NC RoundPoint Mortgage Payoff Request Form free printable template

Show details

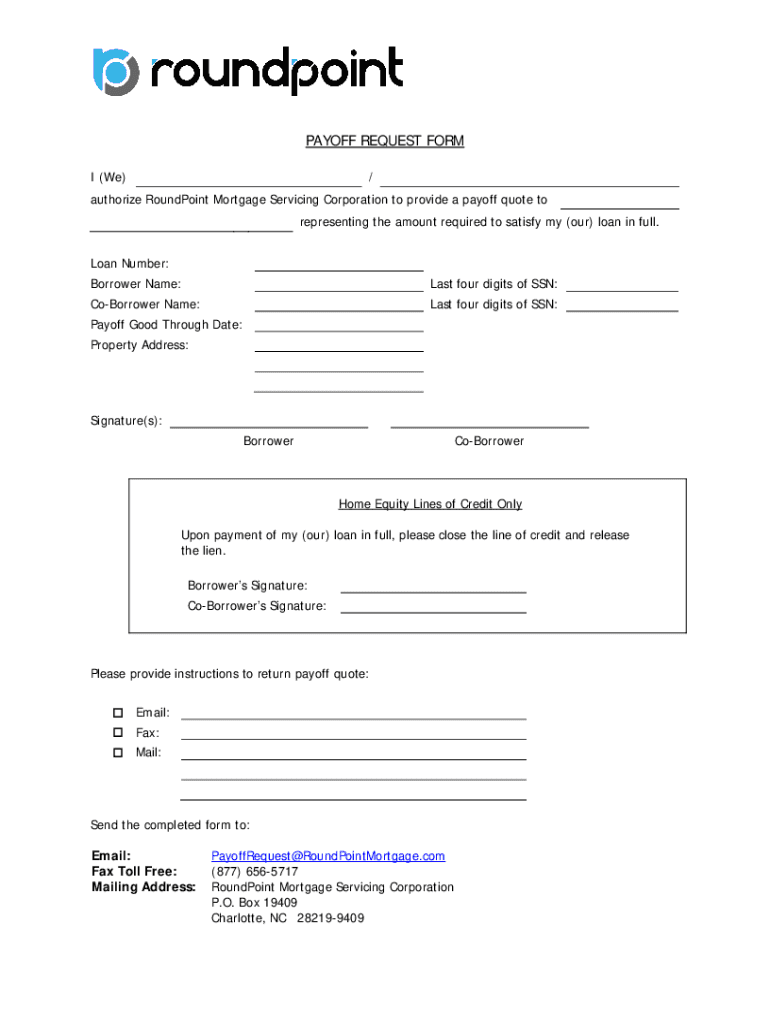

PAYOFF REQUEST FORM

I (We)/authorize Gunpoint Mortgage Servicing Corporation to provide a payoff quote to

representing the amount required to satisfy my (our) loan in full.

Loan Number:

Borrower Name:Last

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign corporation payoff request

Edit your corporation payoff request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporation payoff request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporation payoff request online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit corporation payoff request. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporation payoff request

How to fill out NC RoundPoint Mortgage Payoff Request Form

01

Obtain the NC RoundPoint Mortgage Payoff Request Form from the RoundPoint website or your loan officer.

02

Fill in your loan number at the top of the form.

03

Provide your personal information, including your name, address, and contact details.

04

Indicate the date you are requesting the payoff.

05

Specify whether you want a standard payoff or a payoff for a specific date.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to RoundPoint via mail, fax, or email as specified in the instructions.

Who needs NC RoundPoint Mortgage Payoff Request Form?

01

Current borrowers of RoundPoint Mortgage servicing who wish to pay off their mortgage.

02

Real estate agents assisting clients with closing a property transaction involving a RoundPoint mortgage.

03

Title companies handling the closing process and requiring a payoff statement.

04

Anyone involved in refinancing a RoundPoint mortgage.

Fill

form

: Try Risk Free

People Also Ask about

Can I request a payoff quote?

A payoff quote shows the remaining balance on your mortgage loan, which includes your outstanding principal balance, accrued interest, late charges/fees and any other amounts. You'll need to request your free payoff quote as you think about paying off your mortgage.

How do I get payoff letter from credit?

If you have debt and you want a payoff statement, you can request one by contacting whichever lender or creditor holds the debt. And don't worry, you don't have to pay off the loan early just because you've requested a payoff statement.

What is a payoff request for a car?

If you make a car loan payoff request to your lender, you are simply asking them to give you a payoff price. You're not contracting with them to pay off your car; you're simply getting a quote that you can make use of or not.

How do I get a payoff quote for a car?

If you want to get a payoff letter for the car loan, simply contact your lender. Most lenders allow you to call for a payoff letter while others have this information online. However, you should note these key ideas: Your remaining balance is not the payoff amount because it doesn't include additional interest.

What does it mean to request a payoff amount?

Your payoff amount is how much you will actually have to pay to satisfy the terms of your mortgage loan and completely pay off your debt. Your payoff amount is different from your current balance. Your current balance might not reflect how much you actually have to pay to completely satisfy the loan.

How do I request a payoff for a loan?

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

What happens when you request a payoff quote?

A payoff quote shows the remaining balance on your mortgage loan, which includes your outstanding principal balance, accrued interest, late charges/fees and any other amounts. You'll need to request your free payoff quote as you think about paying off your mortgage.

How do I get a 10 day payoff letter for my car?

How to get your 10-day payoff letter. You'll need to request a 10-day payoff letter from your current loan servicer, which you may be able to do online. Not all lenders offer an online request option, however, so you may need to call or email your loan servicer directly to get this information.

What does payoff request mean?

A payoff request is a statement prepared by your lender which details the payoff amount for prepayment of your mortgage loan. The payoff statement will typically be the remaining balance on your mortgage loan, but it might also include any accrued interest or late charges/fees that could be owed.

Does it cost money to get a mortgage payoff quote?

Expect to pay $25 to $50 for this service. It may be one of the fees on your loan payoff statement. This is a document you definitely want for your records. Final mortgage statement.

What happens if I request a payoff quote?

A payoff quote shows the remaining balance on your mortgage loan, which includes your outstanding principal balance, accrued interest, late charges/fees and any other amounts. You'll need to request your free payoff quote as you think about paying off your mortgage.

How do I request a payoff statement?

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Does it hurt to request a payoff quote?

Don't be afraid to request an auto loan payoff quote. It isn't going to affect your credit, and you're under no obligation to pay off the balance. If you're ready to trade in your vehicle for a new one, but worry your credit is holding you back, let CarsDirect help.

When should you request a payoff quote?

You request a payoff statement from your lender when you want to know exactly how much it costs to pay off your house. You need this information before you sell your home, refinance the mortgage or you otherwise decide to get rid of the debt.

When should I request a payoff statement?

We're here to help! You might request a mortgage payoff statement if you're thinking about refinancing or paying off your mortgage early. It is different from your current balance because it includes interest owed until the payoff date and any fees due.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find corporation payoff request?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the corporation payoff request in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit corporation payoff request on an iOS device?

Create, edit, and share corporation payoff request from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Can I edit corporation payoff request on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share corporation payoff request on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is NC RoundPoint Mortgage Payoff Request Form?

The NC RoundPoint Mortgage Payoff Request Form is a document used to formally request the payoff amount of a mortgage from RoundPoint Financial Group.

Who is required to file NC RoundPoint Mortgage Payoff Request Form?

Typically, the borrower or the authorized representative of the borrower is required to file the NC RoundPoint Mortgage Payoff Request Form.

How to fill out NC RoundPoint Mortgage Payoff Request Form?

To fill out the NC RoundPoint Mortgage Payoff Request Form, provide accurate account details, personal information, and specify the request date. Follow the instructions carefully and ensure all required fields are completed.

What is the purpose of NC RoundPoint Mortgage Payoff Request Form?

The purpose of the NC RoundPoint Mortgage Payoff Request Form is to obtain the exact amount needed to pay off the remaining balance on a mortgage.

What information must be reported on NC RoundPoint Mortgage Payoff Request Form?

Information that must be reported includes the borrower’s name, account number, property address, contact information, and the date on which the request is made.

Fill out your corporation payoff request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporation Payoff Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.