florida Form F-1065?

Who Must File Florida Form F-1065? Every Florida partnership having any partner subject to the Florida Corporate Income Tax Code must file Florida Form F-1065. A limited liability company with a corporate partner, if classified as a partnership for federal tax purposes, must also file Florida Form F-1065.

Does every LLC have to file a 1065?

Filing Requirements for an LLC Partnership The LLC must file an informational partnership tax return on tax form 1065 unless it did not receive any income during the year AND did not have any expenses that it will claim as deductions or credits.

How do I know if I need to file a 1065?

If your business is a partnership or LLC, Form 1065 is one of the most important annual tax forms you must complete for the IRS. You can find the 1065 tax form on the IRS website. If your partnership has more than 100 partners, you're required to file Form 1065 online.

How much money do you have to make in Florida to file taxes?

For 2022, individuals making more than $12,950 and married couples filing jointly earning more than $25,900 are required to file taxes.

Does everyone have a Form 1065?

Who needs to file a 1065? All partnerships in the United States must submit one IRS Form 1065 unless there was no income or expenditures for the year. The IRS defines a “partnership” as any relationship existing between two or more persons who join to carry on a trade or business.

Who needs to file a FL tax return?

Taxpayers are required to file Florida corporate income tax returns electronically if they were required to file federal income tax returns electronically, or if $20,000 or more in Florida corporate income tax was paid during the prior state fiscal year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in FL DoR F-1065?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your FL DoR F-1065 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I edit FL DoR F-1065 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing FL DoR F-1065.

Can I edit FL DoR F-1065 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign FL DoR F-1065 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is FL DoR F-1065?

FL DoR F-1065 is a tax form used in Florida for partnerships to report income, deductions, and other financial information to the state.

Who is required to file FL DoR F-1065?

Partnerships doing business in Florida or earning income from Florida sources are required to file FL DoR F-1065.

How to fill out FL DoR F-1065?

To fill out FL DoR F-1065, you need to provide information on income, deductions, the partnership's name, and details on each partner. Follow the instructions included with the form carefully.

What is the purpose of FL DoR F-1065?

The purpose of FL DoR F-1065 is to report the financial activities of a partnership for state tax purposes and to ensure that tax obligations are met.

What information must be reported on FL DoR F-1065?

FL DoR F-1065 requires reporting of partnership income, deductions, partner information, and other pertinent financial details.

Fill out your FL DoR F-1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DoR F-1065 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.