AU NAT 2586 2020-2025 free printable template

Show details

This document is a form for individuals who do not need to lodge a tax return for the income year 1 July 2019 to 30 June 2020, allowing them to declare their non-lodgment status to the ATO.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non lodgment form

Edit your nat 2586 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your australia nat2586 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit australia nat2586 download online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nat2586 download form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU NAT 2586 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nat2586 form printable

How to fill out AU NAT 2586

01

Download the AU NAT 2586 form from the official website.

02

Read the instructions carefully to understand the requirements.

03

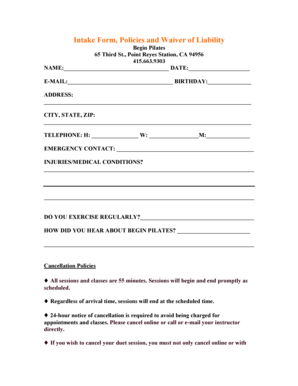

Fill in your personal details, including your name, address, and contact information.

04

Provide relevant identification documents as specified in the instructions.

05

Complete sections pertaining to your employment history and qualifications.

06

Review your information for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the form along with any required documentation to the appropriate authority.

Who needs AU NAT 2586?

01

Individuals applying for migration to Australia who need to confirm their qualifications or skills.

02

Persons seeking employment in Australia who require a skills assessment.

03

Candidates who need to fulfill requirements for certain visa applications related to work.

Fill

au nat 2586

: Try Risk Free

People Also Ask about australia 2586 form

How do I report a scammer to ATO?

If you did pay money or provide sensitive personal identifying information to the scammer, phone us on 1800 008 540 to report it.

What does return not necessary mean?

Return not necessary (RNN) and Further return not necessary (FRNN) advices are also known as non-lodgment advices. If there are no further returns required, you should lodge an FRNN advice and remove the client from your client list. Notify us if your client is not required to lodge their Fringe benefits tax return.

How do I contact ATO?

Ask the operator to connect you to 1300 146 094 Fast Key Code 1 1 8. You will be transferred to an officer who can help you. You can also phone +61 3 9268 8332 for a free interpreting service and ask to be connected to 1300 146 094 .

How do I contact ATO about a dispute?

You can contact ATO Complaints on 1800 199 010 or the Compensation Assistance Line on 1800 005 172 to discuss your options.

What is the ATO office?

Australian Taxation Office (ATO)

How do I contact the ATO outside Australia?

If you are calling from overseas you can contact us between 8:00 am and 5:00 pm (AEST or AEDT), Monday to Friday on +61 2 6216 1111, and ask to be transferred to 1800 050 377.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2020 non lodgment without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including 2020 australia nat2586, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I fill out the non lodgment advice form form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign non lodgment advice form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How can I fill out non lodgment advice form on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your non lodgment advice form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is AU NAT 2586?

AU NAT 2586 is a form used by employers in Australia to report their quarterly Pay As You Go (PAYG) withholding tax obligations to the Australian Taxation Office (ATO).

Who is required to file AU NAT 2586?

Employers who withhold amounts from payments made to employees, contractors, or other entities for working in Australia are required to file AU NAT 2586.

How to fill out AU NAT 2586?

To fill out AU NAT 2586, employers need to provide information such as their business details, total amount withheld, and the income tax withheld from employees' pay during the reporting period.

What is the purpose of AU NAT 2586?

The purpose of AU NAT 2586 is to ensure that employers comply with their tax obligations by accurately reporting the amounts withheld from employee wages to the ATO.

What information must be reported on AU NAT 2586?

The information that must be reported on AU NAT 2586 includes the employer's details, the amount of PAYG withholding, and the total gross wages paid to employees during the reporting period.

Fill out your non lodgment advice form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non Lodgment Advice Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.