Get the free Hennepin County General Accounting A-13

Show details

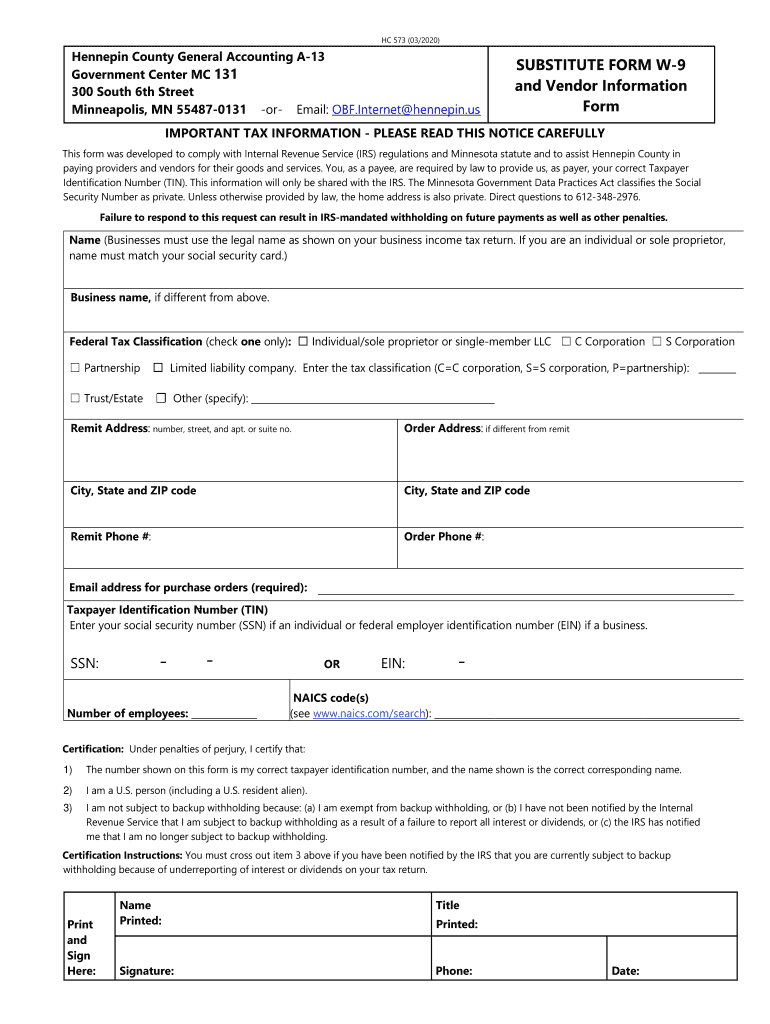

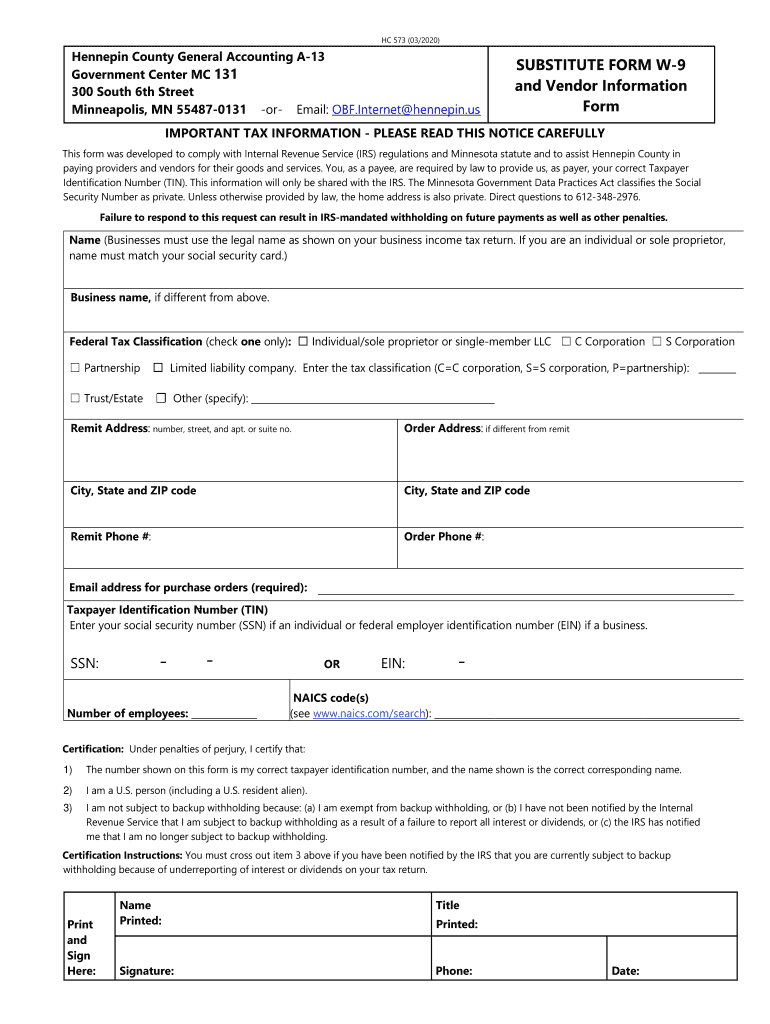

HC 573 (03/2020)Hennepin County General Accounting A13 Government Center MC 131 300 South 6th Street Minneapolis, MN 554870131 or Email: OF. Internet Hennepin. Substitute FORM W9 and Vendor Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hennepin county general accounting

Edit your hennepin county general accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hennepin county general accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hennepin county general accounting online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit hennepin county general accounting. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hennepin county general accounting

How to fill out hennepin county general accounting

01

Gather all the necessary financial documents and records, such as invoices, receipts, and bank statements.

02

Start by filling out the basic information section at the beginning of the form. This includes your name, contact information, and the period or date range the accounting is for.

03

Proceed to the income section and enter all the sources of income during the specified period. Make sure to include any additional income or reimbursements received.

04

Move on to the expenses section and list all the expenses incurred during the specified period. Categorize them according to different expense types, such as office supplies, utilities, or travel expenses.

05

Provide any supporting documentation for the expenses, such as receipts or invoices. Make sure to attach them securely to the form.

06

Calculate the net income or loss by subtracting the total expenses from the total income. Enter this figure in the appropriate section of the form.

07

Review the completed form for any errors or missing information. Make necessary corrections before submitting it.

08

Once you are satisfied with the accuracy of the information provided, sign and date the form to affirm its authenticity.

09

Submit the filled out form to the designated department or authority responsible for Hennepin County general accounting.

10

Keep a copy of the filled out form and supporting documents for your records.

Who needs hennepin county general accounting?

01

Hennepin County general accounting is needed by individuals or organizations who are required to report their financial activities and comply with the accounting regulations set by Hennepin County.

02

This includes businesses, non-profit organizations, and individuals who are residents or have financial operations within Hennepin County.

03

Hennepin County general accounting helps in maintaining accurate financial records, facilitating tax compliance, supporting financial decision-making, and ensuring transparency in financial operations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send hennepin county general accounting to be eSigned by others?

To distribute your hennepin county general accounting, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an eSignature for the hennepin county general accounting in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your hennepin county general accounting and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I edit hennepin county general accounting on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing hennepin county general accounting right away.

What is hennepin county general accounting?

Hennepin County General Accounting refers to the department responsible for overseeing the financial reporting, record-keeping, and ensuring compliance with laws and regulations related to the county's financial transactions.

Who is required to file hennepin county general accounting?

Entities and organizations that conduct business or have financial transactions within Hennepin County are typically required to file general accounting reports.

How to fill out hennepin county general accounting?

To fill out Hennepin County General Accounting, individuals or organizations need to follow the prescribed forms provided by the county, accurately input financial data, and ensure all required documentation is attached.

What is the purpose of hennepin county general accounting?

The purpose of Hennepin County General Accounting is to maintain accurate financial records, ensure fiscal transparency, manage public funds effectively, and comply with local, state, and federal regulations.

What information must be reported on hennepin county general accounting?

Information that must be reported includes financial transactions, revenue sources, expenditure details, and any relevant compliance data required by the county regulations.

Fill out your hennepin county general accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hennepin County General Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.