Get the free Pro Forma Financial Information - SEC.govFinancial ...

Show details

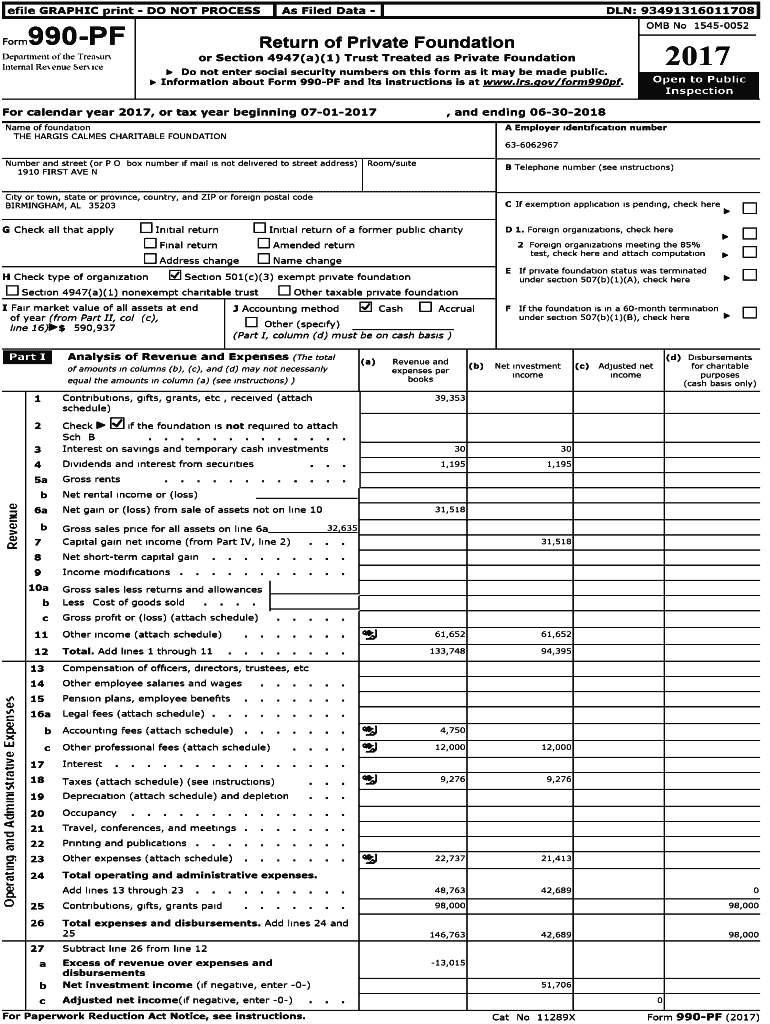

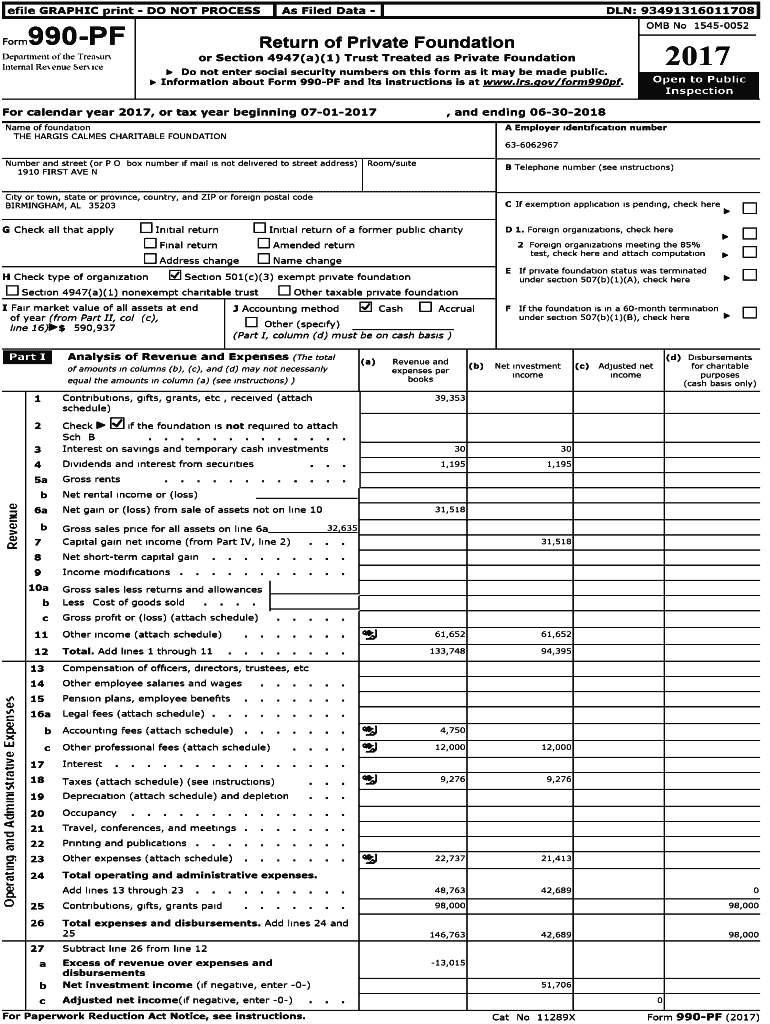

Le file GRAPHIC print DO NOT PROCESS Format Filed Data DAN:93491316011708 OMB No 15450052990PFReturn of Private FoundationDepartment of the Area UN Internal Re venue SER ice2017or Section 4947(a)(1)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pro forma financial information

Edit your pro forma financial information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pro forma financial information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pro forma financial information online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pro forma financial information. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pro forma financial information

How to fill out pro forma financial information

01

Here is a step-by-step guide on how to fill out pro forma financial information:

02

Start by gathering the necessary financial data, such as historical financial statements, sales forecasts, and expense projections.

03

Analyze the historical financial statements to understand the trends and patterns in the company's financial performance.

04

Use the sales forecasts and expense projections to estimate future revenues and expenses of the company.

05

Calculate the projected net income by subtracting projected expenses from projected revenues.

06

Determine the projected cash flow by analyzing the company's operating, investing, and financing activities.

07

Prepare the pro forma balance sheet by listing the projected assets, liabilities, and shareholders' equity based on the estimated financial data.

08

Ensure that the pro forma financial information complies with accounting principles and standards.

09

Include any necessary assumptions and explanations in the footnotes of the pro forma financial statements.

10

Review and revise the pro forma financial information as necessary to ensure accuracy and reliability.

11

Communicate and present the pro forma financial information to relevant stakeholders, such as investors, lenders, or management.

Who needs pro forma financial information?

01

Pro forma financial information is needed by various parties, including:

02

- Business owners and management: They use pro forma financial information to evaluate the financial feasibility of proposed business plans and investment opportunities.

03

- Investors and lenders: They require pro forma financial information to assess the future profitability and financial health of a company, which helps them make informed investment or lending decisions.

04

- Government agencies and regulatory bodies: They may request pro forma financial information to ensure compliance with accounting and reporting requirements.

05

- Potential buyers or partners: They utilize pro forma financial information to assess the value and potential of a business before making acquisition or partnership decisions.

06

- Analysts and researchers: They analyze pro forma financial information to understand industry trends, compare companies, and make financial projections.

07

- Internal stakeholders: Pro forma financial information can be used by departments within a company, such as marketing or operations, to develop budgets and set financial targets.

Fill

form

: Try Risk Free

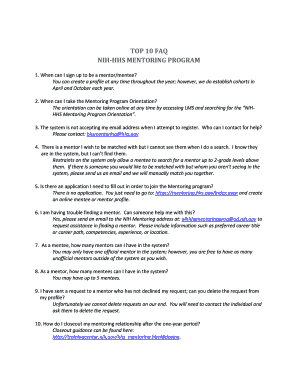

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pro forma financial information in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing pro forma financial information and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit pro forma financial information on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing pro forma financial information, you need to install and log in to the app.

Can I edit pro forma financial information on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share pro forma financial information from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is pro forma financial information?

Pro forma financial information refers to financial statements that include projected or estimated results, often prepared to provide insights into future performance or to illustrate the effects of a specific transaction or event.

Who is required to file pro forma financial information?

Companies that are publicly traded or are planning to go public, as well as those seeking investments or involved in mergers and acquisitions, are typically required to file pro forma financial information.

How to fill out pro forma financial information?

To fill out pro forma financial information, companies need to gather historical financial data, apply relevant adjustments or projections, and present the information clearly, often in the format of income statements, balance sheets, or cash flow statements.

What is the purpose of pro forma financial information?

The purpose of pro forma financial information is to provide stakeholders with a clearer picture of a company’s potential financial performance, especially after a significant event like a merger or acquisition.

What information must be reported on pro forma financial information?

Pro forma financial information must report detailed revenue and expense projections, adjustments made to historical financial data, and the rationale behind these adjustments, typically including both income statements and balance sheets.

Fill out your pro forma financial information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pro Forma Financial Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.