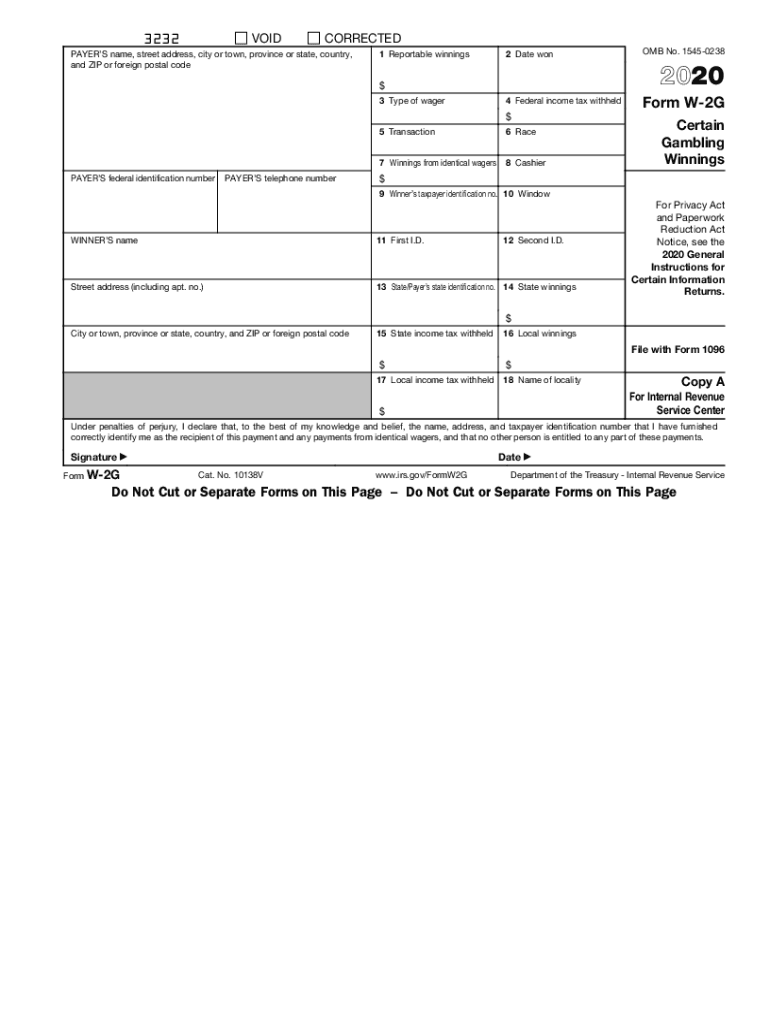

Who uses Form W2-G?

A payer of gambling winnings must report them on Form W-2G if:

-

The winnings from a bingo game or slot machine are equal to or exceeding $1,200 (not reduced by the wager);

-

The winnings from a keno game are equal to or exceeding $1,500 (reduced by the wager);

-

The winnings from a poker tournament are equal to or exceeding $5,000 (reduced by the wager or buy-in);

-

The winnings (except winnings from bingo, slot machines, keno, and poker tournaments) reduced, at the option of the payer, by the wager are:

-

$600 or more, and

-

At least 300 times the amount of the wager; or

-

The winnings are subject to federal income tax withholding (either regular gambling withholding or backup withholding).

What is the purpose of the Form W2-G?

The purpose of this form is to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and withholding depend on the type of gambling, the amount of the winning, and the ratio of the gambling to the wager.

When is the Form W2-G due?

The payer is required to furnish Copies B and C of the W2-G form to the winner by January 31, 2017, and file Copy A of the form with the IRS by February 28, 2017. If the payer files electronically, the due date is March 31, 2017.

What information should be provided?

The W-2G report form requests the provision of the following information:

-

Details about the payer (name, address, FIN, phone number, state identification number);

-

Details about the winner (name, address, taxpayer identification number);

-

Winnings details (gross amount, date, amount of taxes withheld, transaction);

-

Type of wager;

-

Transaction;

-

Race;

-

Cashier, etc.

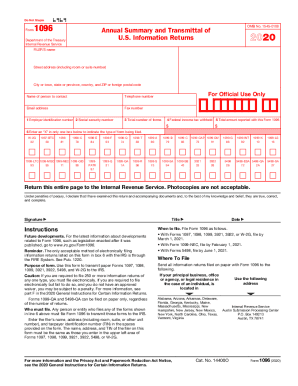

Where do I send the Form W2-G?

Each copy of the W-2G form has its own destination:

-

Copy A should be filed with the IRS service Center;

-

Copies B and C should be delivered to the winner;

-

Copy D is for the payer’s personal records;

-

Copy 1 is to be submitted to the State, City, or Local Tax Department; and

-

Copy 2 should be attached to the payer’s state, city, or local income tax return.