Get the free Over 2,700 gifts to PM Modi on auction from SaturdayIndia ...

Show details

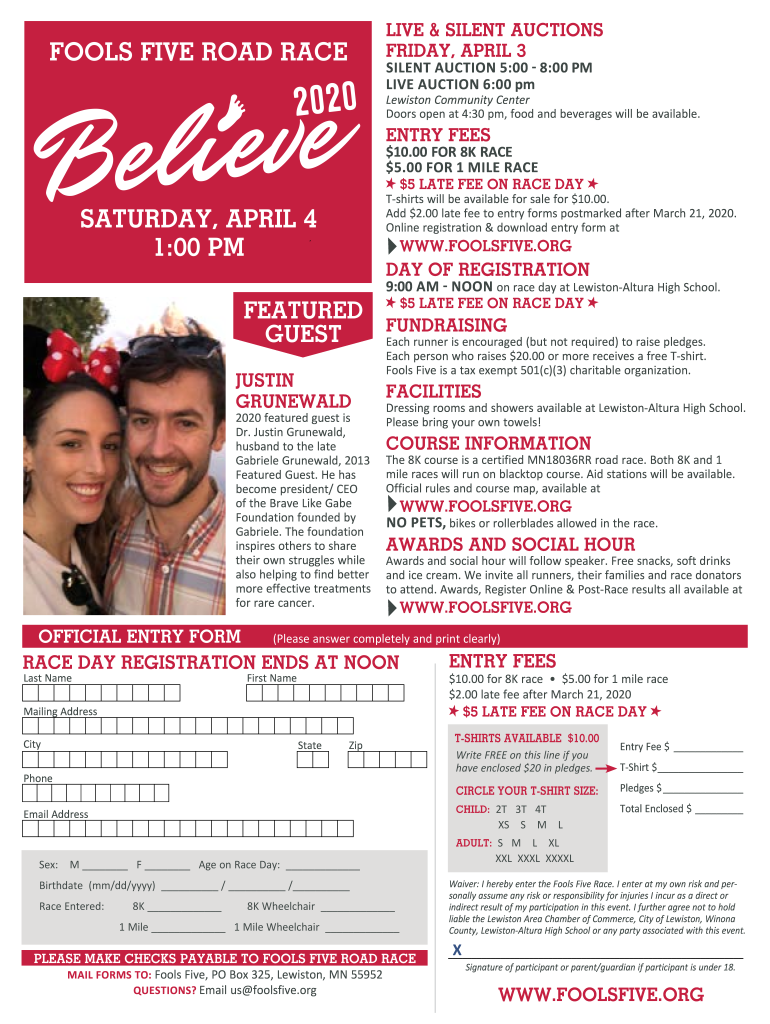

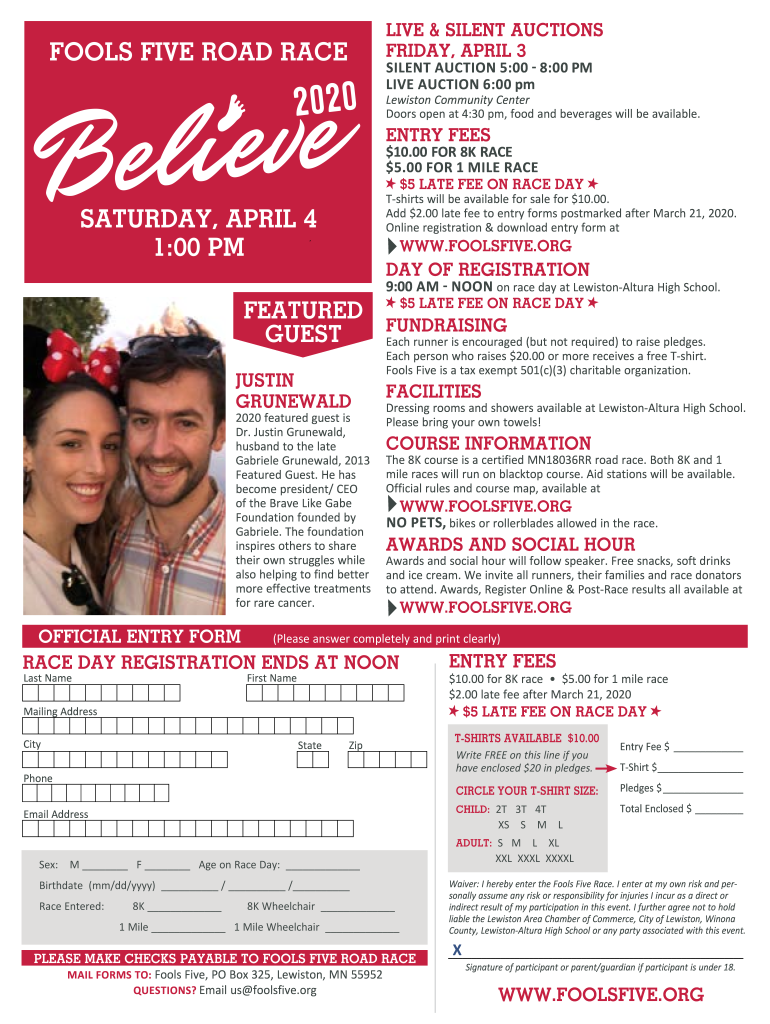

LIVE & SILENT AUCTIONS FRIDAY, APRIL 3FOOLS FIVE ROAD RESIDENT AUCTION 5:00 8:00 PM LIVE AUCTION 6:00 pm Lewiston Community Center Doors open at 4:30 pm, food and beverages will be available. ENTRY

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign over 2700 gifts to

Edit your over 2700 gifts to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your over 2700 gifts to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing over 2700 gifts to online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit over 2700 gifts to. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out over 2700 gifts to

How to fill out over 2700 gifts to

01

Make a list of all the gifts you will need to fill out.

02

Purchase the gifts in bulk to save time and money.

03

Gather all the necessary wrapping materials such as wrapping paper, tape, bows, and gift tags.

04

Set up a designated area with a large table or workspace to comfortably wrap and assemble the gifts.

05

Start by sorting the gifts into categories or themes to make the process more organized.

06

Wrap each gift carefully, making sure to remove any price tags or labels.

07

Add a personal touch by attaching a thoughtful note or card to each gift.

08

Assemble any gift baskets or multiple-item gifts by arranging them in an aesthetically pleasing way.

09

Double-check that all the gifts are properly wrapped and labeled with the recipient's name.

10

Store the completed gifts in a secure location until they are ready to be distributed.

Who needs over 2700 gifts to?

01

Large organizations or charities that are organizing a big event

02

Companies that are hosting company-wide gifting programs or promotions

03

Event planners or organizers who are coordinating giveaways or promotional activities

04

Non-profit organizations that are collecting gifts for underprivileged children or families

05

Schools or educational institutions organizing gift drives for students

06

Hospitals or healthcare facilities organizing gift exchanges for patients or staff

07

Military organizations or support groups organizing care packages for deployed troops

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get over 2700 gifts to?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific over 2700 gifts to and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit over 2700 gifts to on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign over 2700 gifts to on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit over 2700 gifts to on an Android device?

You can edit, sign, and distribute over 2700 gifts to on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is over 2700 gifts to?

Form 709, also known as the 'United States Gift (and Generation-Skipping Transfer) Tax Return,' is required for reporting gifts that exceed the annual exclusion amount set by the IRS. Specifically, it is for reporting gifts made by an individual that, together with any prior gifts made, exceed the lifetime gift exemption.

Who is required to file over 2700 gifts to?

Any individual who makes gifts in excess of the annual exclusion amount or who gives gifts that cumulatively exceed the lifetime exemption amount is required to file Form 709.

How to fill out over 2700 gifts to?

To fill out Form 709, individuals must include details such as the name and address of the donor and recipient, the date of the gift, a description of the property gifted, its fair market value, and any applicable deductions. Additionally, the form requires reporting of any gifts made to spouses or charities.

What is the purpose of over 2700 gifts to?

The purpose of Form 709 is to report taxable gifts for the year, help taxpayers adhere to federal tax laws regarding gift taxation, and to account for the lifetime exclusion limit on gifts.

What information must be reported on over 2700 gifts to?

The information that must be reported on Form 709 includes details about the donor, a summary of the gifts made, the value of each gift, the recipients, and any deductions or exclusions that apply.

Fill out your over 2700 gifts to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Over 2700 Gifts To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.