Get the free Automatic Investment Plan and Electronic Bank Transfer Form

Show details

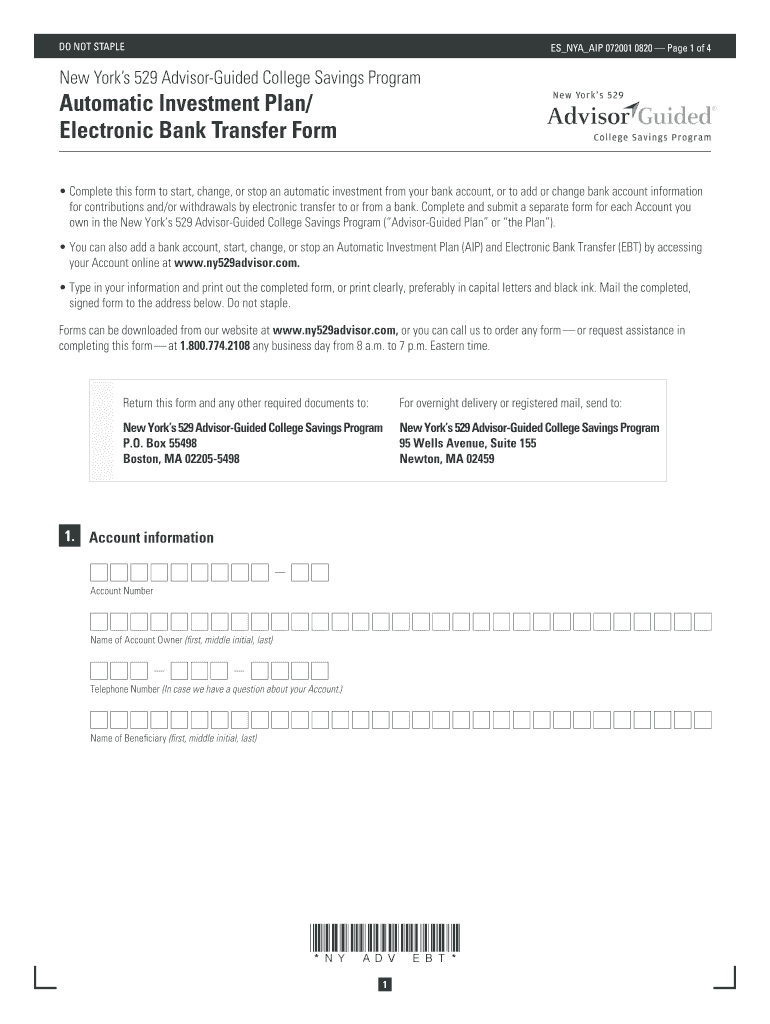

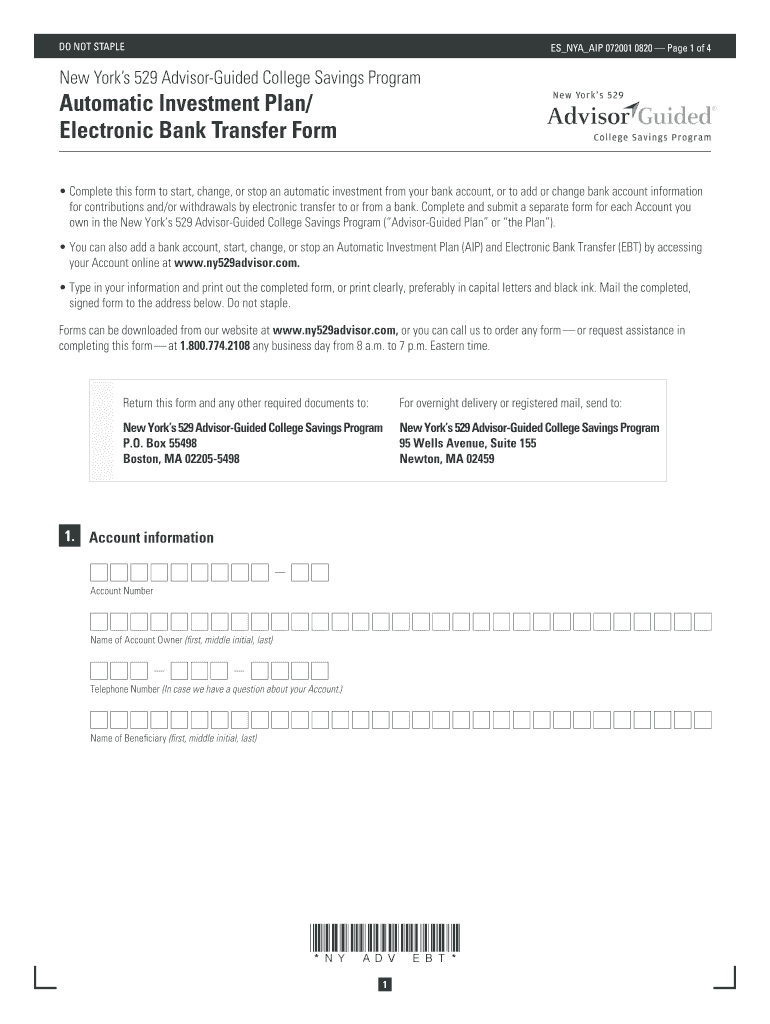

DO NOT Staple NYC AIP 072001 0820-Page 1 of 4New York's 529 AdvisorGuided College Savings ProgramAutomatic Investment Plan/ Electronic Bank Transfer Form Complete this form to start, change, or stop

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automatic investment plan and

Edit your automatic investment plan and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automatic investment plan and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit automatic investment plan and online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit automatic investment plan and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automatic investment plan and

How to fill out automatic investment plan and

01

To fill out an automatic investment plan, follow these steps:

02

Contact your financial institution or investment firm to inquire about their automatic investment plan. They will provide you with the necessary forms and information.

03

Read the terms and conditions of the plan thoroughly to understand the fees, investment options, and other important details.

04

Determine the amount and frequency of the investments you want to make. This could be a fixed amount every month or a percentage of your income.

05

Provide your personal and financial details as required, including your bank account information for automatic deductions.

06

Choose the investment options that align with your goals and risk tolerance. You may have the option to invest in mutual funds, stocks, bonds, or other assets.

07

Review and sign the completed forms. Make sure you understand all the terms and conditions before proceeding.

08

Submit the filled-out forms to your financial institution or investment firm. They will verify the information and set up your automatic investment plan.

09

Monitor your investments periodically and make any necessary adjustments as your financial goals or circumstances change.

Who needs automatic investment plan and?

01

An automatic investment plan is suitable for individuals who want to:

02

- Build long-term wealth and save for retirement without actively managing their investments.

03

- Take advantage of dollar-cost averaging, which allows them to buy more shares when prices are low and fewer shares when prices are high.

04

- Systematically invest a fixed amount or percentage of their income without having to remember to do it manually every month.

05

- Diversify their investment portfolio by regularly investing in different assets.

06

- Stay disciplined and avoid emotional investment decisions driven by market volatility.

07

- Automate their savings and investment goals, making it easier to achieve financial success.

08

Overall, anyone who wants to simplify their investment process and grow their wealth over time can benefit from an automatic investment plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify automatic investment plan and without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including automatic investment plan and. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute automatic investment plan and online?

pdfFiller has made filling out and eSigning automatic investment plan and easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit automatic investment plan and straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing automatic investment plan and.

What is automatic investment plan?

An automatic investment plan is a strategy that allows investors to invest a predetermined amount of money on a regular basis into a specific investment vehicle, such as mutual funds or stocks, without needing to make individual investment decisions each time.

Who is required to file automatic investment plan?

Individuals or entities who participate in an automatic investment plan that involves contributions to retirement accounts or other investment accounts may be required to file specific forms with the appropriate financial or tax authorities.

How to fill out automatic investment plan?

To fill out an automatic investment plan, one typically needs to provide personal and financial information, select the investment amount, set the frequency of investments, and authorize the financial institution to withdraw funds from their bank account.

What is the purpose of automatic investment plan?

The purpose of an automatic investment plan is to facilitate a disciplined and consistent saving strategy, promote long-term wealth accumulation, and reduce the emotional stress of investing by automating contributions.

What information must be reported on automatic investment plan?

Information that must be reported on an automatic investment plan may include the investor's personal identification details, investment amounts, frequency of contributions, bank account information for fund transfers, and any tax identification numbers.

Fill out your automatic investment plan and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automatic Investment Plan And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.