Get the free Notice CP523

Show details

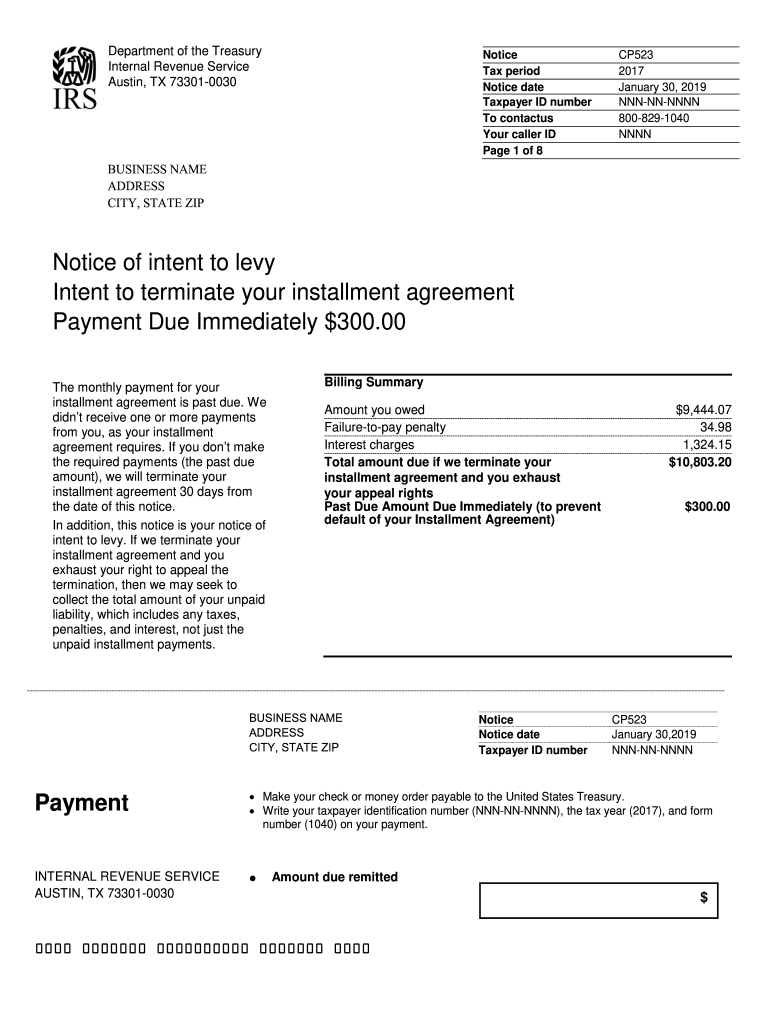

Department of the Treasury

Internal Revenue Service

Austin, TX 733010030Notice

Tax period

Notice date

Taxpayer ID number

To contact us

Your caller ID

Page 1 of 8CP523

2017

January 30, 2019,

NNNNNNNNN

8008291040

NNNNBUSINESS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice cp523

Edit your notice cp523 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice cp523 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit notice cp523 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit notice cp523. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice cp523

How to fill out notice cp523

01

To fill out notice cp523, follow these steps:

02

Start by entering your personal information such as your name, address, and Social Security number at the top of the notice.

03

Next, provide the tax period or periods for which the notice applies. This information is typically found in the upper right corner of the notice.

04

Review the notice to understand the reason for the proposed changes or adjustments to your tax return. It may provide specific instructions on what you need to do next.

05

If you agree with the proposed changes, sign and date the notice and include any additional requested information or documentation.

06

If you disagree with the proposed changes, provide a detailed explanation stating why you disagree and include any supporting documents or evidence.

07

Return the completed notice cp523 to the address provided on the notice, making sure to keep a copy for your records.

08

Note: It is strongly recommended to seek professional tax advice or consult the IRS instructions for more guidance specific to your situation.

Who needs notice cp523?

01

Notice cp523 is typically sent to individuals or businesses who have filed a tax return and are being notified of proposed changes or adjustments to their tax liability. It is important to carefully review the notice and take appropriate action based on the instructions provided.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get notice cp523?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the notice cp523 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make changes in notice cp523?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your notice cp523 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit notice cp523 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share notice cp523 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is notice cp523?

Notice CP523 is a notification sent by the IRS indicating that a taxpayer may be facing an imminent levy action due to a balance owed.

Who is required to file notice cp523?

Taxpayers who have received a CP523 notice and want to request a collection due process hearing to contest the IRS's actions are required to file this notice.

How to fill out notice cp523?

To fill out Notice CP523, taxpayers must provide their personal information, including name, address, and Social Security number, and detail their reasons for disputing the tax liability.

What is the purpose of notice cp523?

The purpose of notice CP523 is to inform taxpayers about their right to request a hearing regarding the IRS's intent to levy their assets.

What information must be reported on notice cp523?

Taxpayers must report personal identification information, the tax period in question, details of the dispute, and any arguments against the collection actions.

Fill out your notice cp523 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice cp523 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.