Get the free AS A NONPROFIT CORPORATION

Show details

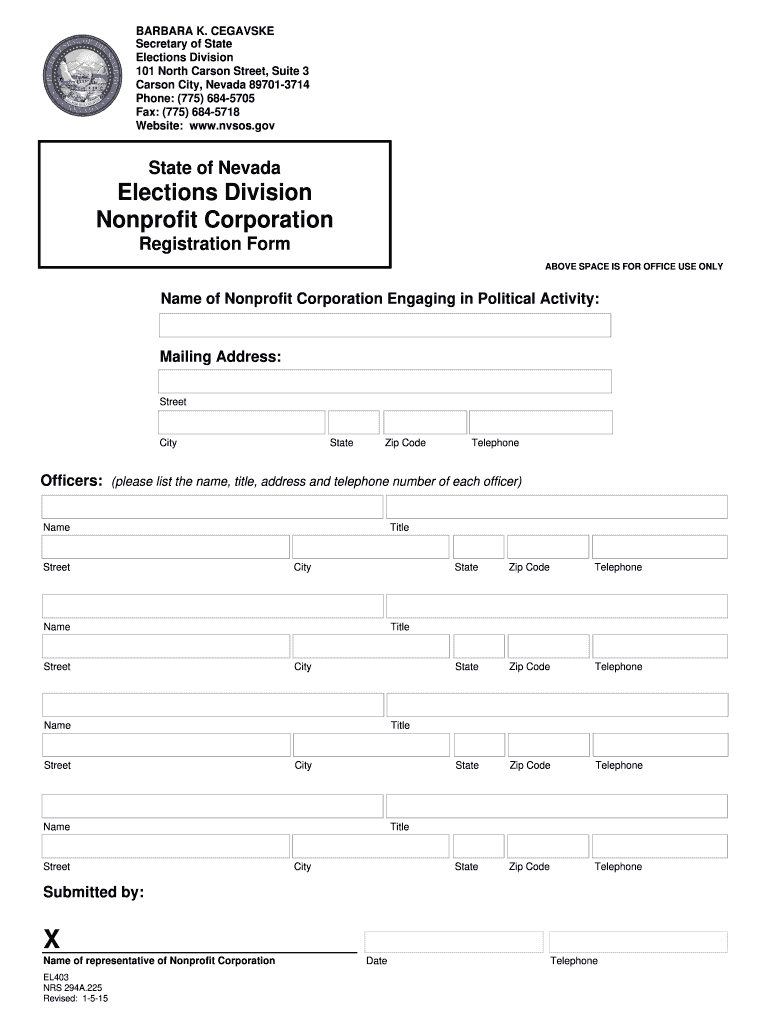

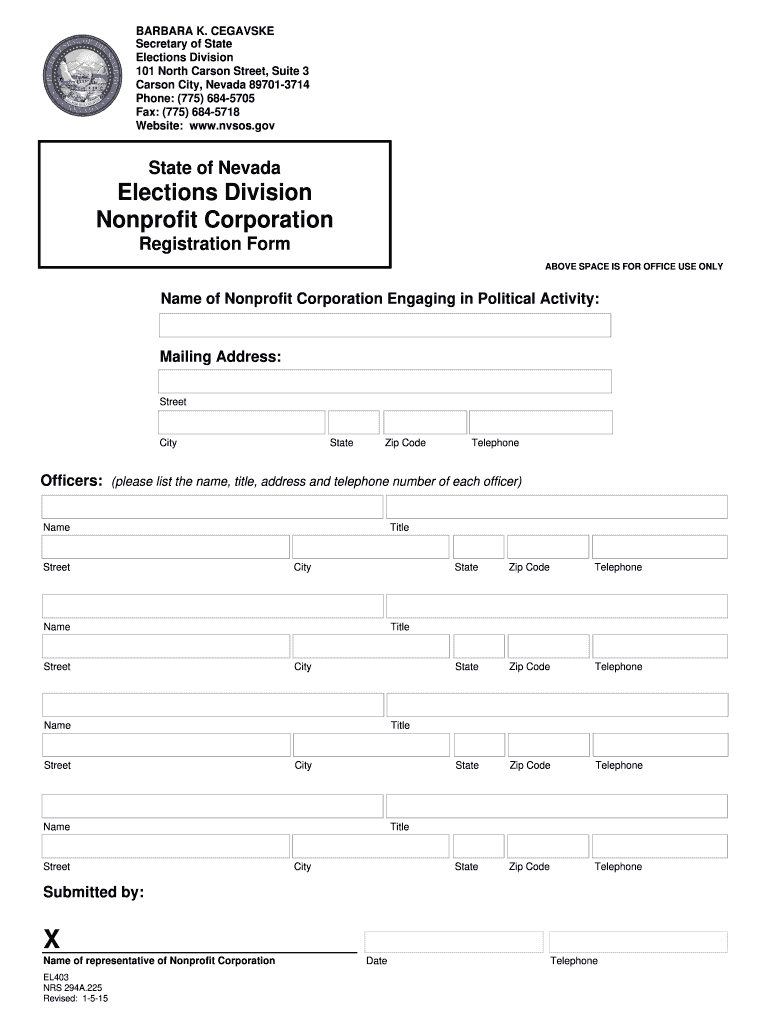

BARBARA K. CEASE

Secretary of State

Elections Division

101 North Carson Street, Suite 3

Carson City, Nevada 897013714

Phone: (775) 6845705

Fax: (775) 6845718

Website: www.nvsos.govState of NevadaElections

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign as a nonprofit corporation

Edit your as a nonprofit corporation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your as a nonprofit corporation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit as a nonprofit corporation online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit as a nonprofit corporation. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out as a nonprofit corporation

How to fill out as a nonprofit corporation

01

Choose a legal structure for your nonprofit corporation. Common options include a trust, association, or corporation.

02

Choose a unique name for your nonprofit corporation and check if it is available with the appropriate government agency.

03

Prepare and file the necessary articles of incorporation with the state in which you plan to operate.

04

Develop bylaws that outline the rules and procedures for your nonprofit corporation.

05

Hold an initial meeting of the board of directors to elect officers, adopt bylaws, and discuss important organizational matters.

06

Obtain any necessary licenses or permits to operate as a nonprofit corporation.

07

Apply for tax-exempt status with the Internal Revenue Service (IRS) by filing Form 1023 or Form 1023-EZ.

08

Establish a system for financial recordkeeping and ensure compliance with applicable state and federal regulations.

09

Develop a fundraising strategy and explore grants and other funding opportunities.

10

Regularly review and update your nonprofit corporation's activities, finances, and legal compliance.

Who needs as a nonprofit corporation?

01

Nonprofit corporations are generally needed by organizations or groups that operate for charitable, educational, religious, scientific, literary, or public safety purposes.

02

Specific examples of who may need a nonprofit corporation include charities, schools or educational institutions, religious organizations, scientific research institutes, libraries, museums, animal welfare organizations, and various community service groups.

03

Nonprofit corporations provide a legal framework that allows these organizations to operate and receive tax-exempt status, allowing them to raise funds, seek grants, and engage in activities that benefit the community or a designated cause.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the as a nonprofit corporation form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign as a nonprofit corporation and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit as a nonprofit corporation on an iOS device?

Use the pdfFiller mobile app to create, edit, and share as a nonprofit corporation from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out as a nonprofit corporation on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your as a nonprofit corporation. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is a nonprofit corporation?

A nonprofit corporation is an organization that is formed for purposes other than generating profit, typically focused on social, charitable, educational, or religious objectives.

Who is required to file as a nonprofit corporation?

Any group of individuals wanting to form a nonprofit entity for public benefit is required to file as a nonprofit corporation, including charities, educational institutions, and religious organizations.

How to fill out as a nonprofit corporation?

To fill out the necessary documentation as a nonprofit corporation, the founders must complete and file articles of incorporation with the appropriate state authority, often including bylaws and an application for tax-exempt status.

What is the purpose of a nonprofit corporation?

The purpose of a nonprofit corporation is to operate for public or community benefit rather than for private profit, often focusing on charitable, educational, religious, or cultural goals.

What information must be reported on as a nonprofit corporation?

A nonprofit corporation must report information such as financial statements, activities undertaken, board members, and compliance with IRS regulations if it is tax-exempt.

Fill out your as a nonprofit corporation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

As A Nonprofit Corporation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.