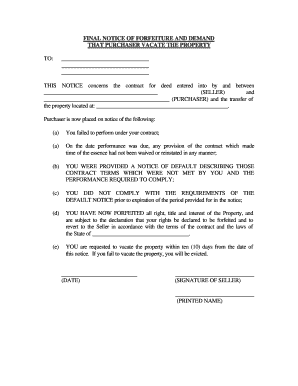

The Final Notice of Forfeiture and Demand Buyer Vacate Property form notifies the Purchaser, after all prior notices of breach have expired, that Seller has elected to cancel the contract for deed in accordance with its terms and all past payments made by Purchaser are now considered forfeited and any future occupancy of property will result in action by the court.

Get the free Ohio Final Notice of Forfeiture and Request to Vacate Property under Contract for Deed

Show details

FINAL NOTICE OF FORFEITURE AND DEMAND THAT PURCHASER Vacates THE PROPERTY TO: THIS NOTICE concerns the contract for deed entered into by and between (SELLER) and (PURCHASER) and the transfer of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ohio final notice of

Edit your ohio final notice of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio final notice of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ohio final notice of online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ohio final notice of. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ohio final notice of

How to fill out Ohio final notice of:

01

Obtain the necessary form: Start by acquiring the Ohio final notice of form, which can typically be found online on the official website of the Ohio Department of Taxation or by contacting your local tax office.

02

Provide your personal information: Begin filling out the form by entering your name, address, and contact information in the designated sections. Make sure to provide accurate and up-to-date information.

03

Specify the tax type and year: Indicate the specific tax type and the corresponding year for which the final notice is being submitted. This could be related to income tax, sales tax, property tax, or any other relevant tax category.

04

Include any supporting documentation: If applicable, attach any supporting documentation or evidence that substantiates your reasons for submitting the final notice. This could include receipts, invoices, or any relevant financial documents.

05

State your reasons: Clearly explain the reasons for submitting the final notice. This may involve providing details about deductions, exemptions, or any special circumstances that warrant consideration.

06

Review and sign the form: Before submission, thoroughly review the completed form to ensure accuracy and completeness. Once you are satisfied with the information provided, sign the form in the designated area.

Who needs Ohio final notice of:

01

Individuals or businesses with outstanding tax liabilities: The Ohio final notice of is necessary for individuals or businesses that have outstanding tax liabilities and need to formally notify the Ohio Department of Taxation about their intention to address the issue.

02

Individuals or businesses seeking resolution: Those who are looking to resolve tax-related matters and want to initiate the process of communicating with the Ohio Department of Taxation can make use of the Ohio final notice of.

03

Parties involved in tax-related disputes: In cases where there is a dispute or disagreement regarding tax obligations or assessments, the Ohio final notice of can be utilized by individuals or businesses to formally express their position and seek a resolution.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ohio final notice of to be eSigned by others?

Once your ohio final notice of is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the ohio final notice of electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your ohio final notice of in seconds.

Can I create an electronic signature for signing my ohio final notice of in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your ohio final notice of right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is ohio final notice of?

Ohio final notice of refers to the formal notification sent by the state of Ohio to taxpayers indicating the final opportunity to resolve tax-related issues or disputes.

Who is required to file ohio final notice of?

The state of Ohio requires individual taxpayers, businesses, and organizations that have outstanding tax liabilities or unresolved tax matters to file ohio final notice of.

How to fill out ohio final notice of?

To fill out ohio final notice of, taxpayers need to provide their personal or business information, details of the tax liabilities or disputes, and any supporting documents or evidence.

What is the purpose of ohio final notice of?

The purpose of ohio final notice of is to formally notify taxpayers about their outstanding tax liabilities or unresolved tax matters and provide them with a final opportunity to address and resolve these issues before further legal actions or penalties.

What information must be reported on ohio final notice of?

Ohio final notice of requires taxpayers to report their personal or business information, details of the tax liabilities or disputes, and provide any relevant supporting documents or evidence.

Fill out your ohio final notice of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ohio Final Notice Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.