TX TCDRS-85 2018-2025 free printable template

Show details

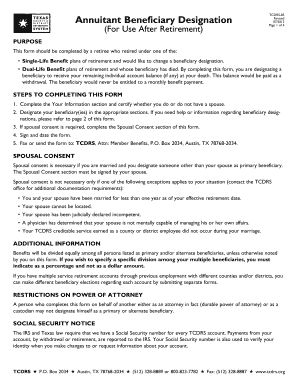

Annuitant Beneficiary Designation

(For Use After Retirement)TCDRS85

Revised

06/2018-Page 1 of 4PURPOSE

This form should be completed by a retiree who retired under one of the:

Singletree Benefit plans

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX TCDRS-85

Edit your TX TCDRS-85 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX TCDRS-85 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX TCDRS-85 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX TCDRS-85. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX TCDRS-85 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX TCDRS-85

How to fill out TX TCDRS-85

01

Start by downloading the TX TCDRS-85 form from the official website.

02

Fill in your personal information, including your full name and contact details.

03

Provide your Social Security Number (SSN) as required on the form.

04

Review the categories of service and select the applicable ones based on your employment history.

05

Include any necessary documentation as specified in the instructions.

06

Double-check that all information is accurate and complete.

07

Sign and date the form at the designated section.

08

Submit the form according to the provided submission instructions, whether electronically or via mail.

Who needs TX TCDRS-85?

01

Individuals who are members of the Texas County & District Retirement System (TCDRS).

02

Employees who are applying for retirement benefits with TCDRS.

03

Former employees seeking to verify service credits or request a refund.

Fill

form

: Try Risk Free

People Also Ask about

How do I fill beneficiary details?

Enter key beneficiary details – sending money to your own account (Optional) Friendly name: name for your own reference (e.g. My DBS Account) Name/Company name: pre-filled to your name/company name. County of beneficiary: country in which the beneficiary is based.

How to fill out beneficiary designation form with trust?

Name a Trust Provide the following information on the beneficiary designation: The full name of the trust as it shows on the trust document. The date the trust was created. The name of the trustee, followed by the word “trustee,” or if you cannot provide a trustee, ETF may accept another contact person.

How to fill out beneficiary designation form?

Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write “children” on one of the lines; instead write the full names of each of your children on separate lines.

What is the beneficiary designation form?

The beneficiary designation forms allow you to name primary and secondary beneficiaries. Your “primary beneficiaries” are the first people or entities that you want to receive your benefit after you die.

Can you withdraw money from Tcdrs?

To withdraw your money, sign into your TCDRS account online and complete the withdrawal process. We will send you a check made out to you for the total amount of your account balance, minus the tax withholding, two to four weeks after we receive your application.

Can I borrow money from my TCDRS account?

You cannot borrow from your account. Your TCDRS benefit is “unassignable”, which means you cannot give another person or business the rights to your account. You cannot take out a loan against your TCDRS savings, and your savings are protected from creditors.

Who should be my beneficiary if you are single?

If you are unmarried, consider choosing a close family member like a parent, sibling, cousin, or child. 2. You may want to consider your potential beneficiary's needs. An easy way to select a beneficiary is to also take into consideration your potential inheritor's needs.

What percentages are required for beneficiary designation?

The total for all primary beneficiaries must equal 100%. If no percentages are specified, the proceeds will be split evenly among those named. If no named beneficiary survives you, settlement will be made to your estate, unless otherwise provided in the Group Contract.

How to fill out 401k beneficiary form?

How to name a beneficiary on your 401(k) account. If you name a person as your beneficiary, you should provide their full legal name, mailing address, date of birth, and Social Security number. You may also be asked to explain their relationship to you.

How do I fill out a beneficiary designation form?

Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write “children” on one of the lines; instead write the full names of each of your children on separate lines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TX TCDRS-85 to be eSigned by others?

Once you are ready to share your TX TCDRS-85, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my TX TCDRS-85 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your TX TCDRS-85 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete TX TCDRS-85 on an Android device?

Complete TX TCDRS-85 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is TX TCDRS-85?

TX TCDRS-85 is a form used by employers participating in the Texas County & District Retirement System (TCDRS) to report employee work and compensation details for retirement purposes.

Who is required to file TX TCDRS-85?

Employers who are part of the Texas County & District Retirement System (TCDRS) and have eligible employees are required to file TX TCDRS-85.

How to fill out TX TCDRS-85?

To fill out TX TCDRS-85, employers must provide accurate details about the employees' work, including their compensation, hours worked, and other relevant data as specified in the form instructions.

What is the purpose of TX TCDRS-85?

The purpose of TX TCDRS-85 is to ensure accurate reporting of employee data necessary for the administration of retirement benefits under the TCDRS.

What information must be reported on TX TCDRS-85?

TX TCDRS-85 requires reporting of employee identification details, earnings, hours worked, service credit, and other relevant employment information necessary for retirement calculations.

Fill out your TX TCDRS-85 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX TCDRS-85 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.