Get the free Students Income Information

Show details

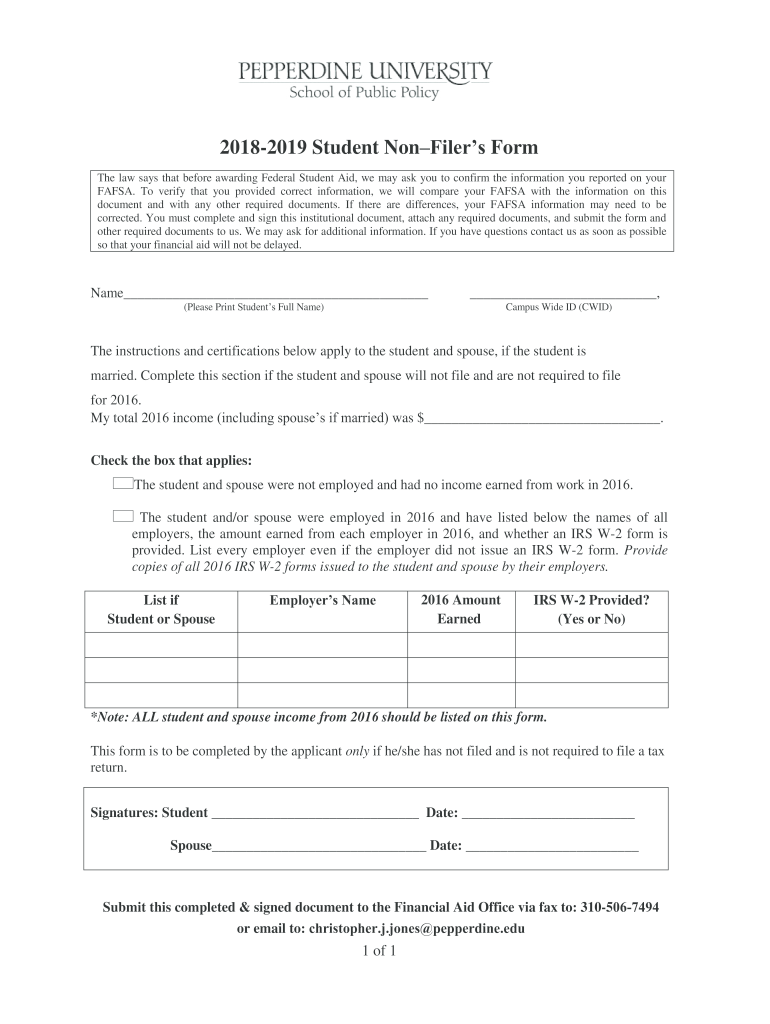

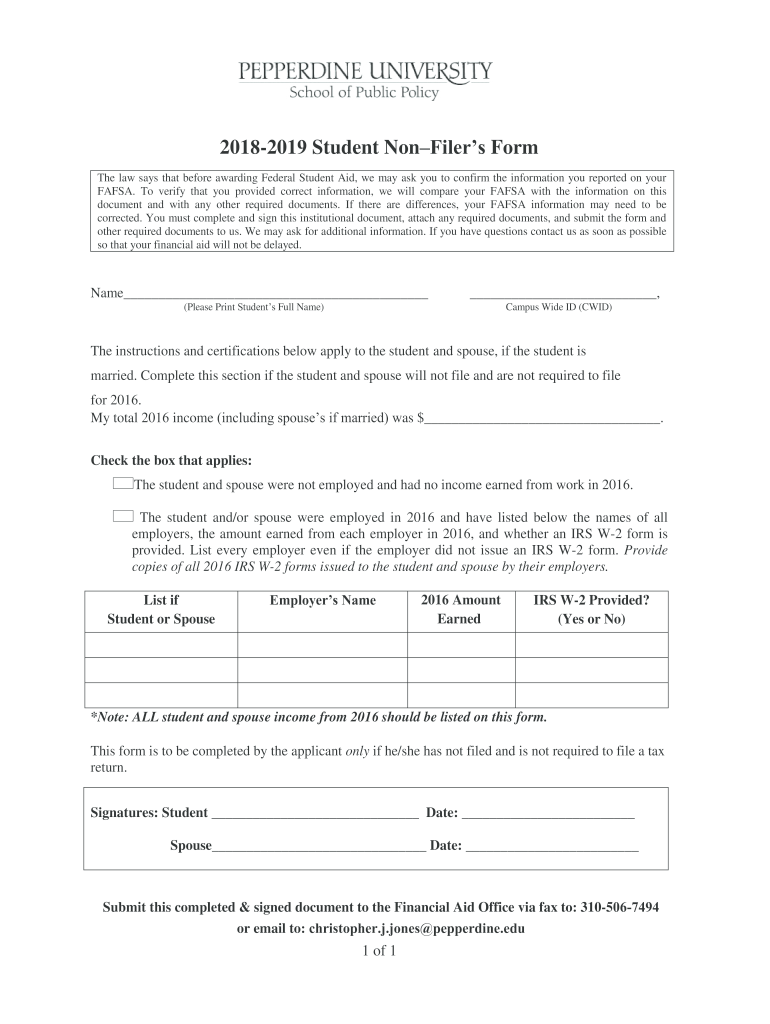

20182019 Student Confiders Form

The law says that before awarding Federal Student Aid, we may ask you to confirm the information you reported on your

FAFSA. To verify that you provided correct information,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign students income information

Edit your students income information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your students income information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit students income information online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit students income information. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out students income information

How to fill out students income information

01

To fill out students income information, follow these steps:

02

Start by gathering all the necessary documents, such as pay stubs, W-2 forms, and any other income-related documents for the student.

03

Begin filling out the income section of the student's application form or financial aid form.

04

Provide accurate information about the student's income from all sources, including part-time jobs, internships, scholarships, grants, and any other sources of income.

05

Clearly indicate the frequency of income, whether it is weekly, monthly, or annually.

06

Include information about any deductions or taxes withheld from the student's income, if applicable.

07

Double-check all the entered information for accuracy and make sure it is up to date.

08

Submit the completed income information section of the form along with any supporting documents as required.

09

If filling out the information online, ensure all the data is entered correctly before submitting.

10

Keep a copy of all the submitted documents and forms for future reference.

11

If any changes occur in the student's income situation, promptly update the income information by contacting the relevant institution or organization.

Who needs students income information?

01

Students income information is typically needed by:

02

- Educational institutions to determine eligibility for financial aid or scholarships.

03

- Government agencies to assess eligibility for certain student welfare programs or grants.

04

- Lenders or banks when applying for student loans.

05

- Potential employers who may request income information for internships or work-study opportunities.

06

- Research institutions conducting studies related to student income and its impact on education.

07

- Non-profit organizations or foundations offering assistance or support to students based on income criteria.

08

- Some academic programs or courses that have specific income requirements for admission or fee waivers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my students income information in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your students income information and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit students income information on an Android device?

You can edit, sign, and distribute students income information on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I fill out students income information on an Android device?

Complete students income information and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is students income information?

Student income information refers to the financial details that report a student's earnings from work, investments, or other sources that may impact their eligibility for financial aid.

Who is required to file students income information?

Students who are applying for federal financial aid and those who meet certain income thresholds are required to file their income information.

How to fill out students income information?

To fill out student income information, students should gather their financial documents, complete the applicable sections on the FAFSA or financial aid forms accurately, and ensure all income sources are reported.

What is the purpose of students income information?

The purpose of student income information is to assess a student's financial need and determine eligibility for financial aid programs.

What information must be reported on students income information?

Students must report wages, interest income, dividends, and any other taxable income, as well as pertinent tax information such as adjusted gross income.

Fill out your students income information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Students Income Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.