Get the free Standard & Poor's: "AAA"

Show details

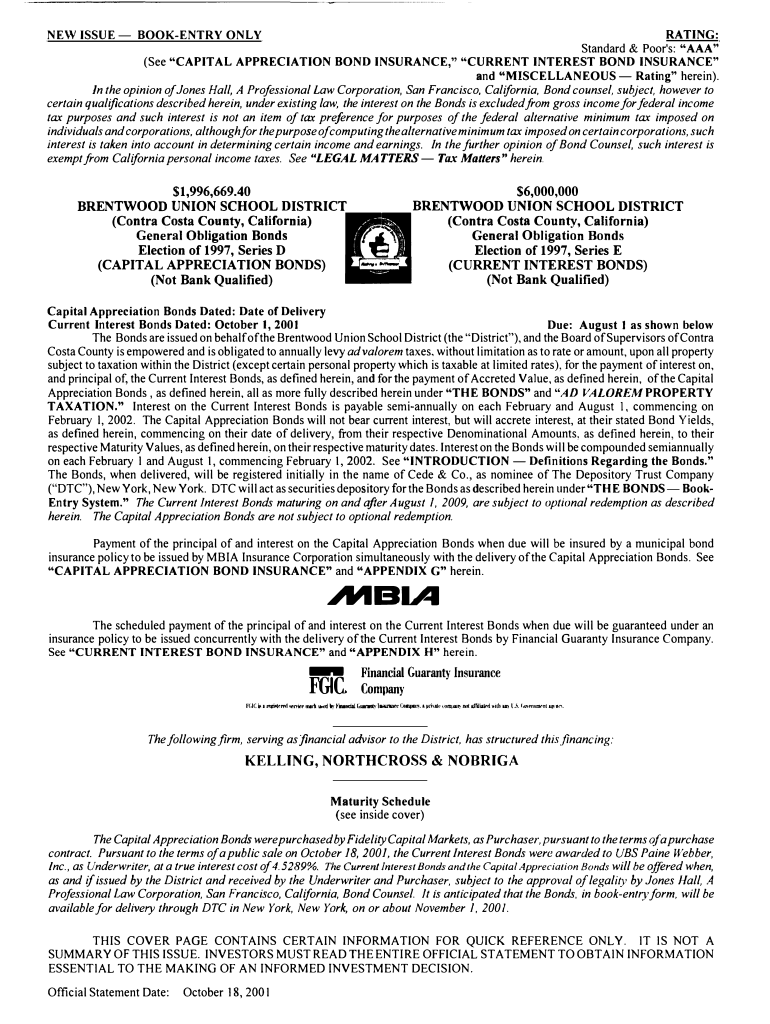

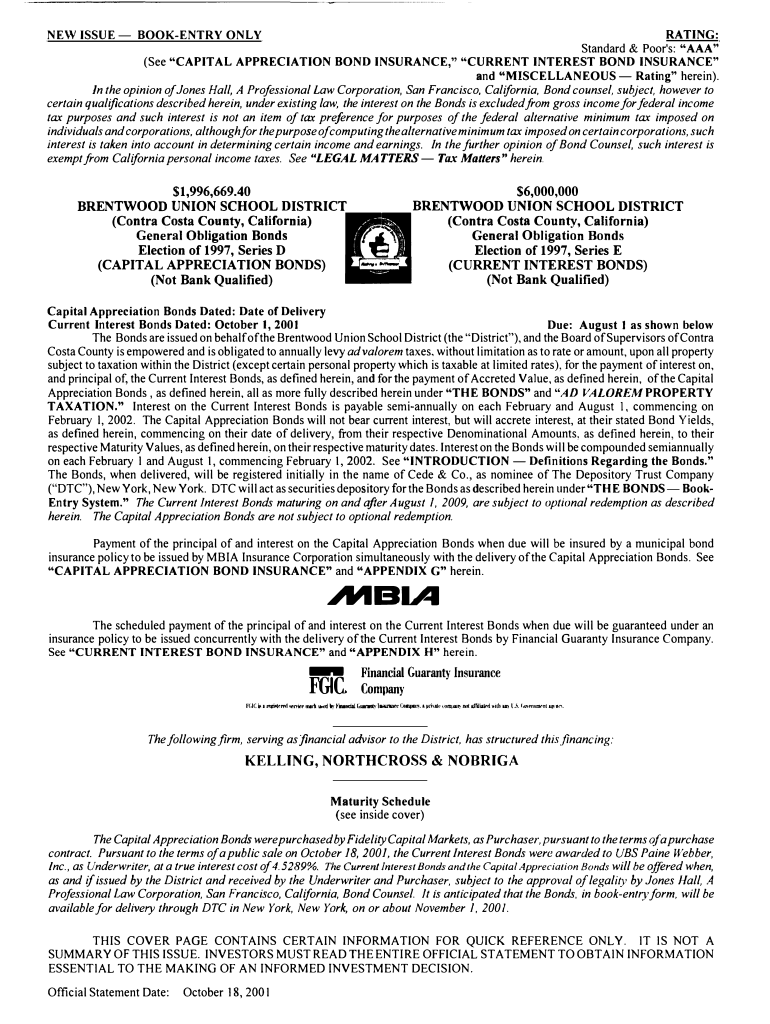

RATING: Standard & Poor's: “AAA (See “CAPITAL APPRECIATION BOND INSURANCE, “CURRENT INTEREST BOND INSURANCE and “MISCELLANEOUS Rating herein). In the opinion of Jones Hall, A Professional

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standard amp poors quotaaaquot

Edit your standard amp poors quotaaaquot form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standard amp poors quotaaaquot form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit standard amp poors quotaaaquot online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit standard amp poors quotaaaquot. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out standard amp poors quotaaaquot

How to fill out standard amp poors quotaaaquot

01

Gather all the necessary information about the company or government entity you are evaluating, such as their financial statements, debt levels, and credit history.

02

Understand the criteria used by Standard & Poor's to assign ratings, such as the issuer's ability to meet financial obligations, economic conditions, and industry risks.

03

Analyze the company's financial performance, including profitability, liquidity, and leverage ratios.

04

Assess the issuer's creditworthiness and ability to repay debts by evaluating their cash flows, interest coverage ratios, and debt maturity profiles.

05

Consider qualitative factors, such as management expertise, competitive position, and regulatory environment.

06

Determine the appropriate rating category based on the evaluation and compare it to Standard & Poor's rating scale.

07

Prepare a comprehensive report summarizing the analysis and justification for assigning the rating.

08

Submit the rating request to Standard & Poor's for review and approval.

09

Follow any additional instructions or guidelines provided by Standard & Poor's during the rating process.

10

Revise and update the rating as needed based on changes in the issuer's financial condition or market dynamics.

Who needs standard amp poors quotaaaquot?

01

Investors: Investors need Standard & Poor's "AAA" ratings to assess the creditworthiness and risk associated with fixed income investments. The "AAA" rating indicates the highest level of creditworthiness and suggests a low risk of default.

02

Financial Institutions: Banks, insurance companies, and other financial institutions rely on Standard & Poor's "AAA" ratings to evaluate the creditworthiness of potential borrowers and counterparties. This helps them make informed lending and investment decisions.

03

Issuers: Companies and governments seeking to issue bonds or other debt instruments benefit from having a strong credit rating. A "AAA" rating from Standard & Poor's can attract a broader investor base and lower borrowing costs.

04

Regulators: Regulatory authorities may use Standard & Poor's ratings as one of the benchmarks to assess the financial stability and risk management practices of financial institutions operating in their jurisdictions.

05

Analysts and Researchers: Professionals in the finance industry use Standard & Poor's ratings as a reference point for their own analysis and research. The "AAA" rating provides a benchmark for comparing the creditworthiness of different entities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit standard amp poors quotaaaquot on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing standard amp poors quotaaaquot.

Can I edit standard amp poors quotaaaquot on an iOS device?

Create, modify, and share standard amp poors quotaaaquot using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I fill out standard amp poors quotaaaquot on an Android device?

Use the pdfFiller mobile app to complete your standard amp poors quotaaaquot on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is standard amp poors "aaa"?

Standard & Poor's "AAA" is a credit rating that represents the highest level of creditworthiness, indicating that an issuer (such as a corporation or government) is very unlikely to default on its debt obligations.

Who is required to file standard amp poors "aaa"?

Entities like corporations, municipalities, and government agencies seeking to obtain a credit rating from Standard & Poor's must file for a rating which could include an "AAA" designation.

How to fill out standard amp poors "aaa"?

To fill out the application for a Standard & Poor's rating, an entity must provide financial statements, information about its operations, management, and plans for future growth, as well as additional documentation as requested by S&P.

What is the purpose of standard amp poors "aaa"?

The purpose of Standard & Poor's rating system, including the "AAA" rating, is to provide investors with an assessment of an entity's credit risk, helping them to make informed investment decisions.

What information must be reported on standard amp poors "aaa"?

Entities must report financial details such as income statements, balance sheets, cash flow statements, along with details about their operational history, business strategy, and any relevant market conditions.

Fill out your standard amp poors quotaaaquot online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standard Amp Poors Quotaaaquot is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.