Get the free SURETY BOND FOR EMPLOYER CONTRIBUTIONS TO EMPLOYEE BENEFIT

Show details

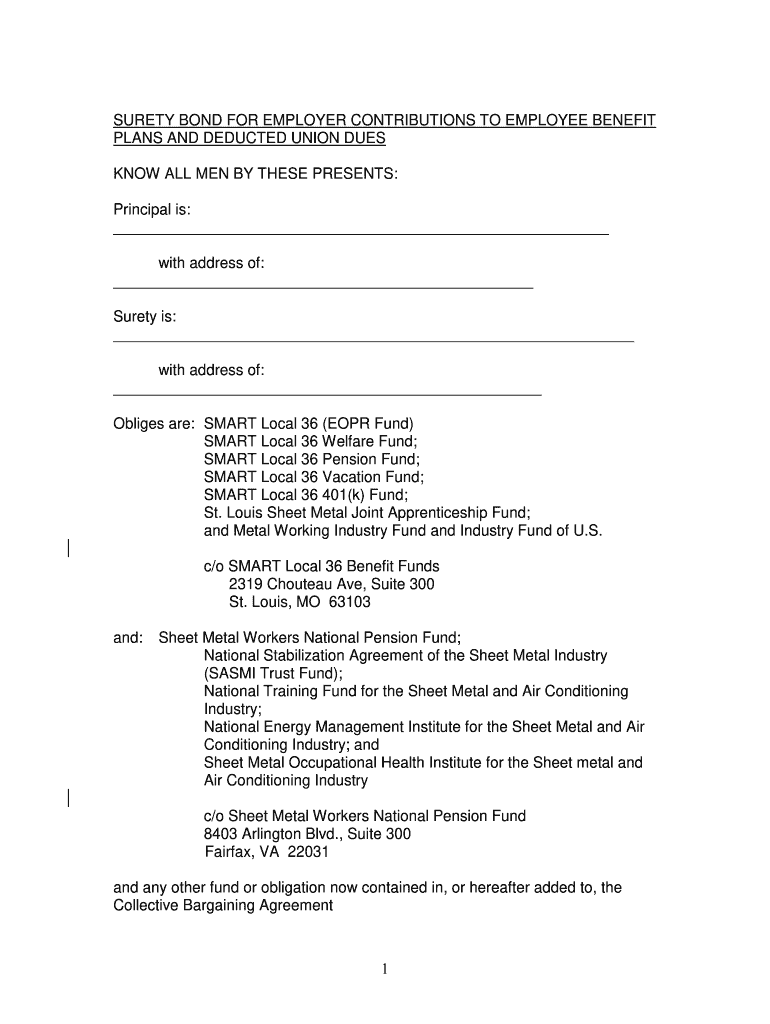

SURETY BOND FOR EMPLOYER CONTRIBUTIONS TO EMPLOYEE BENEFIT PLANS AND DEDUCTED UNION DUES KNOW ALL MEN BY THESE PRESENTS: Principal is: with address of: Surety is: with address of: Obliges are: SMART

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surety bond for employer

Edit your surety bond for employer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your surety bond for employer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit surety bond for employer online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit surety bond for employer. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out surety bond for employer

How to fill out surety bond for employer

01

To fill out a surety bond for an employer, follow these steps:

02

Gather the necessary information: You will need to know the name and contact information of both the employer and the surety company providing the bond.

03

Understand the requirements: Familiarize yourself with the specific bond requirements set by the employer or the regulatory authority. This may include coverage amounts, duration, and any other special conditions.

04

Obtain the bond form: Request the bond form from the surety company or download it from their website. Make sure you have the most up-to-date version.

05

Complete the bond form: Fill in all the required fields on the bond form. This typically includes the employer's information, bond amount, effective date, and any other relevant details.

06

Provide additional documentation: In some cases, you may need to attach additional documentation, such as financial statements or proof of insurance.

07

Review and double-check: Carefully review all the information you have provided on the bond form. Make sure there are no errors or missing information.

08

Sign the bond: Once you are satisfied with the accuracy of the form, sign it along with any other required parties, such as a co-signer or witness.

09

Submit the bond: Send the completed and signed bond form to the employer or the regulatory authority, depending on their instructions. You may also need to provide a copy to the surety company.

10

Keep a copy for your records: Make sure to keep a copy of the filled-out bond form for your own records in case you need it in the future.

11

Follow up: If required, follow up with the employer or the regulatory authority to ensure that the bond has been received and accepted.

Who needs surety bond for employer?

01

Surety bond for employer is needed by various individuals or businesses in different industries. Here are some examples of who might need a surety bond for an employer:

02

- Construction contractors or subcontractors who are bidding on public or private projects.

03

- Employment agencies or recruiters who place workers in jobs.

04

- Janitorial or cleaning service providers who have employees working in clients' properties.

05

- Home healthcare agencies that provide care services and employ caregivers.

06

- Professional service providers, such as accountants, consultants, or IT contractors, who require bonding as part of their licensing requirements.

07

- Manufacturing companies that employ workers who handle valuable goods or materials.

08

- Security companies that provide guard services and employ security personnel.

09

These are just a few examples, and the specific requirements may vary depending on the industry and location. It is important to consult with the employer or the regulatory authority to determine if a surety bond is needed and what the specific requirements are.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit surety bond for employer online?

The editing procedure is simple with pdfFiller. Open your surety bond for employer in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit surety bond for employer straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing surety bond for employer.

How do I edit surety bond for employer on an Android device?

You can make any changes to PDF files, such as surety bond for employer, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is surety bond for employer?

A surety bond for employer is a legally binding contract that ensures compliance with state regulations, employee protection, and financial obligations incurred by the employer.

Who is required to file surety bond for employer?

Employers who have been mandated by state laws or regulations, especially those operating in certain industries or handling specific types of employee relationships, are required to file a surety bond.

How to fill out surety bond for employer?

To fill out a surety bond for an employer, ensure you have the necessary information including the employer's details, bond amount, and the surety provider. Complete the bond form accurately, then have it signed and notarized if required.

What is the purpose of surety bond for employer?

The purpose of a surety bond for employer is to protect employees and the state by ensuring that the employer meets certain financial obligations, adheres to labor laws, and fulfills contractual commitments.

What information must be reported on surety bond for employer?

Information that must be reported on a surety bond for employer includes the employer's name and address, the amount of the bond, the duration of the bond, and details about the surety company providing the bond.

Fill out your surety bond for employer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surety Bond For Employer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.