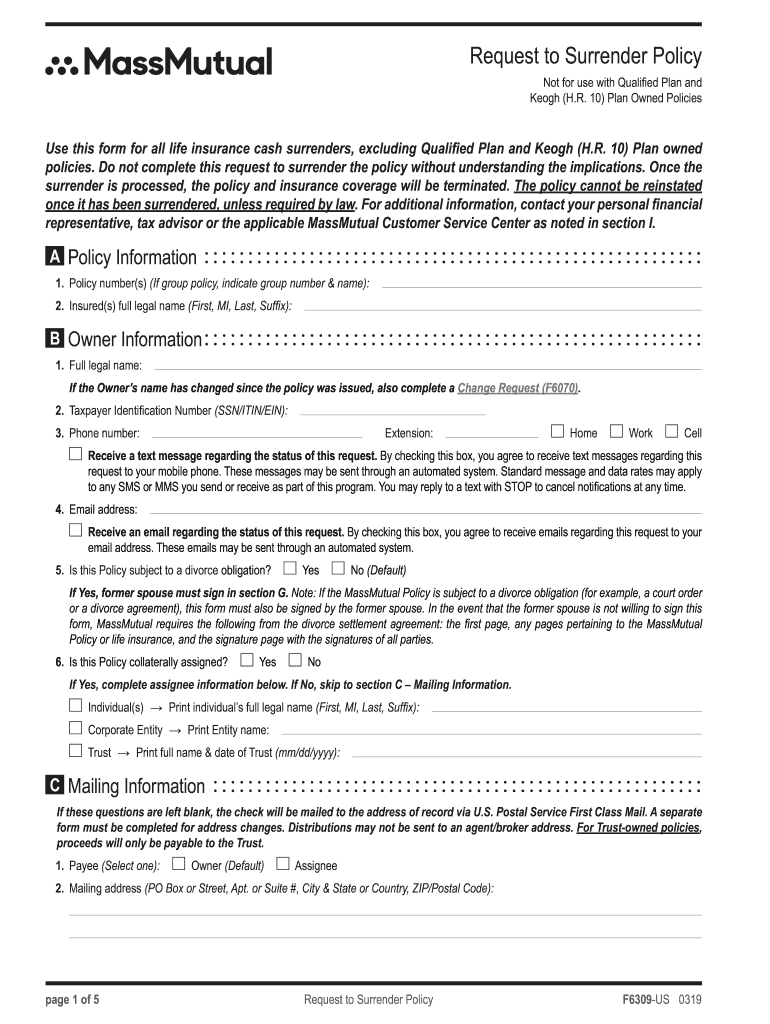

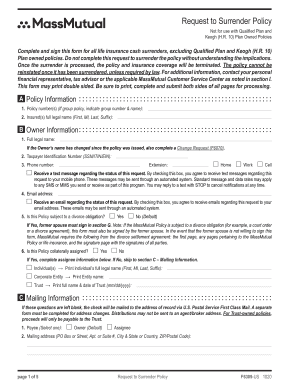

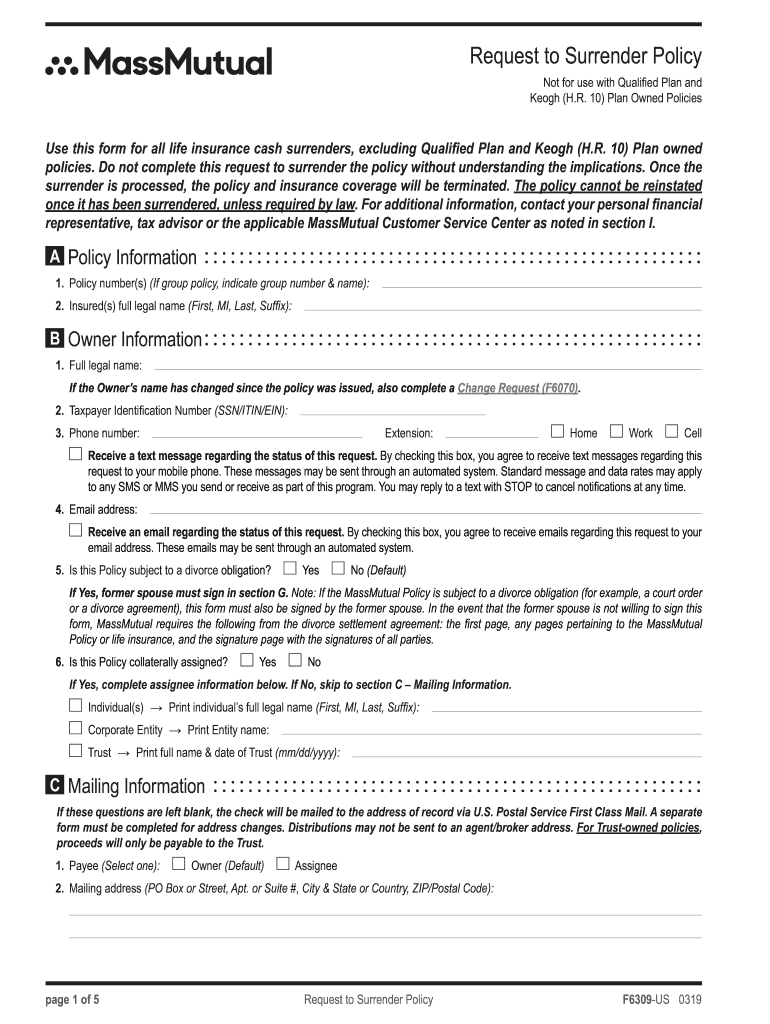

MA F6309-US 2019 free printable template

Get, Create, Make and Sign MA F6309-US

Editing MA F6309-US online

Uncompromising security for your PDF editing and eSignature needs

MA F6309-US Form Versions

How to fill out MA F6309-US

How to fill out MA F6309-US

Who needs MA F6309-US?

Instructions and Help about MA F6309-US

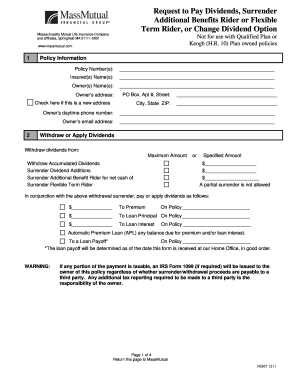

Today were going to cover policy flexibility as we normally do well focus on the top companies to maximize performance for major mutual carriers flexibility what we mean here is one that has the ability to adjust their contribution or contributions as the years pass and not have to jump through the pulse, so company selection is important it's all ties to the banking concept, but we just want to know how we can pay into a policy so well go down the list here relatively quick the first company we have is mass mutual 2019 is coming up, so we just lift it listed what their dividend will be six point four percent they have two ways in which you can add more money to a policy the first is the easiest additional contributions which would be in the form of PU As cash additions can be made without medical underwriting one-time year every year provided that the contribution fall on the policy anniversary date so if we started a policy on December 13th then December 13th of each year would be our anniversary date in which we can make additional contributions cannot have to go through any medical exams we just let the company know how much we want to pay in if we don't want to have to wait until our anniversary date, and we want to go with MassMutual we can add more money but what will happen is they're going to require that we go through medical underwriting before they accept additional PUA or cash contributions if its under 25000 we have to ask answer medical questions they pull medical records take your height weight anything greater than that they require blood and urine its kind of pain the companies limits are ten times the base premium her year what this means is if we have a 10000 premium we can add another ten times that per year into cash next we've got Guardian there's their current dividend rate 585 they're the most flexible someone their income is very cash flow based, and it fluctuates they're going to allow you to pay ten times the minimum premium while the term rider is attached really at leisure you can just throw money in any time you want to an online account or check and then if we don't have a term rider its three times the minimum premium

People Also Ask about

Can I take money out of my MassMutual account?

How long does Massmutual take to process a withdrawal?

How long does it take for your 401k to be direct deposited?

How do I close out my MassMutual account?

Is MassMutual better than New York life?

Can I cancel my life insurance policy?

How long does 401k withdrawal take?

What reasons can you withdraw from 401k without penalty?

Can I withdraw money from Massmutual?

Is MassMutual owned by Fidelity?

How long does MassMutual take to process a withdrawal?

Can I take money out of my retirement account?

How do I withdraw money from my 401k?

Can you withdraw from empower retirement?

Is MassMutual a reputable company?

What is the new name for MassMutual?

How long has MassMutual been paying dividends?

How do I cancel my MassMutual policy?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MA F6309-US directly from Gmail?

Can I create an electronic signature for the MA F6309-US in Chrome?

How do I fill out MA F6309-US on an Android device?

What is MA F6309-US?

Who is required to file MA F6309-US?

How to fill out MA F6309-US?

What is the purpose of MA F6309-US?

What information must be reported on MA F6309-US?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.