Canada Form T2 - Ontario 2020 free printable template

Show details

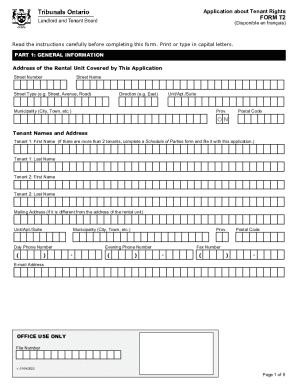

Application about Tenant RightsFORM T2(Disposable en Francis)Important Information for Tenants Use this form to apply to have the Board determine whether your landlord, the landlord's agent or the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada Form T2 - Ontario

Edit your Canada Form T2 - Ontario form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada Form T2 - Ontario form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada Form T2 - Ontario online

To use the professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada Form T2 - Ontario. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada Form T2 - Ontario Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada Form T2 - Ontario

How to fill out Canada Form T2 - Ontario

01

Obtain the Canada Form T2 - Ontario from the Canada Revenue Agency (CRA) website or your local tax office.

02

Begin by filling out your corporation's name, business number, and fiscal period at the top of the form.

03

Complete the identification section, providing details about the corporation, such as its address and type of business.

04

Fill in the financial information section, including total income, net income, and tax calculations.

05

Complete the provincial tax calculation section specific to Ontario.

06

Claim any eligible deductions or credits available to your corporation.

07

Review all entries to ensure accuracy before signing the declaration.

08

Submit the completed Form T2, along with any required schedules and payment for taxes owed, by the due date.

Who needs Canada Form T2 - Ontario?

01

Any corporation operating in Canada, independently from profit status, must file a Canada Form T2.

02

Corporations doing business in Ontario or having income sourced from Ontario are required to use this form for provincial tax calculation.

03

This form is necessary for both Canadian resident and non-resident corporations earning income in Canada.

Fill

form

: Try Risk Free

People Also Ask about

Can my landlord do renovations while occupied Ontario?

Can a landlord remodel while occupied? Yes, and if the work that needs to be done is not overly disruptive or is just a few minor upgrades, then your tenant can stay put.

Can you evict a tenant for renovations Ontario?

A landlord may also apply to terminate a tenancy on the basis that the landlord: (1) will demolish the rental unit; (2) needs vacant possession to do extensive repairs or renovations; or (3) intends to convert the rental unit to non-residential use.

How much can a landlord raise the rent in Ontario 2023?

Every year, the Province of Ontario sets the maximum amount that landlords can raise market rents for most Ontario renters without approval from the Landlord and Tenant Board. The rent increase guideline for 2023 is 2.5%. The guideline applies to rent increases between January 1, 2023 and December 31, 2023.

What is an example of breach of quiet enjoyment Ontario?

A violation or “breach” of quiet enjoyment is most commonly associated with unreasonable noise, but can also include other disturbances such as excessive smoke, intimidation and harassment from the landlord or another tenant, and even repair work that takes away part of a rental unit for an extended period.

What is a t2 form Ontario?

You can use this application to apply to have the Landlord and Tenant Board (the LTB) determine whether the landlord, the landlord's agent or the superintendent: ▪ entered your rental unit illegally, ▪ changed the locking system without giving you replacement keys, ▪ seriously interfered with the reasonable enjoyment

Can my landlord make me move out for repairs California?

[Civil Code 1946.1] Even rental agreements that purport to require you to move for such work are probably not enforceable. Asking you to move out without compensation, move your furniture or otherwise accommodate the landlord's plans is a breach of the implied covenant of good faith and fair dealing.

What reasons can a landlord evict a tenant in Ontario?

Reasons a Landlord Can Apply to Evict a Tenant Abandoned rental unit. Agreement to end the tenancy. Breach of order or mediated settlement. Ceases to qualify for subsidized housing. Convert use to non-residential. Condominium purchase failed. Damage. Demolition.

How much can a landlord raise the rent after renovation Ontario?

In Ontario, rent increases are governed by strict guidelines set by the province's LTB. For 2022, this amount was fixed at a maximum of 1.2%, and for 2023 the maximum was 2.5%. Typically, landlords who increase rent will use the maximum amount, so this also reflects the average rent increase from year-to-year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify Canada Form T2 - Ontario without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your Canada Form T2 - Ontario into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make edits in Canada Form T2 - Ontario without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing Canada Form T2 - Ontario and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I sign the Canada Form T2 - Ontario electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your Canada Form T2 - Ontario in minutes.

What is Canada Form T2 - Ontario?

Canada Form T2 - Ontario is a corporate income tax return form used by corporations operating in Ontario to report their income, deductions, and taxes payable to the Canada Revenue Agency (CRA) and the Ontario Ministry of Finance.

Who is required to file Canada Form T2 - Ontario?

All corporations, including Canadian resident corporations and non-resident corporations earning income in Canada, are required to file Canada Form T2 - Ontario unless they meet specific exemptions.

How to fill out Canada Form T2 - Ontario?

To fill out Canada Form T2 - Ontario, corporations need to gather financial records, complete the T2 return form, provide information on income and expenses, calculate taxes owed, and submit the form along with any required schedules and payment to the CRA.

What is the purpose of Canada Form T2 - Ontario?

The purpose of Canada Form T2 - Ontario is to report a corporation's income, calculate the tax payable, and ensure compliance with federal and provincial tax laws in Canada.

What information must be reported on Canada Form T2 - Ontario?

Information that must be reported on Canada Form T2 - Ontario includes the corporation's income, allowable deductions, capital gains and losses, tax credits, payments made during the year, and information on shareholders and directors.

Fill out your Canada Form T2 - Ontario online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Form t2 - Ontario is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.