IRS 14039-B 2020 free printable template

Show details

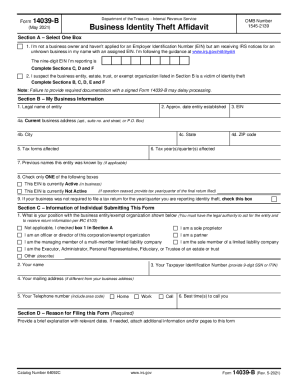

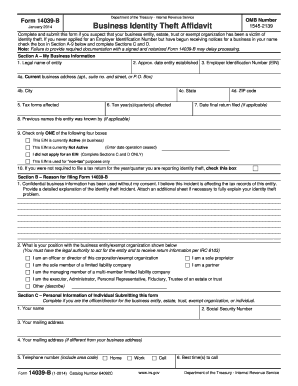

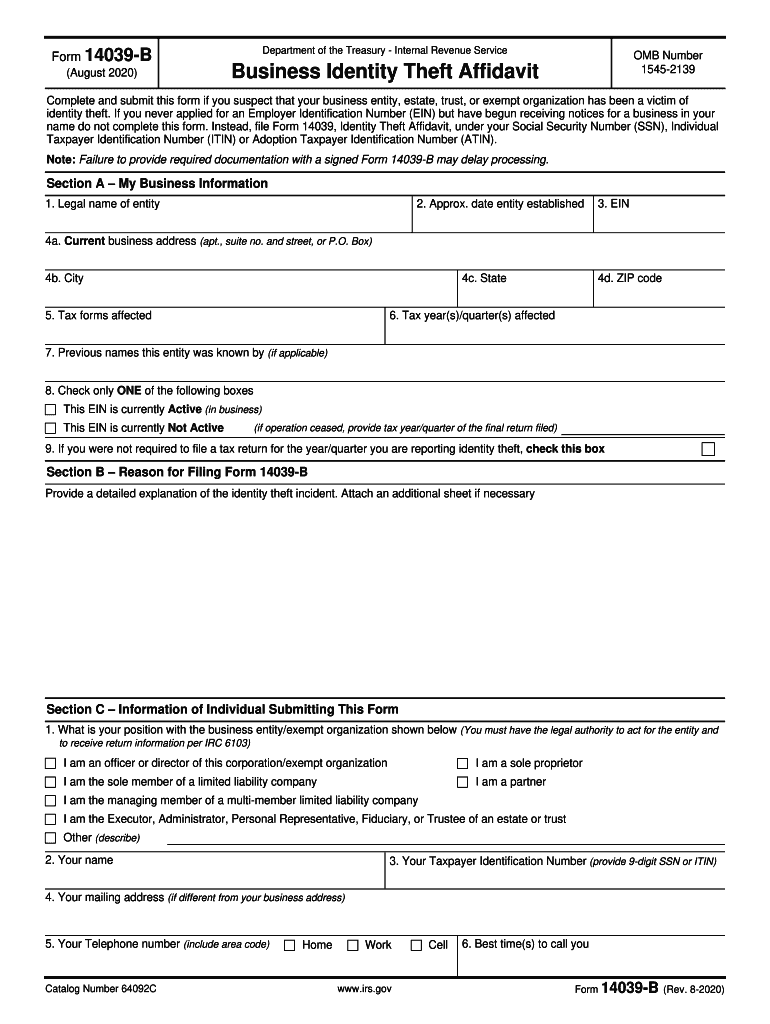

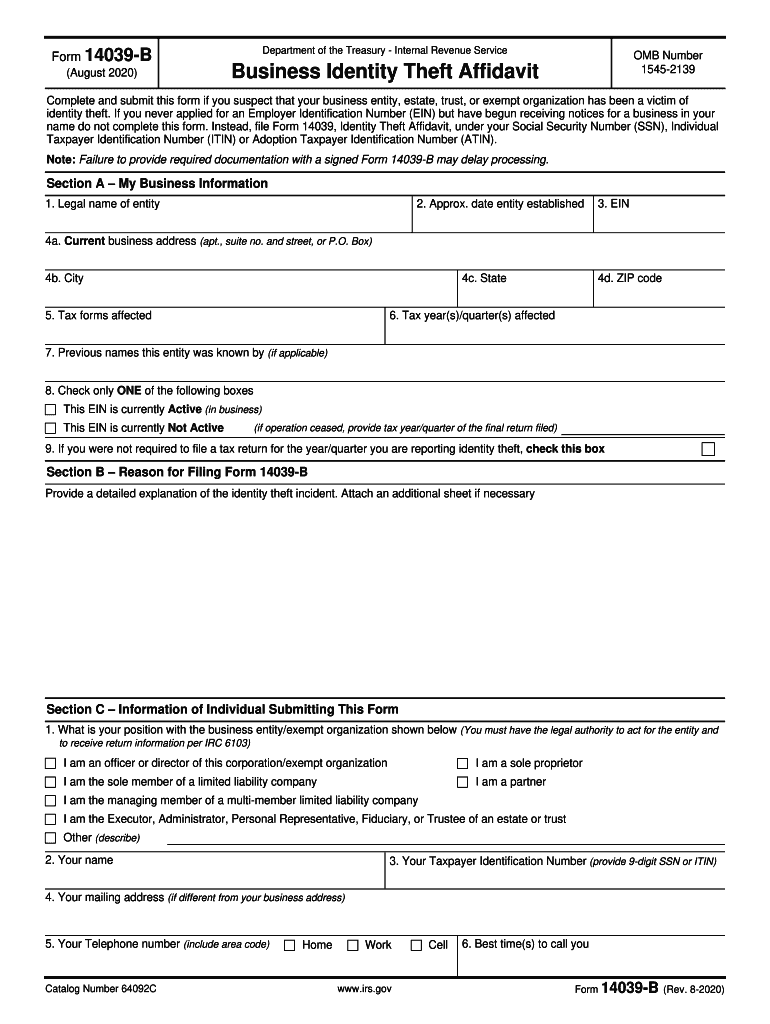

Form 14039B (August 2020)Department of the Treasury Internal Revenue Service OMB Number 15452139Business Identity Theft AffidavitComplete and submit this form if you suspect that your business entity,

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 14039-B

Edit your IRS 14039-B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 14039-B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 14039-B online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 14039-B. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 14039-B Form Versions

Version

Form Popularity

Fillable & printabley

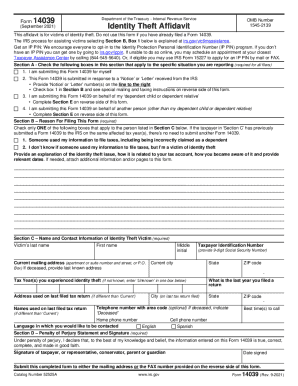

How to fill out IRS 14039-B

How to fill out IRS 14039-B

01

Begin by downloading the IRS Form 14039-B from the official IRS website.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate whether you are a victim of identity theft by checking the appropriate box.

04

If applicable, provide details about the identity theft incident including dates and any relevant information.

05

If you have a police report regarding the identity theft, include the report number in the designated section.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form according to the instructions provided, either by mail or online.

Who needs IRS 14039-B?

01

Individuals who are victims of identity theft and suspect that someone has used their personal information to file a tax return.

02

Taxpayers who receive an IRS notice indicating that more than one tax return has been filed using their Social Security number.

03

People who believe their personal information has been compromised and want to alert the IRS to potential fraudulent activity.

Fill

form

: Try Risk Free

People Also Ask about

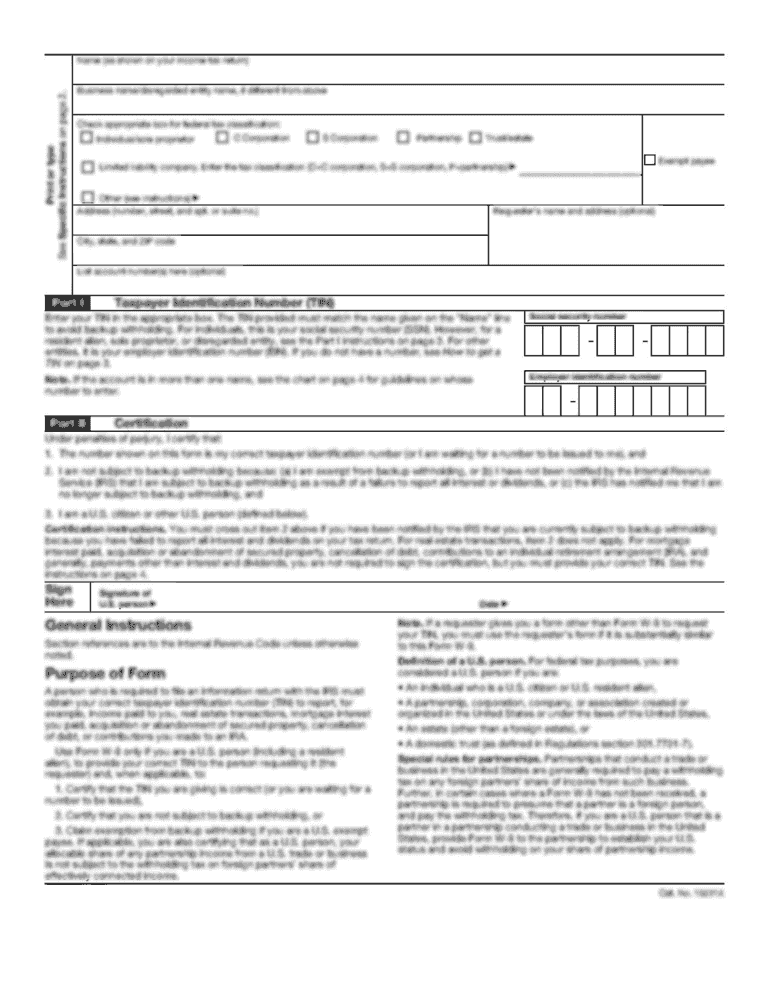

Can I fill out a 14039 form online?

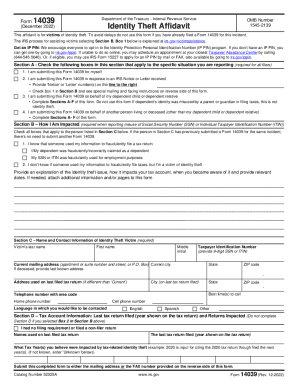

Filing Form 14039, Identity Theft Affidavit It can be completed online, printed and attached to a paper tax return for mailing to the IRS. Or taxpayers may complete the form online at the Federal Trade Commission and the FTC will electronically transfer the Form 14039 – but not the tax return – to the IRS.

How to fill out form 14039?

How to Complete and Submit Form 14039. Explain your issue and how you discovered that your identity had been stolen in Section B. Attach any supporting documentation, such as a notice you received from the IRS, and submit it along with the form. You can't electronically file the IRS Identity Theft Affidavit.

What do I need to submit with form 14039?

Submit your completed form with a photocopy of official identification such as your driver's license, passport, Social Security card or government-issued ID card. Follow the mailing or fax instructions on your notice or on Form 14039.

Where do I send my identity theft affidavit to the IRS?

Mail Form 14039 to this address: Internal Revenue Service, Stop C2003, Fresno, CA 93888.

What happens after filing form 14039?

The IRS will send you a notice. First, the IRS will acknowledge your reported tax identity theft. Within 30 days after the IRS gets your Form 14039, you'll get a letter telling you that the IRS received your affidavit. During this time, the IRS may ask you to prove your identity, typically with letter 5071C.

How do I prove identity theft to the IRS?

Complete Form 14039, Identity Theft AffidavitPDF, attach it to the back of your completed paper tax return and mail to the IRS location based upon the state you reside.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 14039-B from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your IRS 14039-B into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get IRS 14039-B?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the IRS 14039-B in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit IRS 14039-B on an Android device?

You can make any changes to PDF files, like IRS 14039-B, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

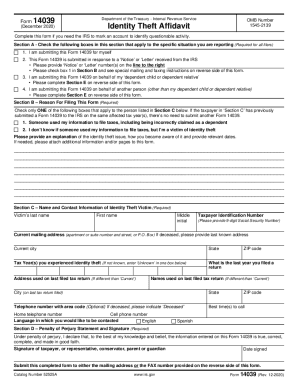

What is IRS 14039-B?

IRS Form 14039-B is a form used to report suspected identity theft related to tax matters.

Who is required to file IRS 14039-B?

Individuals who believe their personal information has been used by someone else to file a tax return or claim a refund are required to file IRS 14039-B.

How to fill out IRS 14039-B?

To fill out IRS 14039-B, individuals need to provide personal identification information, details regarding the identity theft incident, and any supporting documentation, then submit the form to the appropriate IRS office.

What is the purpose of IRS 14039-B?

The purpose of IRS 14039-B is to alert the IRS about potential identity theft and help protect taxpayers from fraudulent tax activities.

What information must be reported on IRS 14039-B?

The information reported on IRS 14039-B includes the taxpayer's name, Social Security number, address, details of the identity theft, and any related documentation that supports the claim.

Fill out your IRS 14039-B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 14039-B is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.