Macquarie Cash Solutions BFS0384 (Formerly FRM3006) 2020 free printable template

Show details

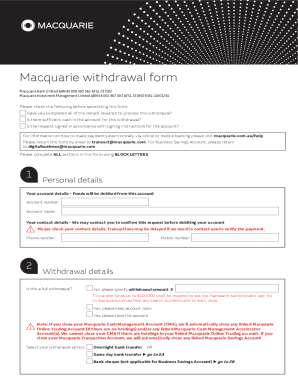

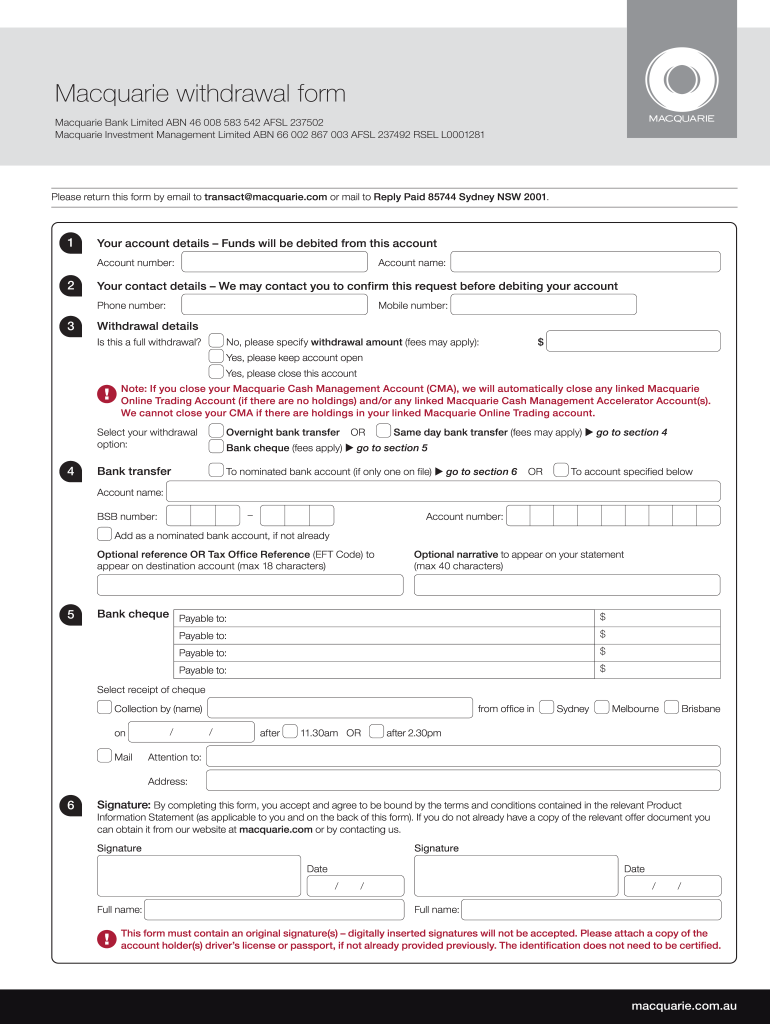

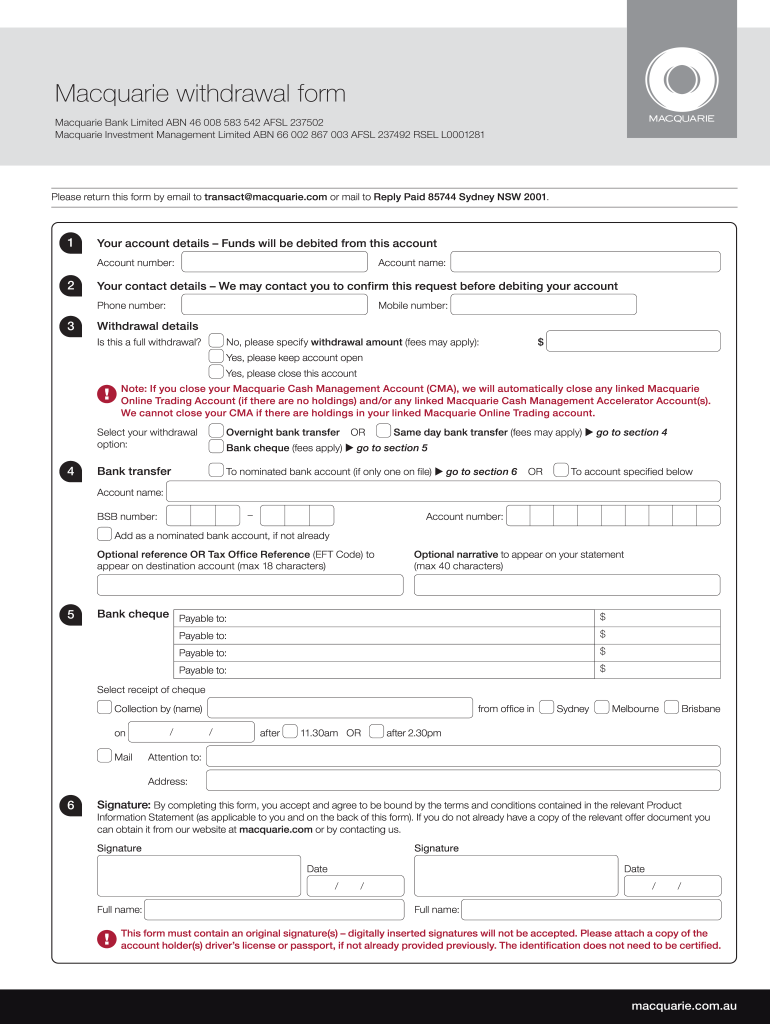

Macquarie's withdrawal form Macquarie Bank Limited ABN 46 008 583 542 ADSL 237502 Macquarie Investment Management Limited ABN 66 002 867 003 ADSL 237492 REEL L0001281Please return this form by email

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Macquarie Cash Solutions BFS0384 Formerly FRM3006

Edit your Macquarie Cash Solutions BFS0384 Formerly FRM3006 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Macquarie Cash Solutions BFS0384 Formerly FRM3006 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Macquarie Cash Solutions BFS0384 Formerly FRM3006 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Macquarie Cash Solutions BFS0384 Formerly FRM3006. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Macquarie Cash Solutions BFS0384 (Formerly FRM3006) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Macquarie Cash Solutions BFS0384 Formerly FRM3006

How to fill out Macquarie Cash Solutions BFS0384 (Formerly FRM3006)

01

Download the Macquarie Cash Solutions BFS0384 form from the Macquarie website.

02

Read the instructions provided at the beginning of the form carefully.

03

Complete the personal information section, including your name, address, and contact details.

04

Provide account details if necessary, such as account numbers or types.

05

Fill out the sections related to your financial objectives and investment preferences.

06

Review the declaration section to confirm your understanding and acceptance of the terms.

07

Sign and date the form at the designated area.

08

Submit the completed form to Macquarie via the provided submission method.

Who needs Macquarie Cash Solutions BFS0384 (Formerly FRM3006)?

01

Individuals or businesses seeking to manage their cash effectively.

02

Clients who are looking for a safe investment option with competitive interest rates.

03

Those who need to formalize an agreement for cash management with Macquarie.

04

Investors who require flexible access to their funds while earning interest.

Fill

form

: Try Risk Free

People Also Ask about

Can a TIAA annuity be cashed out?

The Transfer Payout Annuity (TPA) is an option for transferring some or all of your TIAA Traditional account balances as a rollover or as a cash withdrawal, in 10 payments over 9 years. Since the TIAA portfolio is made up of long-term investments, transfers can only be made in 10 payments over 9 years.

Can you withdraw from 401k for no reason?

Yes, you always have the right to withdraw some or all of your contributions and their earnings, but it's not always that black and white. Every withdrawal you take will be subject to income taxes, and you might owe a tax penalty as well.

Can I pull out all my money from the bank?

Yes, you can withdraw everything in your account from your bank. But if you want your account to stay open, some banks have minimum balances, such as $25 or more, that must remain in the account to keep it from closing and to pay fees.

What qualifies as a hardship withdrawal for 401k?

Hardship distributions A hardship distribution is a withdrawal from a participant's elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need. The money is taxed to the participant and is not paid back to the borrower's account.

Is there a maximum withdrawal from 401k?

The maximum loan amount permitted by the IRS is $50,000 or half of your 401k plan's vested account balance, whichever is less. During the loan, you pay principle and interest to yourself at a couple points above the prime rate, which comes out of your paycheck on an after-tax basis.

Can I withdraw from my 401k before 59 1 2?

Early withdrawals occur if you receive money from a 401(k) before age 59 1/2. In most, but not all, circumstances, this triggers an early withdrawal penalty of 10% of the amount withdrawn. For example, taking a $10,000 early withdrawal would require you to pay $1,000 in tax to the IRS.

What reasons can you withdraw from 401k without penalty?

Here are the ways to take penalty-free withdrawals from your IRA or 401(k) Unreimbursed medical bills. Disability. Health insurance premiums. Death. If you owe the IRS. First-time homebuyers. Higher education expenses. For income purposes.

How long does it take to cash out 401k?

The amount of time it can take for your 401 k payout to come to you varies depending on the type of retirement plan you have. If your situation is uncomplicated, you can expect to receive the check within days. However, a more complex case might mean it takes up to 60 days if you request to receive the money via check.

How long do I have to wait to withdraw from public?

Funds From Fractional Share Rewards: Each fractional share has a 90 day day holding period before it can be withdrawn. The great news is that if you didn't want to wait 90 days, you can always use the proceeds to buy other stocks if you were interested in something else.

What is the penalty for withdrawing TIAA CREF?

You may be subject to a 10% federal tax penalty for early withdrawal if you were under age 55 when your employment ended, or if you're under age 59½ when you take this withdrawal. A withdrawal is taxable if it is not rolled over to another tax-deferred account.

Why can't I withdraw money from my savings account?

With few exceptions, you can't spend money directly out of your savings account. Instead, money in savings needs to be moved to another account. Even then, financial institutions often limit the number of withdrawals or transfers account holders can make from savings accounts during each statement period.

How hard is it to cash out 401k?

Put simply, to cash out all or part of a 401(k) retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial “hardship” (if the plan provides for this last exception).

How do I get my money out of public?

Select your Profile Icon in the top left corner. Scroll down and select the Account Settings Icon. Scroll down to Banking and select Withdraw Funds.

How much can you withdraw from 401k?

401(k) loans Depending on what your employer's plan allows, you could take out as much as 50% of your savings, up to a maximum of $50,000, within a 12-month period. Remember, you'll have to pay that borrowed money back, plus interest, within 5 years of taking your loan, in most cases.

How long does it take to cash out 401k principal?

The process for Principal can be done either online, by phone, or by mailing or faxing their rollover request form. Once the rollover is initiated, Principal will usually send a check directly to your new account provider and you should see your funds deposited in 10-15 business days after you've submitted the request.

How long does it take to withdraw from TIAA?

Proceeds from trades are available for withdrawal upon settlement of the trade (typically 1-3 business days, depending upon the type of security). There is a seven (7) business day hold on checks and ACH deposits. Cash from wires are available for withdrawal the following business day.

Why is my bank not letting me withdraw money?

ATM issue: When your ATM does not dispense cash, despite sufficient balance, chances are your card is getting penetrated by scammers. What you can do is, get a quick details of the ATM, time and amount you were trying to remove. Visit your bank notify the problem to them.

Can I close my 401k and take the money?

Cashing out Your 401k while Still Employed If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income.

How do I get my money out of TIAA?

If your plan allows it, you can withdraw money online. If an online withdrawal is not an option, call us at 800-842-2252. Please be sure to contact us two to three months before you must receive your withdrawal to ensure you receive funds by the required deadline.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in Macquarie Cash Solutions BFS0384 Formerly FRM3006?

The editing procedure is simple with pdfFiller. Open your Macquarie Cash Solutions BFS0384 Formerly FRM3006 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for the Macquarie Cash Solutions BFS0384 Formerly FRM3006 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your Macquarie Cash Solutions BFS0384 Formerly FRM3006 in seconds.

How do I fill out the Macquarie Cash Solutions BFS0384 Formerly FRM3006 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign Macquarie Cash Solutions BFS0384 Formerly FRM3006 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is Macquarie Cash Solutions BFS0384 (Formerly FRM3006)?

Macquarie Cash Solutions BFS0384 is a financial reporting form utilized by Macquarie to capture details related to cash management and liquidity solutions offered to clients.

Who is required to file Macquarie Cash Solutions BFS0384 (Formerly FRM3006)?

Clients and businesses utilizing Macquarie's cash management services are typically required to file Macquarie Cash Solutions BFS0384 for proper documentation and regulatory compliance.

How to fill out Macquarie Cash Solutions BFS0384 (Formerly FRM3006)?

To fill out Macquarie Cash Solutions BFS0384, individuals must provide accurate financial information, including account details, transaction history, and any required supporting documents as specified in the instructions accompanying the form.

What is the purpose of Macquarie Cash Solutions BFS0384 (Formerly FRM3006)?

The purpose of Macquarie Cash Solutions BFS0384 is to ensure transparency and accountability in cash management processes, facilitating record-keeping and compliance with financial regulations.

What information must be reported on Macquarie Cash Solutions BFS0384 (Formerly FRM3006)?

The information that must be reported on Macquarie Cash Solutions BFS0384 includes details about cash inflows and outflows, account balances, and relevant financial metrics as required by Macquarie’s reporting standards.

Fill out your Macquarie Cash Solutions BFS0384 Formerly FRM3006 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Macquarie Cash Solutions bfs0384 Formerly frm3006 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.