Get the free What is Gap Insurance and What does it cover?CarInsurance.com

Show details

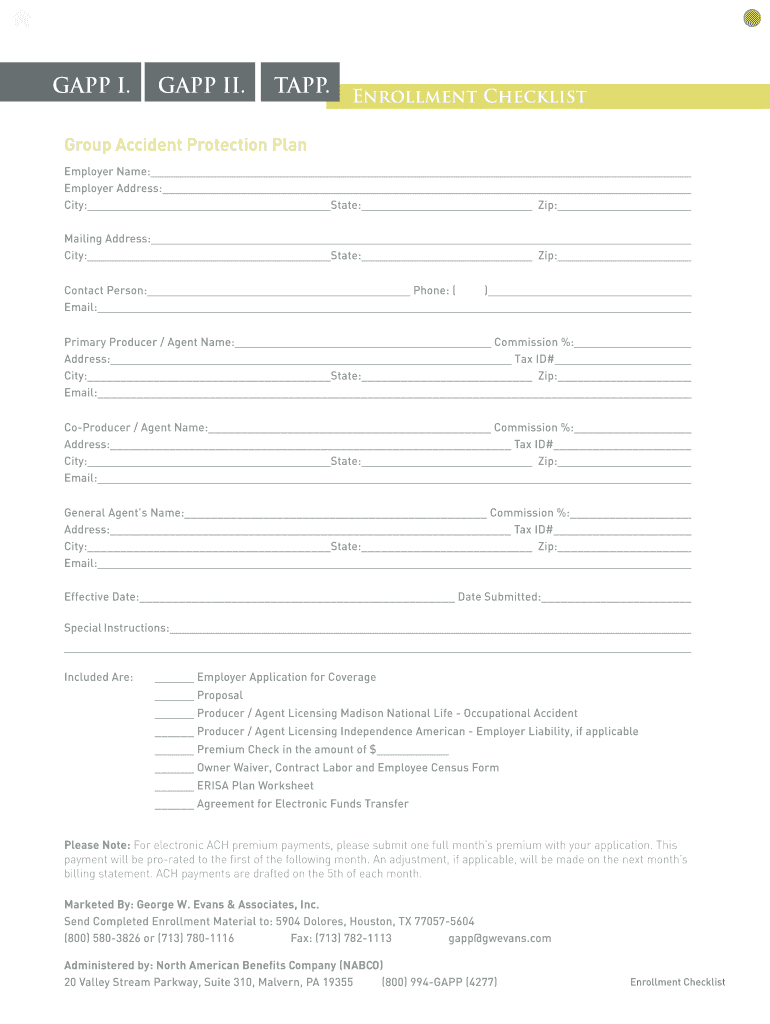

GappWorksGapp I Group Occupational Accident Insurances GAP I is not a policy of Workers Compensation insurance. The employer does not become a subscriber to the Workers Compensation system by purchasing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what is gap insurance

Edit your what is gap insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is gap insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit what is gap insurance online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit what is gap insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what is gap insurance

How to fill out what is gap insurance

01

To fill out what is gap insurance, follow these steps:

02

Understand what gap insurance is: Gap insurance is a type of car insurance coverage that helps cover the gap between the actual cash value of a vehicle and the amount you still owe on an auto loan in the event of a total loss.

03

Research gap insurance providers: Look for reputable insurance companies or financial institutions that offer gap insurance coverage. Compare the coverage options, terms, and prices to find the best fit for your needs.

04

Determine if you need gap insurance: Assess your situation and determine if gap insurance is necessary. It's commonly recommended for individuals who have financed or leased a vehicle, especially if they owe more on the loan than the car's current market value.

05

Check if gap insurance is already included: If you are financing or leasing a car, check if gap insurance is already included in the terms of your loan or lease agreement. Some lenders or leasing companies may automatically include it.

06

Obtain quotes and choose a coverage option: Contact the insurance providers you have researched and obtain quotes for gap insurance coverage. Compare the quotes, considering factors such as coverage limits, deductibles, and premiums. Select the coverage option that suits your needs and budget.

07

Fill out the application: Once you have chosen an insurance provider, fill out the application form for gap insurance. Provide accurate information about your vehicle, loan/lease details, and personal information as requested.

08

Review the terms and conditions: Before finalizing the application, carefully review the terms and conditions of the gap insurance coverage offered. Make sure you understand the coverage limits, exclusions, and any additional requirements.

09

Pay for the coverage: If you are satisfied with the terms, arrange for the payment of the gap insurance coverage. The payment method and frequency will depend on the insurance provider's policies.

10

Keep documentation and proof of coverage: Once you have obtained gap insurance, keep all the relevant documentation and proof of coverage in a safe place. This includes policy documents, payment receipts, and any correspondence with the insurance provider.

11

Renew or cancel as needed: Regularly review your insurance needs and assess if you still require gap insurance coverage. Renew the policy if necessary or cancel it if it's no longer needed.

12

Remember, it's always a good idea to consult with a licensed insurance professional for personalized advice and guidance regarding gap insurance.

Who needs what is gap insurance?

01

Gap insurance is beneficial for the following individuals:

02

- Those who have financed or leased a vehicle: If you have taken out a loan or leased a car, and you owe more on the loan or lease than the vehicle's current market value, gap insurance can help cover the difference in the event of a total loss.

03

- Drivers with high depreciation vehicles: If you own a vehicle that is known for rapid depreciation, such as luxury cars or certain types of vehicles, gap insurance can provide added financial protection.

04

- Individuals with minimal down payments: If you made a small down payment on your vehicle purchase, you may have a higher loan amount relative to the car's value. Gap insurance can help bridge that gap.

05

- People who drive frequently or have long commutes: The more you drive, the higher the risk of an accident. If you spend a significant amount of time on the road, gap insurance can provide additional peace of mind.

06

- Those without significant savings: If you don't have substantial savings to cover the potential difference between your car's value and loan/lease amount, gap insurance can be a valuable safety net.

07

Remember, it's important to carefully consider your individual circumstances and consult with insurance professionals to determine if gap insurance is right for you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in what is gap insurance without leaving Chrome?

what is gap insurance can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the what is gap insurance in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out the what is gap insurance form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign what is gap insurance. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is gap insurance?

Gap insurance is a type of insurance that covers the difference between the actual cash value of a vehicle and the amount still owed on the vehicle's loan or lease in the event the vehicle is totaled or stolen.

Who is required to file what is gap insurance?

Typically, gap insurance is not required to be filed with any government entity; however, it may be required by lenders or dealerships when financing or leasing a vehicle.

How to fill out what is gap insurance?

To acquire gap insurance, fill out an application provided by your insurance provider; usually, you will need to provide information about the vehicle, your financing arrangement, and any existing insurance policies.

What is the purpose of what is gap insurance?

The purpose of gap insurance is to protect vehicle owners from financial loss in case their vehicle is declared a total loss, ensuring they do not owe more than the vehicle's worth.

What information must be reported on what is gap insurance?

Information required for gap insurance may include the vehicle's make, model, year, VIN, purchase price, loan balance, and the primary insurance policy details.

Fill out your what is gap insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is Gap Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.