Get the free Mail To: Tax Assessor, 1170 Main Street, West Warwick, RI 02893

Show details

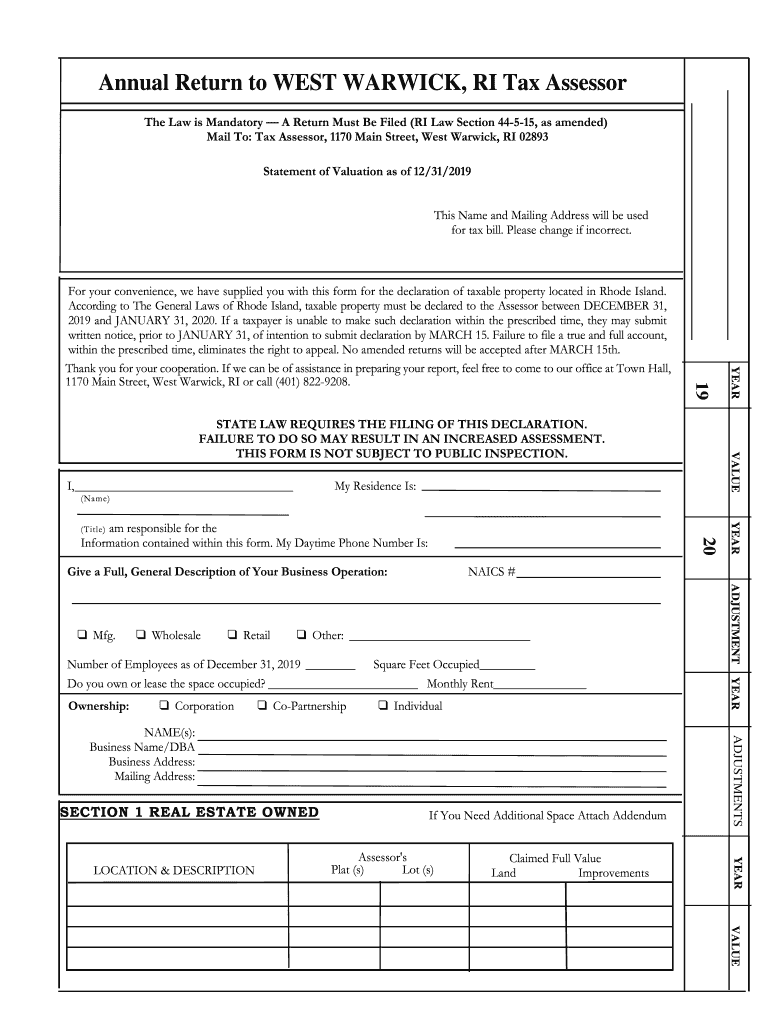

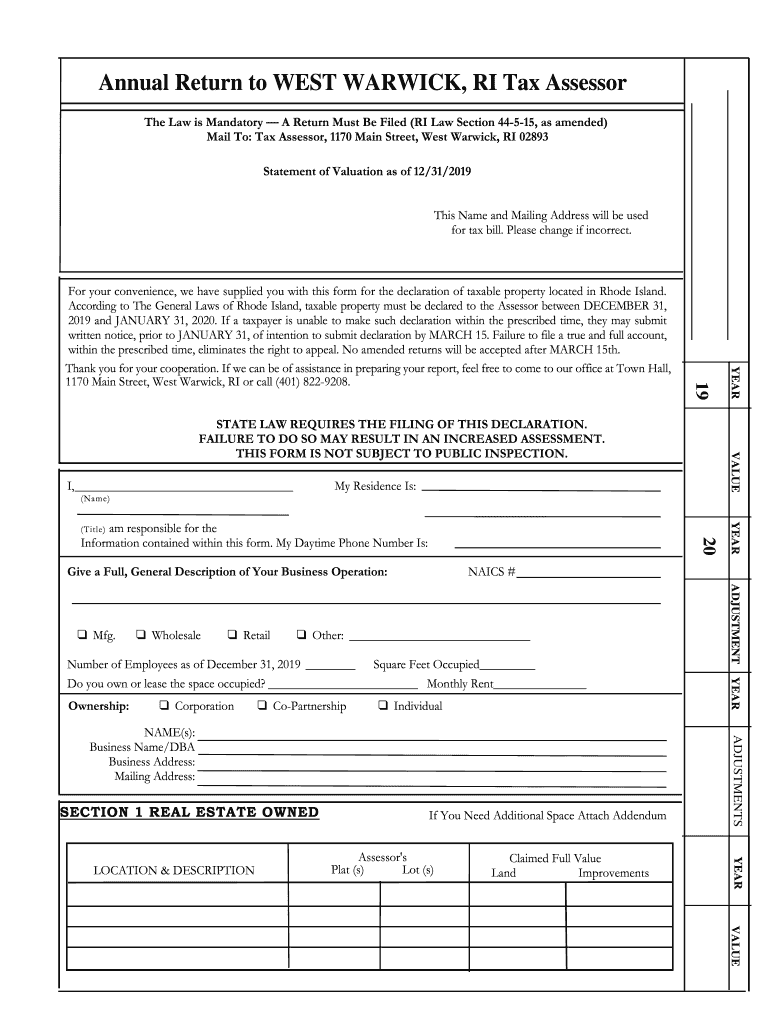

Annual Return to WEST WARWICK, RI Tax Assessor The Law is Mandatory A Return Must Be Filed (RI Law Section 44515, as amended) Mail To: Tax Assessor, 1170 Main Street, West Warwick, RI 02893 Statement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mail to tax assessor

Edit your mail to tax assessor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mail to tax assessor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mail to tax assessor online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mail to tax assessor. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mail to tax assessor

How to fill out mail to tax assessor

01

Start by addressing the mail to the tax assessor.

02

Clearly state the purpose of the mail, such as inquiring about property taxes or requesting a reassessment.

03

Include relevant information such as your name, address, and any account numbers or property details that may be required.

04

Follow a formal tone and ensure the content is clear and concise.

05

Proofread the mail for any errors or omissions before sending it.

06

If necessary, attach any supporting documents or forms that may be needed for the specific purpose of your mail.

07

Finally, sign the mail and send it through a reliable postal service or electronically if applicable.

Who needs mail to tax assessor?

01

Anyone who requires clarification or assistance regarding property taxes, assessments, or related matters can send mail to the tax assessor. This may include property owners, taxpayers, or individuals seeking information about their tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mail to tax assessor online?

With pdfFiller, it's easy to make changes. Open your mail to tax assessor in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I make edits in mail to tax assessor without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing mail to tax assessor and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for the mail to tax assessor in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your mail to tax assessor and you'll be done in minutes.

What is mail to tax assessor?

Mail to the tax assessor refers to any correspondence sent to the local government office responsible for assessing property values for taxation purposes.

Who is required to file mail to tax assessor?

Property owners and residents who are contesting their property valuation or applying for tax exemptions are typically required to file mail to the tax assessor.

How to fill out mail to tax assessor?

To fill out mail to the tax assessor, include your personal information, property details, the purpose of your correspondence, and any relevant documentation or attached forms.

What is the purpose of mail to tax assessor?

The purpose of mail to the tax assessor is to formally communicate issues regarding property assessments, to request information, or to apply for tax-related benefits.

What information must be reported on mail to tax assessor?

Information typically required includes the property owner's name, property address, tax parcel number, the reason for the correspondence, and any relevant evidence or documents.

Fill out your mail to tax assessor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mail To Tax Assessor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.