Get the free Import Tariff and Exchange Rate Transmission in a Small ...

Show details

Import Tariff and Exchange Rate Transmission in a Small Open Economy

Andrea Madera

Jose Angelo Divine×Abstract

This paper presents a small open economy DSE model with internal and external sticky

prices,

We are not affiliated with any brand or entity on this form

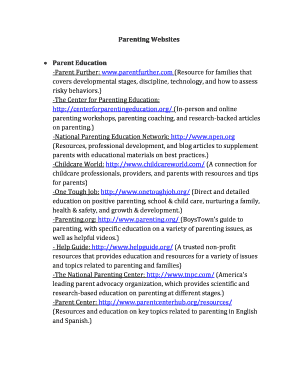

Get, Create, Make and Sign import tariff and exchange

Edit your import tariff and exchange form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your import tariff and exchange form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing import tariff and exchange online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit import tariff and exchange. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out import tariff and exchange

How to fill out import tariff and exchange

01

To fill out import tariff and exchange, follow these steps:

02

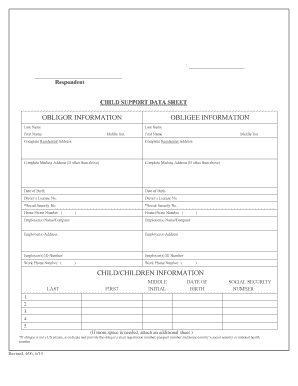

Gather all the required information related to the imported goods, including the HS code, country of origin, and declared value.

03

Determine the applicable tariff rates for the specific goods by referring to the customs regulations or consulting with customs authorities.

04

Calculate the import duties by multiplying the declared value with the corresponding tariff rate.

05

Fill out the import tariff form by providing accurate and complete information about the imported goods, such as description, quantity, value, and applicable tariff rates.

06

Submit the completed import tariff form, along with any required supporting documents, to the customs authorities.

07

Pay the calculated import duties, either in cash or through an electronic payment system, as per the prescribed procedures.

08

Obtain the necessary customs clearance and documentation, allowing the imported goods to enter the country legally and be released from customs control.

09

Keep copies of the import tariff form and supporting documents for future reference or potential audits by customs authorities.

Who needs import tariff and exchange?

01

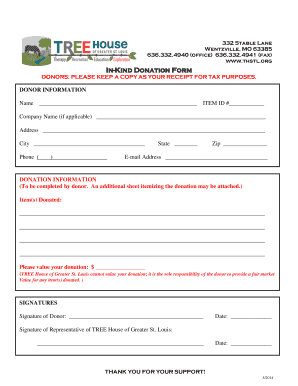

Import tariff and exchange are needed by various individuals, organizations, and government entities involved in international trade, including:

02

- Importers: Importers need to understand and comply with import tariff regulations to accurately calculate and pay the applicable import duties.

03

- Exporters: Exporters may need to be aware of import tariff rates in the destination country to provide information to potential buyers or negotiate trading terms.

04

- Customs Authorities: Customs authorities require import tariff information to enforce customs regulations, assess and collect import duties, and control the flow of goods across borders.

05

- Trade Associations: Trade associations and industry groups may use import tariff data to analyze market trends, advocate for trade policies, and provide guidance to their members.

06

- Governments: Governments utilize import tariff and exchange information for economic planning, revenue collection, trade policy development, and protection of domestic industries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my import tariff and exchange directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your import tariff and exchange and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I edit import tariff and exchange on an iOS device?

Create, edit, and share import tariff and exchange from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I fill out import tariff and exchange on an Android device?

On Android, use the pdfFiller mobile app to finish your import tariff and exchange. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

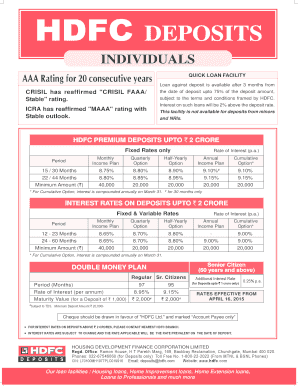

What is import tariff and exchange?

An import tariff is a tax imposed by a government on imported goods, typically aimed at protecting domestic industries and generating revenue. Exchange refers to the process of converting one currency into another, which is often necessary for international trade.

Who is required to file import tariff and exchange?

Importers and exporters engaged in international trade transactions are required to file import tariff and exchange documents to comply with customs regulations.

How to fill out import tariff and exchange?

To fill out import tariff and exchange forms, you need to provide details such as the description of imported goods, their country of origin, the value of the goods, the applicable tariff rates, and any exchange rate information if relevant.

What is the purpose of import tariff and exchange?

The purpose of import tariff and exchange is to regulate international trade, protect local industries from foreign competition, raise government revenue, and monitor the flow of goods and currency.

What information must be reported on import tariff and exchange?

The information that must be reported includes the classification of the goods, their value, country of origin, tariff rate, quantity, and any pertinent exchange rate if transactions involve multiple currencies.

Fill out your import tariff and exchange online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Import Tariff And Exchange is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.