Get the free PDF Fixed Index Annuity Plan for your retirement lifestyle Issued by ...

Show details

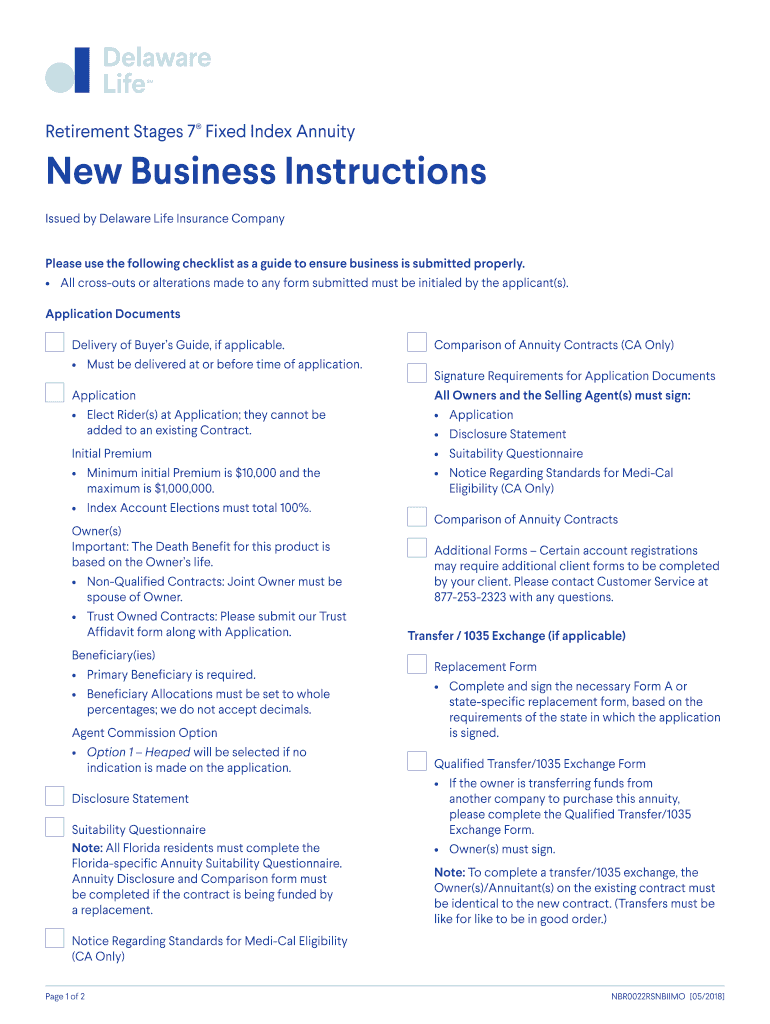

Retirement Stages 7 Fixed Index Annuity Plan for your retirement lifestyle Issued by Delaware Life Insurance Company RS7GI16CBThe Retirement Planning Challenge: Creating Income That LastsRetirement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdf fixed index annuity

Edit your pdf fixed index annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdf fixed index annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdf fixed index annuity online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pdf fixed index annuity. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdf fixed index annuity

How to fill out pdf fixed index annuity

01

To fill out a PDF fixed index annuity, follow these steps:

02

Open the PDF file of the fixed index annuity using a PDF reader or editor program.

03

Review the document and familiarize yourself with the sections and fields that need to be filled out.

04

Locate the first field that requires input. This could be personal information such as name and contact details.

05

Click or tap on the field to activate it for input.

06

Enter the relevant information in the field. Ensure accuracy and double-check for any mistakes.

07

Proceed to the next field and repeat the process until all required fields are completed.

08

If there are checkboxes or multiple-choice options, select the appropriate ones as per your preferences.

09

If the annuity contract requires a signature, find the designated signature field.

10

Depending on the PDF editor you are using, you may have options to digitally sign the document or create a physical signature and scan it.

11

Ensure all necessary fields, checkboxes, and signatures are completed.

12

Review the filled-out form again to ensure accuracy and completeness.

13

Save the filled-out PDF annuity form, and make a backup copy if necessary.

14

Submit the completed form to the relevant party or retain it for your records.

15

It's important to note that these instructions are general, and specific guidelines may vary depending on the particular PDF form and software you are using. Always refer to the instructions provided with the form or consult professional advice if needed.

Who needs pdf fixed index annuity?

01

A PDF fixed index annuity can be beneficial for individuals who:

02

- Are looking for a long-term savings and investment option

03

- Want to receive guaranteed income during retirement

04

- Prefer a lower-risk investment strategy

05

- Desire protection against market downturns or volatility

06

- Are comfortable with a fixed interest rate tied to a specific index

07

- Want to defer taxes on their investment gains

08

- Are willing to commit funds for a specified period

09

- Seek a financial product that offers both growth potential and downside protection

10

It's important to consider individual financial goals, risk tolerance, and consult with a financial advisor to determine if a PDF fixed index annuity is suitable for specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the pdf fixed index annuity electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your pdf fixed index annuity in minutes.

How do I fill out pdf fixed index annuity using my mobile device?

Use the pdfFiller mobile app to fill out and sign pdf fixed index annuity on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit pdf fixed index annuity on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign pdf fixed index annuity on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is pdf fixed index annuity?

A PDF fixed index annuity is a type of financial product that combines features of fixed and indexed annuities, offering a guaranteed minimum return while also allowing for potential gains based on a specific market index.

Who is required to file pdf fixed index annuity?

Individuals or entities that hold or own a fixed index annuity typically need to file the appropriate documentation, which may include financial institutions, insurance companies, or individuals making investment claims.

How to fill out pdf fixed index annuity?

To fill out a PDF fixed index annuity, you need to provide personal information, financial details, and specific terms related to the annuity. Ensure to follow the instructions on the form carefully and provide accurate data.

What is the purpose of pdf fixed index annuity?

The purpose of a PDF fixed index annuity is to provide a safe investment vehicle that offers the potential for higher returns linked to market performance while also ensuring a guaranteed minimum return.

What information must be reported on pdf fixed index annuity?

Information that must be reported includes personal identification, investment amounts, interest rates, terms of the annuity, and any relevant account numbers.

Fill out your pdf fixed index annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdf Fixed Index Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.