Get the free penalties including fines and/or imprisonment

Show details

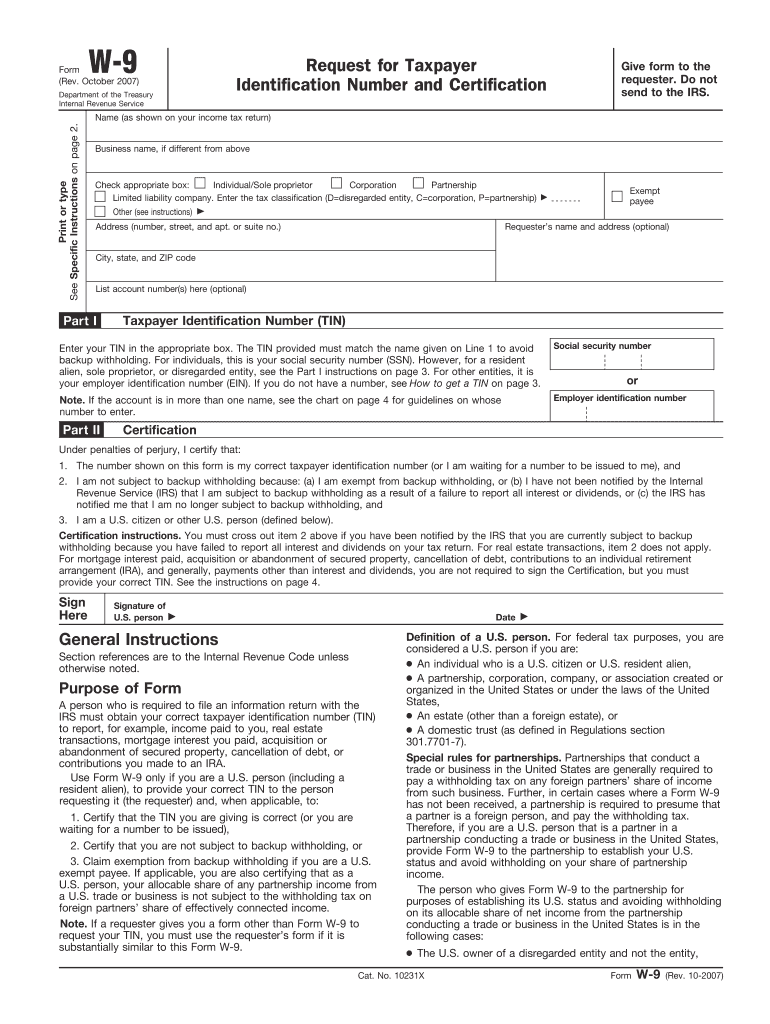

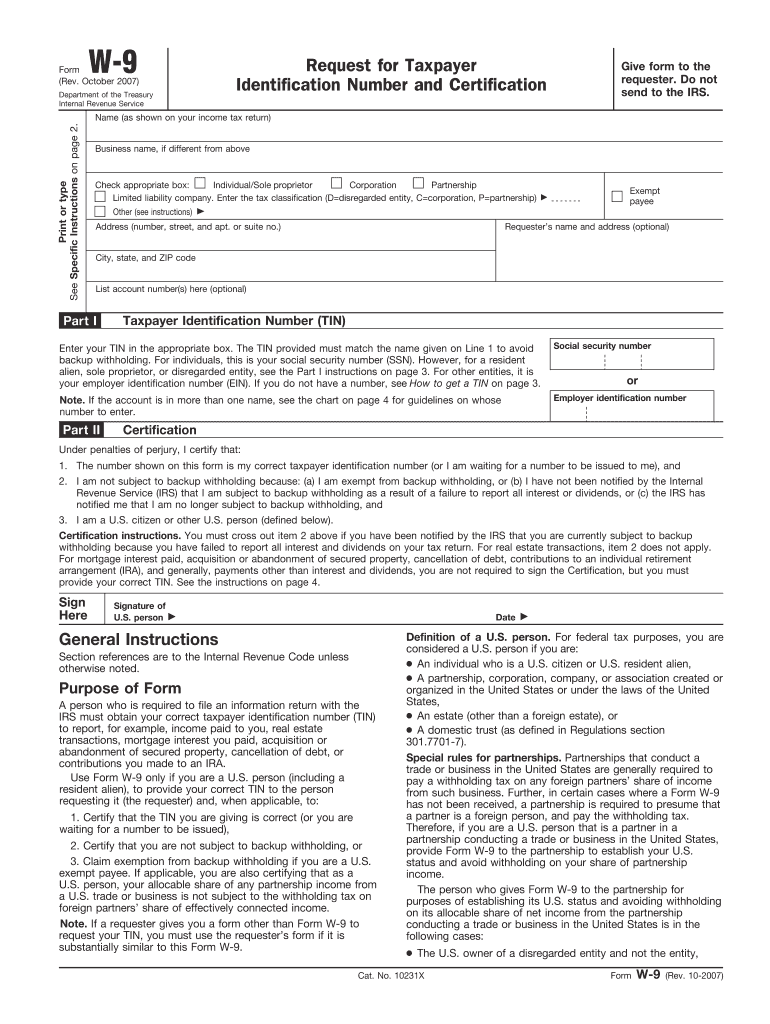

W9Request for Taxpayer

Identification Number and CertificationForm

(Rev. October 2007)

Department of the Treasury

Internal Revenue Serviceable form to the

requester. Do not

send to the IRS. Print

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign penalties including fines andor

Edit your penalties including fines andor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your penalties including fines andor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing penalties including fines andor online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit penalties including fines andor. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out penalties including fines andor

How to fill out penalties including fines andor

01

To fill out penalties including fines, follow these steps:

02

Understand the nature of the penalty or fine and the reasons behind it.

03

Gather all the necessary documents and information related to the violation.

04

Read the penalty notice or fine details thoroughly to ensure you have a clear understanding of the requirements.

05

Complete any required forms or paperwork accurately and legibly.

06

Provide any requested evidence or supporting documentation to justify your case.

07

Submit the penalties including fines form or documents to the appropriate authority or agency, following their specific instructions and deadlines.

08

Keep a copy of all the submitted materials for your records.

09

Monitor the progress of your penalty or fine, and take any necessary actions to resolve the issue or comply with the regulations.

10

If needed, seek legal advice or assistance to handle complex penalties or fines.

11

Always double-check your submissions and ensure compliance with the rules and regulations.

12

Remember, each penalty or fine may have unique requirements, so it's crucial to carefully read and follow the instructions provided by the relevant authority.

Who needs penalties including fines andor?

01

Penalties including fines may be applicable to various individuals or entities, such as:

02

- Individuals who commit traffic violations or other minor offenses.

03

- Companies or businesses that violate regulations or fail to meet specific standards.

04

- Taxpayers who fail to meet tax obligations or comply with reporting requirements.

05

- Contractors or vendors who breach contractual terms or fail to deliver on commitments.

06

- Professionals who violate codes of conduct or ethical standards in their respective industries.

07

- Any person or organization involved in illegal activities or fraudulent behavior.

08

In general, penalties including fines are designed to maintain order, enforce rules, deter wrongdoing, and ensure compliance with laws and regulations. Therefore, anyone who violates the established norms and regulations can potentially be subject to penalties and fines.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send penalties including fines andor for eSignature?

When your penalties including fines andor is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the penalties including fines andor electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your penalties including fines andor in minutes.

Can I create an eSignature for the penalties including fines andor in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your penalties including fines andor and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is penalties including fines andor?

Penalties including fines and/or are financial charges imposed for violating laws, regulations, or contractual agreements. They are intended to deter illegal or non-compliant behavior.

Who is required to file penalties including fines andor?

Entities or individuals that have incurred penalties, fines, or have been assessed non-compliance charges are typically required to file these penalties, which may include businesses, organizations, and individuals.

How to fill out penalties including fines andor?

To fill out penalties including fines and/or, obtain the required forms from the appropriate regulatory authority, provide the necessary details about the penalty assessment, pay the required fees, and submit the completed forms by the specified deadline.

What is the purpose of penalties including fines andor?

The purpose of penalties including fines and/or is to enforce compliance with regulations, serve as a deterrent against non-compliance, and recoup losses incurred by regulatory authorities or affected parties.

What information must be reported on penalties including fines andor?

Information that must be reported on penalties including fines and/or includes the nature of the violation, the amount of the fine or penalty, the relevant legal or regulatory references, and any corrective actions taken by the violator.

Fill out your penalties including fines andor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Penalties Including Fines Andor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.