Canada 5498A 2020 free printable template

Show details

Notice to readers: This document complies with Quebec government standard S G Q R I 0 0 8 0 2 on the accessibility of downloadable documents. If you experience difficulties, please contact us at:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada 5498A

Edit your Canada 5498A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada 5498A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada 5498A online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada 5498A. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada 5498A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada 5498A

How to fill out Canada 5498A

01

Obtain the Canada 5498A form from the CRA website or your tax professional.

02

Fill in your personal information including your name, address, and social insurance number.

03

Indicate the type of contribution (such as RRSP, TFSA, etc.) by checking the appropriate box.

04

Enter the total amount of contributions made during the tax year.

05

Provide the date of each contribution, ensuring they fall within the correct tax year.

06

Sign and date the form, certifying that the information provided is accurate.

07

Submit the completed form to the Canada Revenue Agency (CRA) by the due date.

Who needs Canada 5498A?

01

Individuals who have made contributions to a Registered Retirement Savings Plan (RRSP), Tax-Free Savings Account (TFSA), or similar accounts.

02

Taxpayers who need to report these contributions for tax purposes in Canada.

03

Anyone eligible for tax deductions related to retirement account contributions.

Fill

form

: Try Risk Free

People Also Ask about

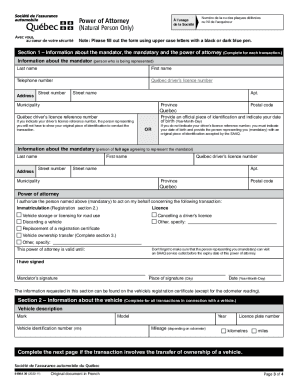

How do I transfer ownership of a car in Québec?

Documents required by the SAAQ for transfer of ownership a copy of the act of birth. the original or a certified copy of a contract or certificate proving your marriage or civil union. a driver's licence bearing the same address and same last name.

How do I deregister my car in Quebec?

You must send us a letter requesting the cancellation of your vehicle registration.The letter must contain: your last name, first name and complete address. your licence plate number. your file number, which consists of the first letter of your last name followed by 12 digits.

What is the difference between mandator and mandatary SAAQ?

Mandator: Person who gives another person the power to represent them and conduct a transaction on their behalf with the SAAQ. Mandatary: Person who agrees to represent you and conduct a transaction on your behalf with the SAAQ.

How do I complete a transfer of ownership?

How to make the transfer Click on VEHICLE REGISTRATION to access the menu. Click on APPLY FOR TRANSFER OF OWNERSHIP. Click on CREATE NEW button and key in the vehicle registration number. Click on INQUIRE to find information about the vehicle. Then click VIEW to get more information. UPLOAD a scanned copy of the logbook.

Can I sell my car without going to the SAAQ?

When an automobile or a motor home is sold between individuals, both the buyer and seller must go to an SAAQ service outlet to have the vehicle registered in the buyer's name.

What paperwork do I need to sell my car privately in Quebec?

In Quebec, in order to finalize a private vehicle sale, the buyer and seller should sign a contract to make things official. This isn't mandatory, but it's advisable. CAA Quebec provides its members with standard contracts, but Bill of Sale forms can also be found online.

Do you pay tax on private car sales in Quebec?

The purchaser must pay the Quebec sales tax ( QST ). The QST is calculated on the declared selling price for vehicles that are over 10 years old.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Canada 5498A in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your Canada 5498A and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make edits in Canada 5498A without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing Canada 5498A and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out the Canada 5498A form on my smartphone?

Use the pdfFiller mobile app to complete and sign Canada 5498A on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is Canada 5498A?

Canada 5498A is a tax form used to report contributions made to Registered Retirement Savings Plans (RRSPs) and other tax-deferred accounts in Canada.

Who is required to file Canada 5498A?

Financial institutions and plan administrators are required to file Canada 5498A to report contributions made by account holders to their RRSPs or similar plans.

How to fill out Canada 5498A?

To fill out Canada 5498A, enter the account holder's information, the contribution amount, the type of account, and the relevant tax year on the form, ensuring all required fields are completed accurately.

What is the purpose of Canada 5498A?

The purpose of Canada 5498A is to provide the Canada Revenue Agency (CRA) with information on contributions to RRSPs and to help ensure accurate tax reporting for individuals.

What information must be reported on Canada 5498A?

The information that must be reported on Canada 5498A includes the account holder's name, address, social insurance number (SIN), contribution amounts, the type of plan, and the reporting year.

Fill out your Canada 5498A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada 5498a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.