Get the free IN-SOS Loan Processing Company Registration New ... - NMLS - sos nebraska

Show details

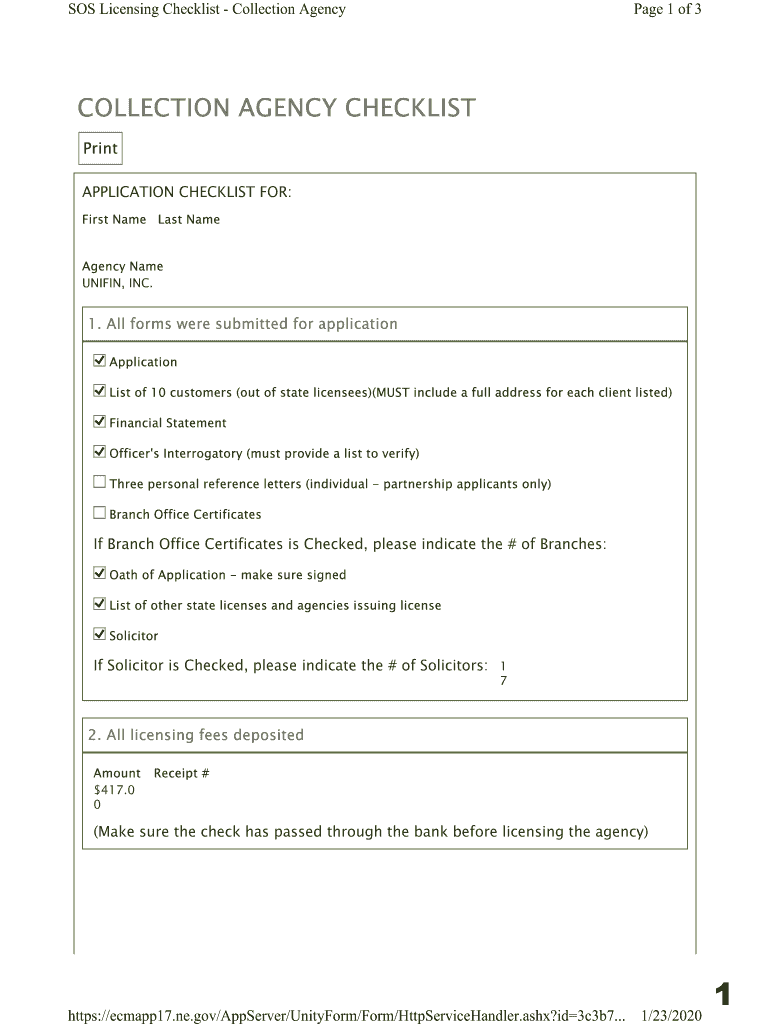

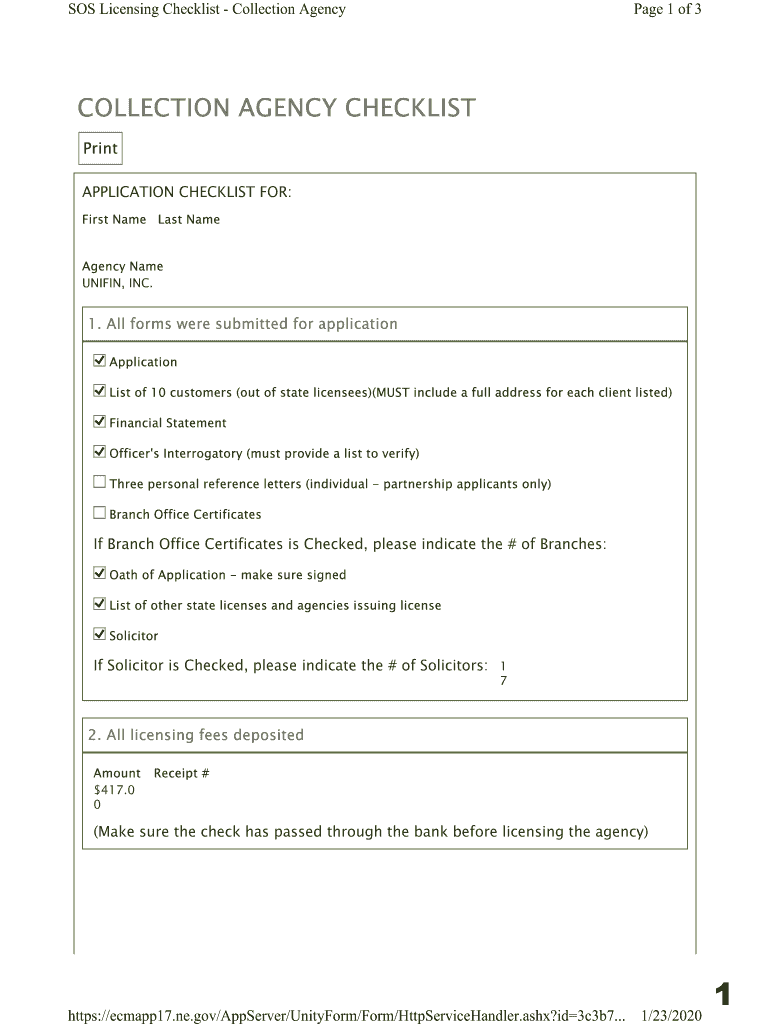

SOS Licensing Checklist Collection Agency Page 1 of 3COLLECTION AGENCY CHECKLIST Print APPLICATION CHECKLIST FOR: First Name Last Name Agency Name UNIFIL, INC.1. All forms were submitted for application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign in-sos loan processing company

Edit your in-sos loan processing company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in-sos loan processing company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing in-sos loan processing company online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit in-sos loan processing company. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out in-sos loan processing company

How to fill out in-sos loan processing company

01

Gather all the necessary documents and information required for the loan application such as financial statements, personal identification, credit history, and business plan.

02

Research and choose a reliable and reputable in-sos loan processing company.

03

Contact the chosen company and inquire about their application process and requirements.

04

Follow the instructions provided by the in-sos loan processing company carefully.

05

Fill out the loan application form accurately and provide all the requested information.

06

Submit all the required documents and information along with the completed application form.

07

Pay attention to any additional steps or requirements mentioned by the company.

08

Wait for the processing time as specified by the company.

09

Respond promptly to any further inquiries or requests for additional information from the company.

10

Once approved, review the loan offer carefully and make a decision.

11

If you decide to accept the loan offer, complete any additional paperwork and fulfill any remaining requirements.

12

Follow up with the company regarding the disbursement of funds and repayment terms.

13

Stay in touch with the in-sos loan processing company throughout the duration of the loan repayment.

14

Make timely payments as agreed and notify the company of any changes in financial circumstances.

Who needs in-sos loan processing company?

01

Entrepreneurs or business owners who require financial assistance to fund their business operations, expansion, or investments.

02

Individuals or organizations seeking loans for personal use, such as education, medical expenses, or purchasing assets.

03

Startups or early-stage companies looking for capital to kickstart their business and cover initial expenses.

04

Individuals or businesses with limited credit history or low credit scores who may find it difficult to secure traditional loans from banks.

05

Those in need of quick loan processing and efficient service.

06

People who prefer to outsource the loan application and processing tasks to professionals.

07

Anyone who wants personalized advice and assistance throughout the loan application and approval process.

08

Those who value convenience and time-saving in the loan application process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send in-sos loan processing company to be eSigned by others?

To distribute your in-sos loan processing company, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit in-sos loan processing company on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign in-sos loan processing company right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit in-sos loan processing company on an Android device?

You can edit, sign, and distribute in-sos loan processing company on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is in-sos loan processing company?

In-SOS loan processing company is a financial service provider that specializes in assisting clients with loan applications, document preparation, and overall loan processing to ensure a smoother borrowing experience.

Who is required to file in-sos loan processing company?

Typically, individuals or businesses seeking financing through the In-SOS loan processing company are required to file the necessary documentation and forms to initiate the loan process.

How to fill out in-sos loan processing company?

To fill out the In-SOS loan processing company forms, applicants need to provide personal information, financial details, and supporting documentation as outlined by the company's application guidelines.

What is the purpose of in-sos loan processing company?

The purpose of In-SOS loan processing company is to streamline the loan application process, offering assistance and expertise to help individuals and businesses secure funding efficiently.

What information must be reported on in-sos loan processing company?

Applicants must report their personal details, income information, employment history, credit history, and any relevant financial documentation as required by the In-SOS loan processing company.

Fill out your in-sos loan processing company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

In-Sos Loan Processing Company is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.