Get the free Life Insurance - Retirement PlanningNational Life Group

Show details

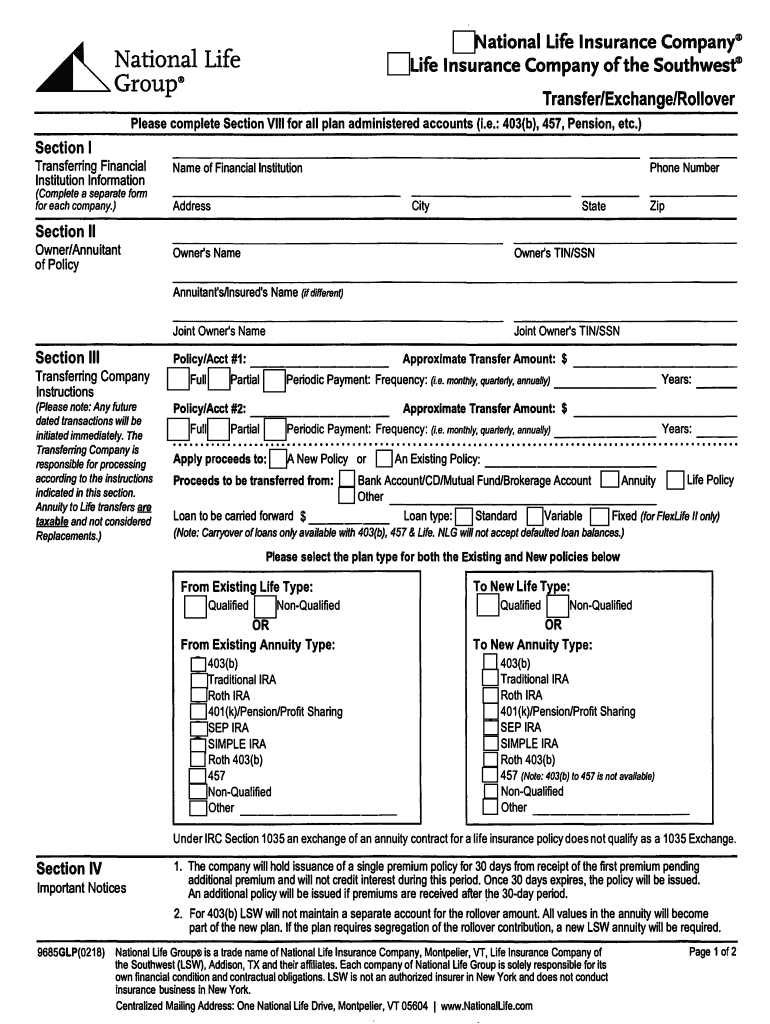

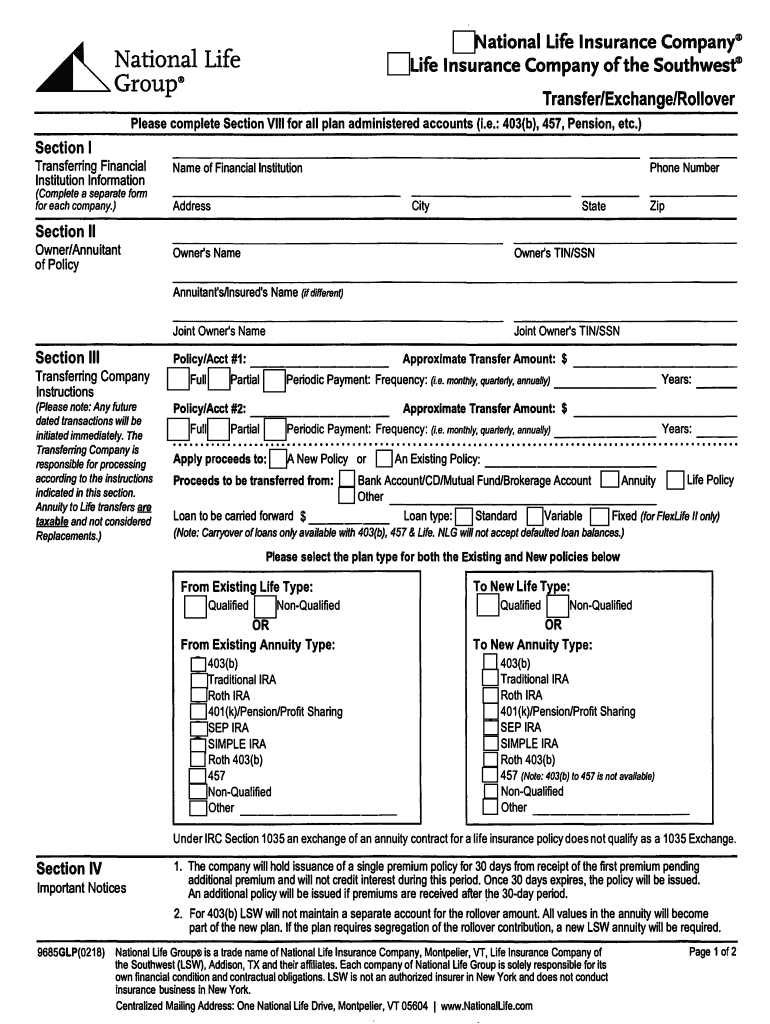

National Life Insurance Company Life Insurance Company of the Southwest National Life Group Transfer/Exchange/RolloverPlease complete Section VIII for all plan administered accounts (i.e.: 403(b,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance - retirement

Edit your life insurance - retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance - retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life insurance - retirement online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit life insurance - retirement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance - retirement

How to fill out life insurance - retirement

01

Determine the amount of life insurance coverage you need for retirement. Consider factors such as outstanding debts, future income needs, and potential healthcare expenses.

02

Research and compare different life insurance policies available in the market. Look for policies specifically designed for retirement with features like cash value accumulation and flexible premium payment options.

03

Understand the policy terms and conditions, including premium costs, payout options, and potential exclusions or limitations.

04

Complete the application form for the chosen life insurance policy. Provide accurate information about your personal details, health history, and financial situation.

05

Undergo a medical examination if required by the insurance company. This may involve visiting a designated medical facility and providing necessary health records.

06

Review the policy offer presented by the insurance company. Ensure that it meets your retirement goals and has a premium payment schedule that aligns with your financial capabilities.

07

Accept the policy offer and make the initial premium payment as per the specified instructions.

08

Keep a copy of the issued policy document in a secure place for reference.

09

Review and update your life insurance coverage periodically to adapt to changing retirement needs and financial circumstances.

Who needs life insurance - retirement?

01

Anyone who wants to ensure financial security and provide for their loved ones during retirement should consider life insurance.

02

Individuals with dependents, such as a spouse or children, may choose life insurance to replace lost income and cover future expenses.

03

Retirees who want to leave a legacy or pass on wealth to their heirs may find life insurance useful in estate planning.

04

Business owners or self-employed individuals who want to protect their business interests or cover business-related debts may opt for life insurance.

05

People with outstanding debts, such as mortgages or loans, may use life insurance to ensure these debts are paid off in the event of their death.

06

Individuals with a history of health issues may find life insurance necessary to secure coverage at a relatively younger age.

07

Those who are concerned about the rising cost of healthcare and potential long-term care expenses in retirement may seek life insurance with supplemental benefits.

08

Ultimately, the decision to get life insurance for retirement depends on personal circumstances, financial goals, and the desire to have a safety net for loved ones.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my life insurance - retirement directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign life insurance - retirement and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit life insurance - retirement online?

The editing procedure is simple with pdfFiller. Open your life insurance - retirement in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I make edits in life insurance - retirement without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing life insurance - retirement and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is life insurance - retirement?

Life insurance - retirement refers to policies designed to provide financial security and benefits to the policyholder's dependents after their death, while also serving as a savings or investment tool for retirement planning.

Who is required to file life insurance - retirement?

Individuals who own life insurance policies and are using them for retirement planning may be required to file reports or tax forms related to the gains and benefits of those policies.

How to fill out life insurance - retirement?

To fill out life insurance - retirement forms, provide accurate personal information, details about the policy such as the coverage amount, beneficiary information, and any applicable financial details or statements.

What is the purpose of life insurance - retirement?

The purpose of life insurance - retirement is to ensure financial support for dependents after the policyholder's passing and to accumulate funds that can be accessed during retirement.

What information must be reported on life insurance - retirement?

Information that must be reported includes the policy details, premium payments, cash value accumulation, beneficiary designations, and any distributions taken from the policy.

Fill out your life insurance - retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance - Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.