Get the free . /I El

Show details

........ v 11vL c11Lc1.;:, u o.:’t:a.;u11Ly 11ur11uer department OT the Treasury internal Revenue Servicern1s 1orm as 1t may OE made public. A For the 2018 calendar year, or tax year beginning 8Check

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign i el

Edit your i el form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your i el form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit i el online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit i el. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out i el

How to fill out i el

01

Gather all required information, such as name, address, contact details, and identification documents.

02

Visit the i el website or the nearest i el center.

03

Obtain the i el application form.

04

Carefully fill out the application form, ensuring all information provided is accurate and complete.

05

Double-check all the filled information for any mistakes or missing details.

06

Prepare the necessary supporting documents, such as identification proofs or address proofs.

07

Gather all the required documents and attach them along with the filled application form.

08

Submit the completed application form and the supporting documents to the respective authority or i el center.

09

Pay the applicable fees, if any, for processing the i el application.

10

Collect the receipt or acknowledgment for the submitted application.

11

Wait for the processing time specified by the i el authority.

12

Once the i el is processed, collect it from the i el center or receive it via mail, as per the instructions provided.

13

If any modifications or corrections are required in the i el, follow the necessary procedures to rectify them.

Who needs i el?

01

Individuals who frequently travel internationally may need an i el as it serves as a valid identification document during immigration checks.

02

People who need to establish their identity and resident status in a foreign country for educational, employment, or business purposes may require an i el.

03

Individuals who participate in international conferences, events, or exhibitions often need an i el for easy identification and verification.

04

Tourists or travelers who visit multiple countries and need a standardized identification document across borders might benefit from having an i el.

05

People who frequently engage in international transactions or require a globally recognized identification document may find an i el useful.

06

Students pursuing higher education abroad or planning to study in foreign institutions might need an i el for administrative purposes.

07

Professionals working in multinational companies or having job opportunities abroad may be required to possess an i el for work-related procedures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in i el without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your i el, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I sign the i el electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your i el in minutes.

How do I edit i el on an Android device?

You can make any changes to PDF files, like i el, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is i el?

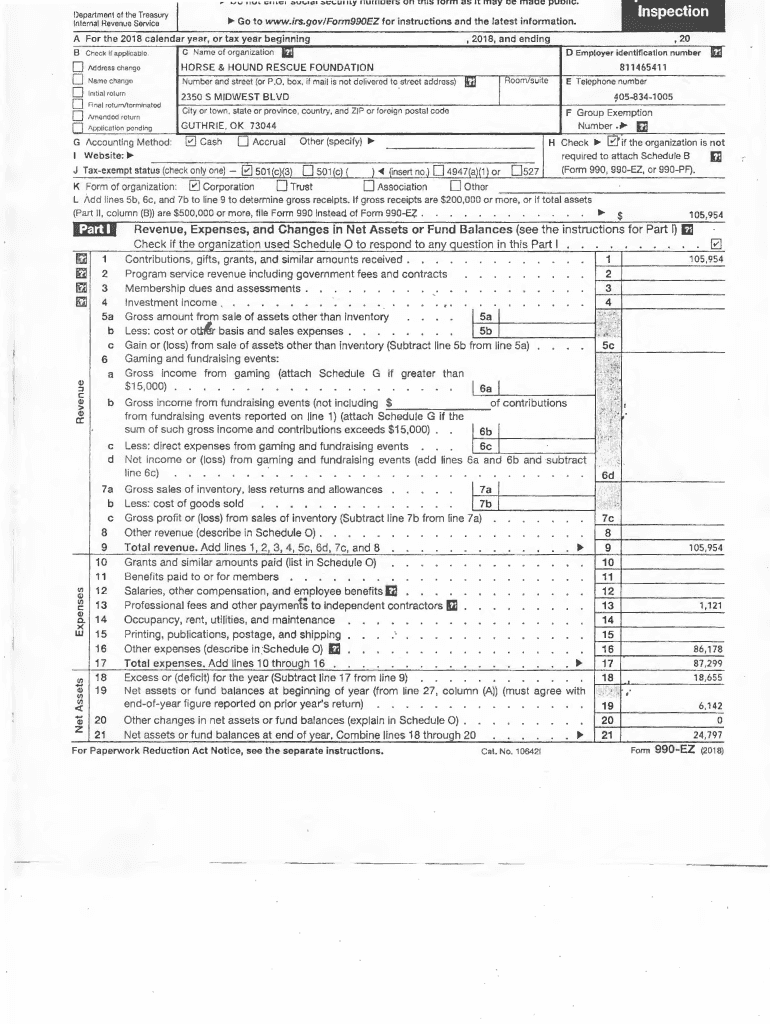

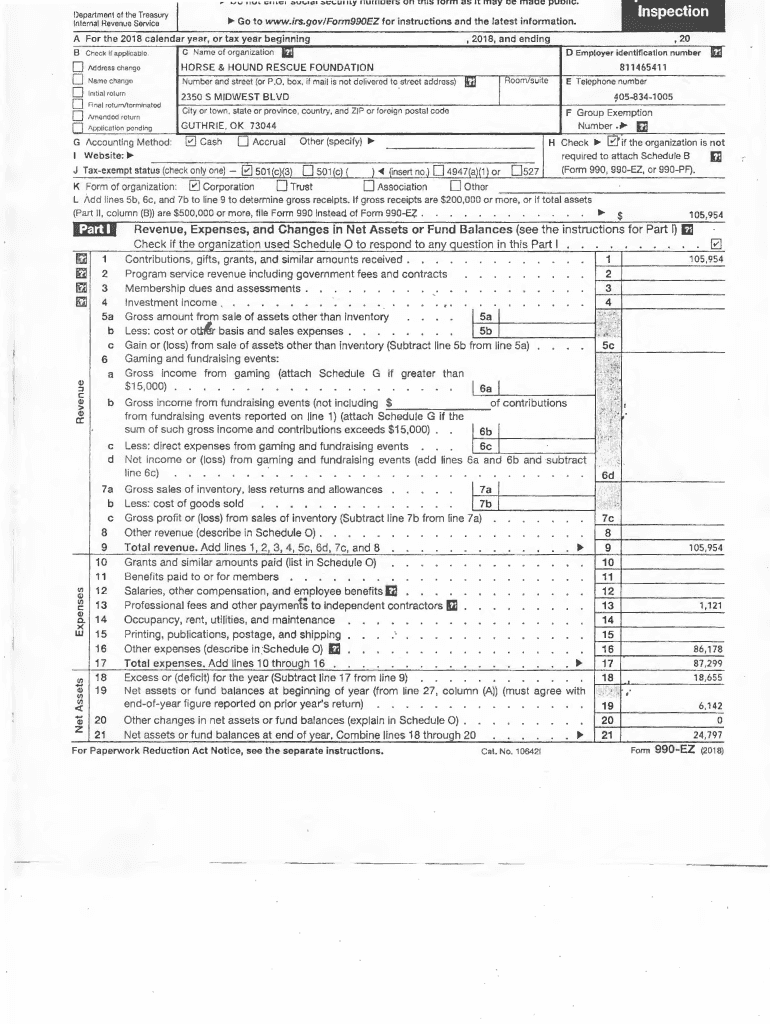

i el is a governmental form related to reporting income, expenses, or other relevant financial information to tax authorities.

Who is required to file i el?

Individuals and entities that meet specific income thresholds or business activities, as defined by tax regulations, are required to file i el.

How to fill out i el?

To fill out i el, gather the necessary financial documents, provide accurate information as per the guidelines, and ensure all calculations are correct before submission.

What is the purpose of i el?

The purpose of i el is to ensure transparency and compliance with tax laws by reporting relevant income and financial data to the authorities.

What information must be reported on i el?

Information that must be reported on i el typically includes total income, deductions, credits, and other financial transactions relevant to tax liabilities.

Fill out your i el online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

I El is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.