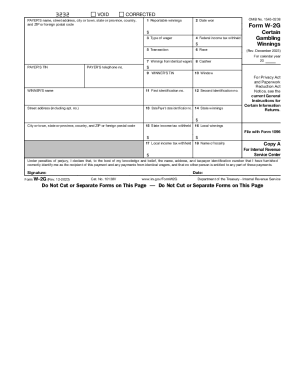

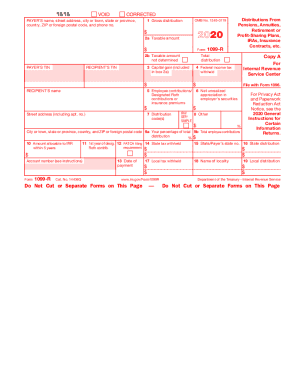

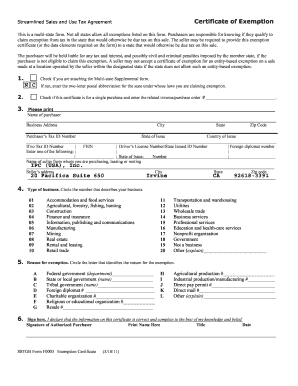

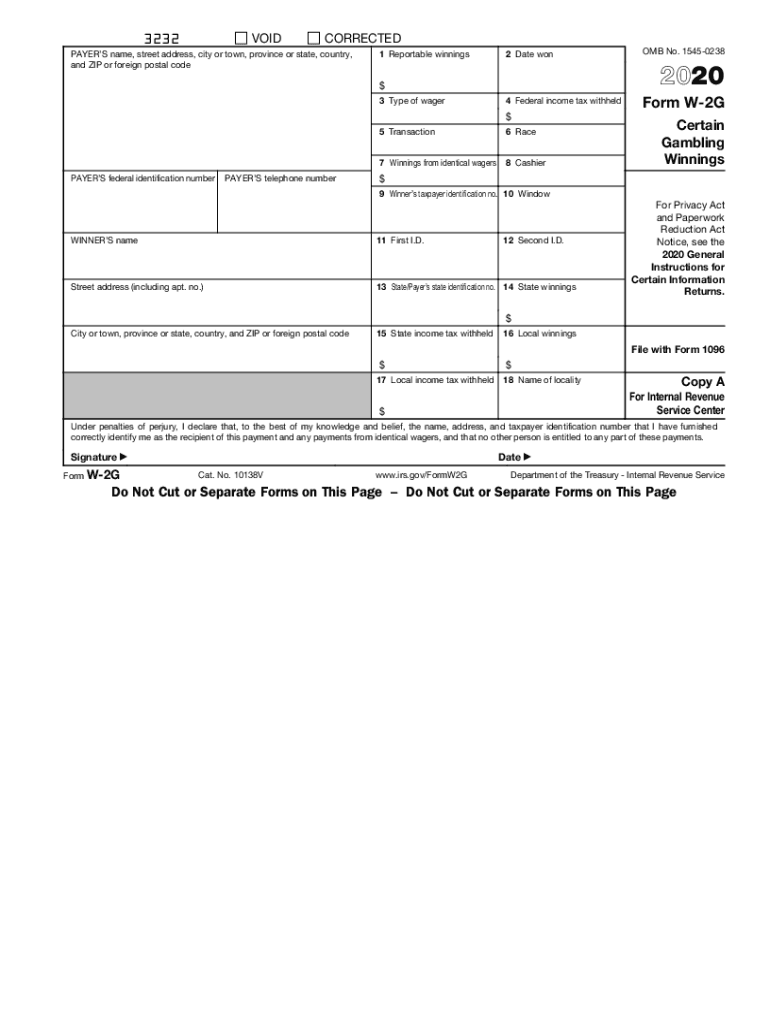

IRS W-2G 2020 free printable template

Instructions and Help about IRS W-2G

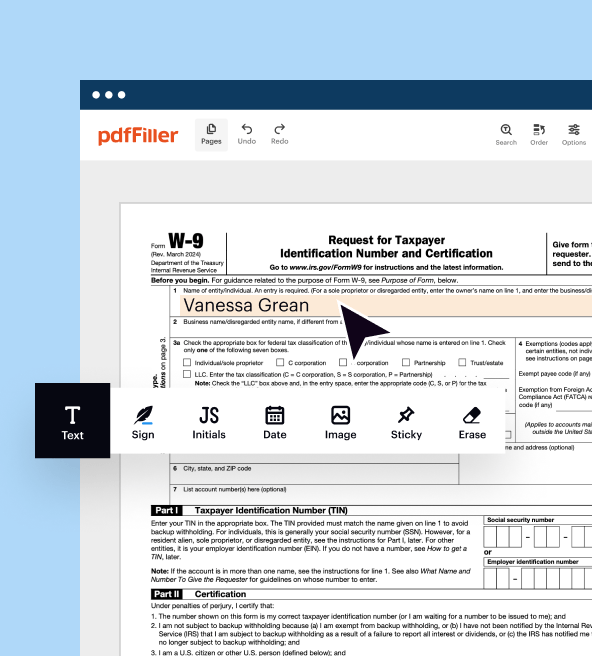

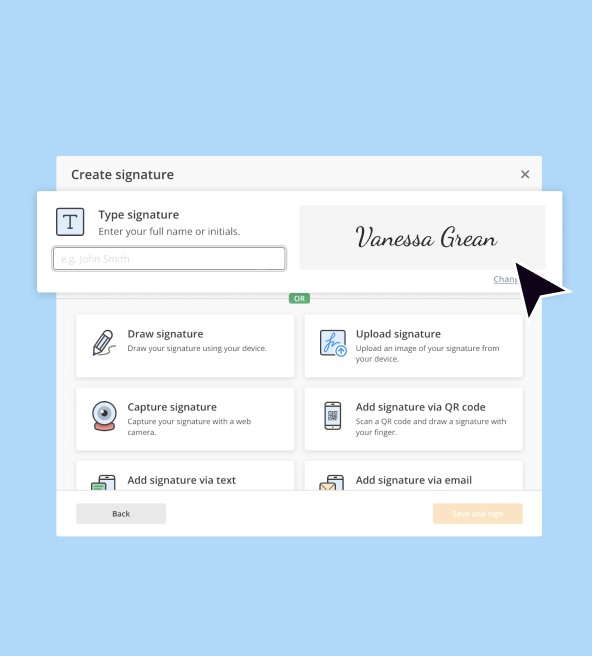

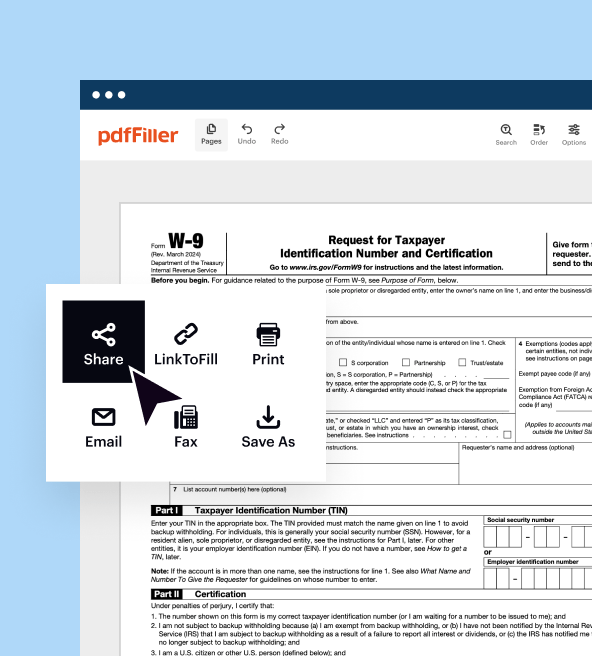

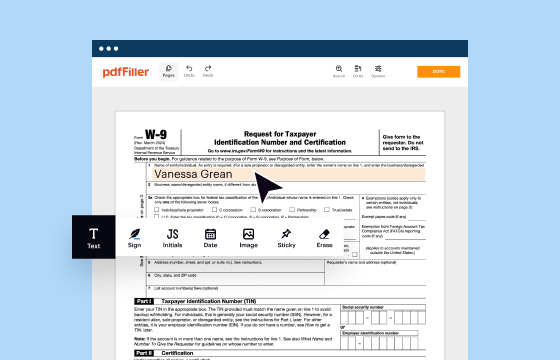

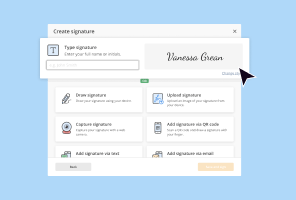

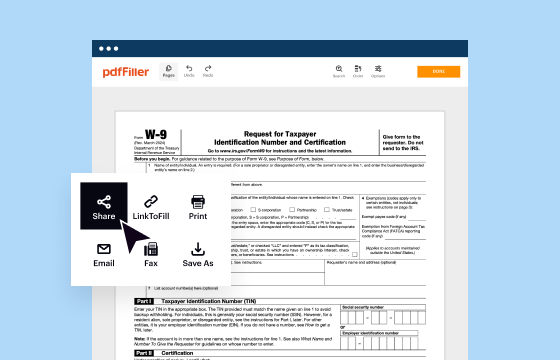

How to edit IRS W-2G

How to fill out IRS W-2G

About IRS W-2G 2020 previous version

What is IRS W-2G?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-2G

What should I do if I need to correct a mistake made on my IRS W-2G?

If you discover an error on your IRS W-2G after filing, you should prepare and submit a corrected form as soon as possible. Indicate in the designated fields that it's a correction, ensuring that the original information is still accessible for reference. This helps to inform the IRS about the amendment and maintains your compliance with reporting obligations.

How can I track the status of my IRS W-2G submission?

To track your IRS W-2G submission, you can use the IRS e-file status tool or contact your tax preparation service if they filed on your behalf. Be aware of common rejection codes that may indicate issues with your filing. If rejected, promptly address the specified problem to ensure your submission can be processed correctly.

Are there any specific privacy concerns associated with filing the IRS W-2G?

When filing the IRS W-2G, you should be aware of privacy and data security issues, as the form contains sensitive personal information. Ensure that your data is securely transmitted, especially if using electronic filing. Retain your filed documents securely according to IRS guidelines to protect your financial and personal information.

What should I do if I receive an IRS notice after submitting my W-2G?

If you receive an IRS notice regarding your W-2G, read it carefully for specific instructions. Gather any relevant documentation that proves your compliance and correct any discrepancies as indicated. Respond to the notice promptly, adhering to any deadlines specified, to ensure that your tax obligations remain in good standing.

See what our users say