Get the free ca 540 form 2022

Show details

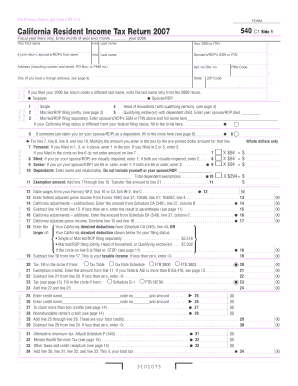

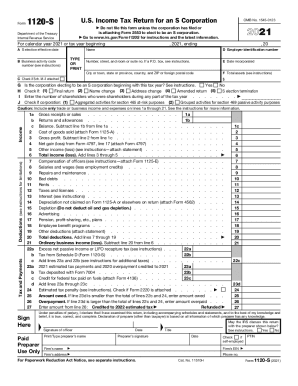

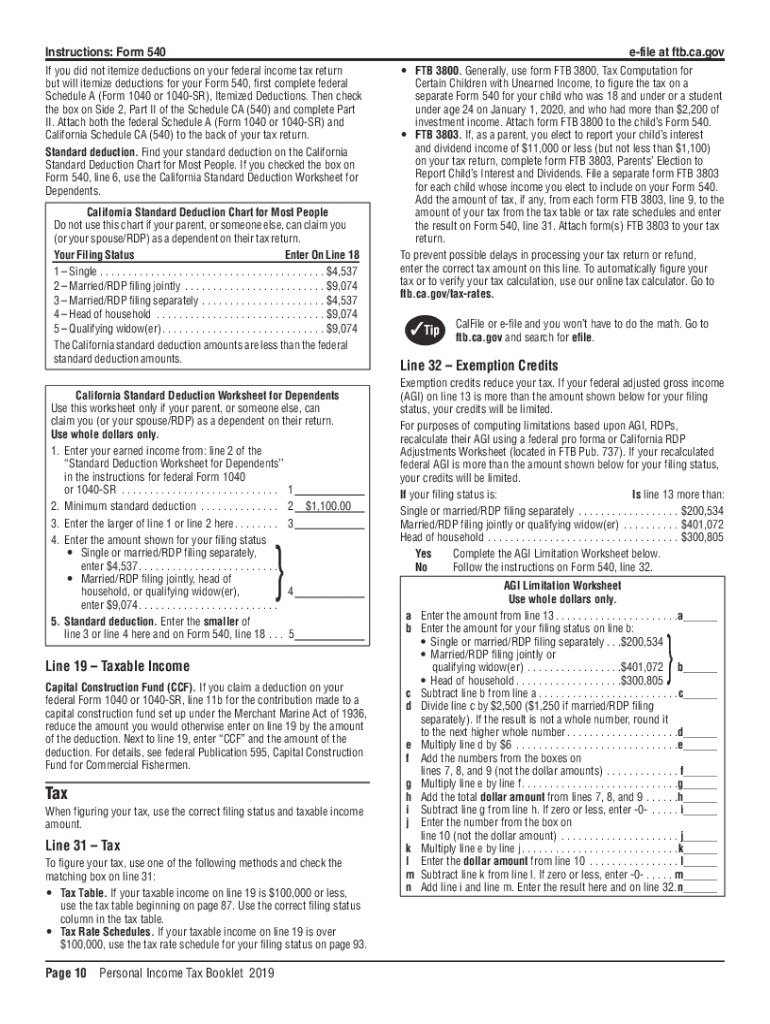

Form 540 2EZ Filer Form 540 and Form 540NR Filers Interest and Dividends Add and enter the amounts from and Dividends line 1b. Completing Schedule CA 540 Part II lines 1 through 30. Enter the result on Form 540 line 18. e-file at ftb. If you filed Form 540 2EZ for 2019 do not use the Form 540 2EZ California 540 Personal Income Tax Booklet. 11 13 Other credits such as other state tax credit. See the 2019 instructions for Form 540 or Form 540NR.. Caution Form 540 has five sides. When filing Form...540 you must send all five sides to the Franchise Tax Board FTB. See instructions. 11 12 Add line 10 and line 11. Enter the amount here and on Form 540 line 40 or Form 540NR line 50. For example lines 20 through 30 do not appear on Form 540 so the line number that follows line 19 on Form 540 is line 31. Write in IRC 1341 and the amount of the credit to the left of the amount column. To determine if you are entitled to this credit refer to your prior year California Form 540 Form 540NR Long or...Short or Schedule CA 540 or 540NR to verify the amount was included in your CA taxable income. CALIFORNIA Forms Instructions Personal Income Tax Booklet Members of the Franchise Tax Board Betty T. Yee Chair Malia M. Cohen Member Keely Bosler Member COVER GRAPHICS OMITTED FOR DOWNLOADING SPEED Table of Contents Important Dates. 2 Do I Have to File. 3 What s New and Other Important Information for 2019. 4 Which Form Should I Use. 63 FTB 3514 California Earned Income Tax Credit. 69 2019 California...Tax Table. 87 How To Get California Tax Information. 94 Privacy Notice. 94 Automated Phone Service. 95 When the due date falls on a weekend or holiday the deadline to file and pay without penalty is extended to the next business day. April 15 2020 Last day to file and pay the 2019 amount you owe to avoid penalties and interest. See form FTB 3519 for more information* If you are living or traveling outside the United States on April 15 2020 the dates for filing your tax return and paying your tax...are different. See form FTB 3519 for more information. October 15 2020 June 15 2020 September 15 2020 January 15 2021 The dates for 2020 estimated tax payments. Generally you do not have to make estimated tax payments if the total of your California withholdings is 90 of your required annual payment. Also you do not have to make estimated tax payments if you will pay enough through withholding to keep the amount you owe with your tax return under 500 250 if married/ registered domestic partner...RDP filing separately. However if you do not pay enough tax either through withholding or by making estimated tax payments you may have an underpayment penalty. You may qualify if you earned less than 50 162 55 952 if married filing jointly and have qualifying children or you have no qualifying children and you earned less than 15 570 21 370 if married filing jointly. Go to the IRS website at irs. gov/taxtopics and choose topic 601 see the federal income tax booklet or go to irs. gov and search...for eitc assistant. California Earned Income Tax Credit EITC EITC reduces your California tax obligation or allows a refund if no California tax is due.

pdfFiller is not affiliated with any government organization

Instructions and Help about CA FTB 540540A BK

How to edit CA FTB 540540A BK

How to fill out CA FTB 540540A BK

Instructions and Help about CA FTB 540540A BK

How to edit CA FTB 540540A BK

To edit the CA FTB 540540A BK form, you can use pdfFiller's editing tools. Simply upload your completed form to the platform and utilize the editing features to make necessary adjustments, whether it's correcting information or adding new details. Once you finish editing, you can save the changes directly within pdfFiller.

How to fill out CA FTB 540540A BK

To fill out the CA FTB 540540A BK form effectively, follow these steps:

01

Gather all required personal information, including your name, address, and taxpayer identification number.

02

Review the instructions on the form to understand each section's requirements.

03

Input the relevant data, ensuring accuracy to avoid future discrepancies.

04

Check the form for any errors before finalizing it.

About CA FTB 540540A BK 2019 previous version

What is CA FTB 540540A BK?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CA FTB 540540A BK 2019 previous version

What is CA FTB 540540A BK?

The CA FTB 540540A BK is a tax form provided by the California Franchise Tax Board. This form is used for filing income tax returns for residents of California. It captures essential tax information for individuals, ensuring compliance with state tax laws and facilitating the assessment of tax liabilities.

What is the purpose of this form?

The purpose of the CA FTB 540540A BK is to report an individual’s income, calculate their tax obligations, and detail any applicable credits or deductions. It serves as an essential document for tax filing, helping the state to determine the taxpayer's final tax liability.

Who needs the form?

Individuals who are residents of California and are required to file a state income tax return must use the CA FTB 540540A BK form. This includes those who earned income above the minimum filing requirement or wish to claim a refund on withheld taxes.

When am I exempt from filling out this form?

You may be exempt from filling out the CA FTB 540540A BK if your gross income falls below California’s minimum filing thresholds. Additionally, certain low-income individuals may qualify for exemptions or alternative filing options based on state provisions.

Components of the form

The CA FTB 540540A BK includes various sections to gather taxpayer information, including personal details, income sources, tax credits, and deductions. It is vital to complete all required sections to ensure accurate processing by the tax authorities.

Due date

The due date for submitting the CA FTB 540540A BK typically falls on April 15th of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is crucial to adhere to this timeline to avoid late fees or penalties.

What are the penalties for not issuing the form?

Failure to file the CA FTB 540540A BK form by the due date may result in penalties imposed by the California Franchise Tax Board. These penalties can include a flat fee for late filing and interest on any unpaid taxes, which adds to your overall tax liability.

What information do you need when you file the form?

When filing the CA FTB 540540A BK, you will need various pieces of information, including your Social Security number, income statements (W-2s, 1099s), details of any deductions or credits, and bank account information if you opt for direct deposit for your refund. Ensure you have accurate documentation ready to prevent delays in processing.

Is the form accompanied by other forms?

The CA FTB 540540A BK may need to be submitted alongside additional forms, such as schedules for itemized deductions or any specific credits applicable to your tax situation. Checking the FTB guidelines can help identify any necessary supplementary forms to include.

Where do I send the form?

You can send the completed CA FTB 540540A BK form to the address specified in the instructions on the form. Make sure to select the correct mailing destination based on whether you are enclosing a payment or not, as this can affect where your form needs to be submitted.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Wow

I'm really not a pro in the legal stuff and I it's nice to find what your looking for.

Thank you

God Bless You.

First experience was perfect. I'm having difficulty finding the current version of the form I need; specifically, the 2014 Revision of the Standard Agreement for the sale of real estate/Pennsylvania.

See what our users say