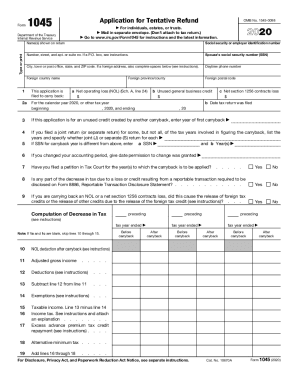

IRS Publication 536 2020 free printable template

Show details

Publication 536ContentsNet Operating

Losses (Vols)

for

Individuals,

Estates, and

TrustsFuture Developments. . . . . . . . . . . . 1Cat. No. 46569U

Department

of the

Treasury

Internal

Revenue

Service(Rev.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Publication 536

Edit your IRS Publication 536 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Publication 536 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Publication 536 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS Publication 536. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Publication 536 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Publication 536

How to fill out IRS Publication 536

01

Obtain a copy of IRS Publication 536, which can be found on the IRS website.

02

Review the publication to understand the applicable credits and deductions for your situation.

03

Gather all necessary financial documents, including income statements and prior tax returns.

04

Follow the instructions in Section 1 to determine if you qualify for any credits.

05

Complete the applicable sections, such as calculating the amount of credit you are eligible for.

06

Transfer the calculated credit amounts to your tax return as indicated in the publication.

07

Verify all entered information for accuracy before submitting your tax documents.

Who needs IRS Publication 536?

01

Individuals or businesses who want to claim tax credits for certain investments or expenditures.

02

Taxpayers interested in understanding their eligibility for additional tax benefits.

03

Those filling out their tax returns who may need guidance on specific IRS credits.

Fill

form

: Try Risk Free

People Also Ask about

What caused the darkness in 536?

Modern scholarship has determined that in early AD 536 (or possibly late 535), an eruption ejected massive amounts of sulfate aerosols into the atmosphere, which reduced the solar radiation reaching the Earth's surface and cooled the atmosphere for several years.

What plague happened in 536?

541–543 The “Justinian” bubonic plague spreads through the Mediterranean, killing 35%–55% of the population and speeding the collapse of the eastern Roman Empire.

How many people died in the year 536?

It created the ideal conditions for the 'Justinian' bubonic plague, the first plague pandemic, to spread across the Mediterranean leading to an estimated 25-50 million deaths, between 35-55% of the population, which also aided the collapse of the eastern Roman Empire.

What was the saddest year in history?

1349 could also be considered on this morbid list as the year when the Black Death wiped out half of Europe, with up to 20 million dead from the plague. Most of the years of World War II could probably lay claim to the “worst year” title as well. But 536 was in a category of its own, argues the historian.

Why was 536 AD dark?

Modern scholarship has determined that in early AD 536 (or possibly late 535), an eruption ejected massive amounts of sulfate aerosols into the atmosphere, which reduced the solar radiation reaching the Earth's surface and cooled the atmosphere for several years.

What was the mysterious fog in 536 AD?

Throughout the year 536 a ''dry fog'' dimmed the sun and moon in the Mediterranean region, scientists have deduced from early chronicles of the area. They believe the fog was caused by a distant volcanic eruption that may have been the most violent on earth since the last ice age.

Why was there no sun in 536 AD?

Modern scholarship has determined that in early AD 536 (or possibly late 535), an eruption ejected massive amounts of sulfate aerosols into the atmosphere, which reduced the solar radiation reaching the Earth's surface and cooled the atmosphere for several years.

What catastrophe happened in 536 AD?

At a workshop at Harvard this week, the team reported that a cataclysmic volcanic eruption in Iceland spewed ash across the Northern Hemisphere early in 536.

How many people died in the 536 AD?

It created the ideal conditions for the 'Justinian' bubonic plague, the first plague pandemic, to spread across the Mediterranean leading to an estimated 25-50 million deaths, between 35-55% of the population, which also aided the collapse of the eastern Roman Empire.

What was the worst time in history?

That's what a team of scientists and historians determined after looking back at humans' history on Earth and identifying the year 536 AD as the absolute worst time to be alive, ing to CNN.

What happened in 536 year?

But in 536 A.D., much of the world went dark for a full 18 months, as a mysterious fog rolled over Europe, the Middle East and parts of Asia. The fog blocked the sun during the day, causing temperatures to drop, crops to fail and people to die. It was, you might say, the literal Dark Age.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS Publication 536 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your IRS Publication 536 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit IRS Publication 536 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your IRS Publication 536 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for the IRS Publication 536 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your IRS Publication 536 in minutes.

What is IRS Publication 536?

IRS Publication 536 provides guidelines for determining how to claim a tax credit for individuals who receive certain types of assistance related to federal tax laws.

Who is required to file IRS Publication 536?

Taxpayers who are claiming the Credit for the Elderly or the Disabled, or are receiving certain types of assistance, may be required to file IRS Publication 536.

How to fill out IRS Publication 536?

To fill out IRS Publication 536, complete the appropriate sections by providing required personal information, income details, and any other necessary data as outlined in the publication instructions, ensuring all calculations are accurate.

What is the purpose of IRS Publication 536?

The purpose of IRS Publication 536 is to help taxpayers understand and properly claim the tax credits related to older adults and disabled individuals, ensuring they receive the financial support for which they may be eligible.

What information must be reported on IRS Publication 536?

Information that must be reported on IRS Publication 536 includes personal identification details, income sources, amounts, and any tax credits being claimed, along with required supporting documentation.

Fill out your IRS Publication 536 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Publication 536 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.