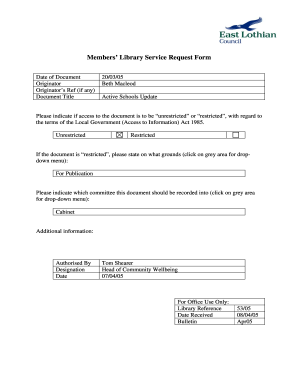

Get the free double taxation

Show details

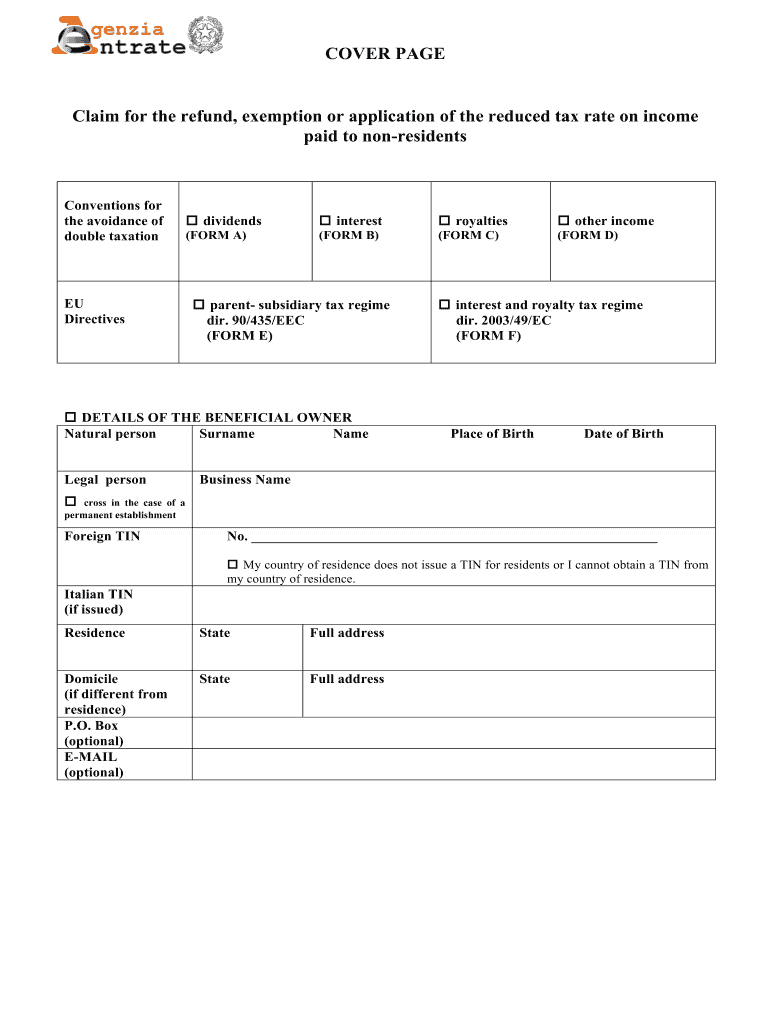

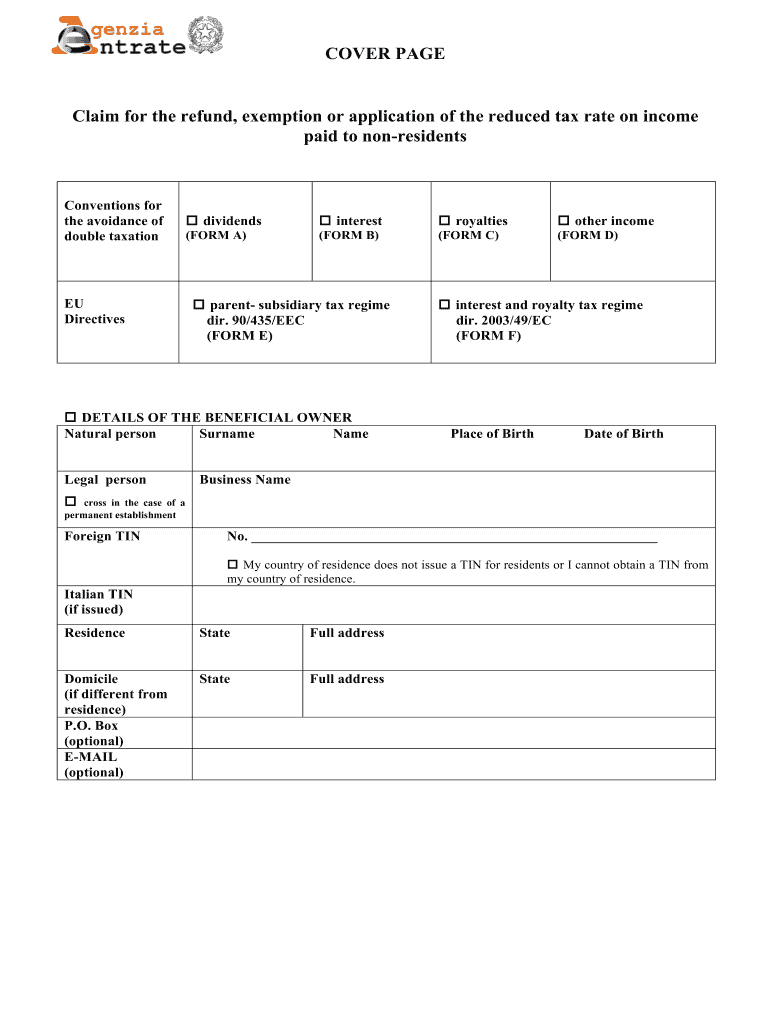

COVER Acclaim for the refund, exemption or application of the reduced tax rate on income

paid to nonresidentsConventions for

the avoidance of

double taxation EU

Directives dividends interest royalties

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign double taxation

Edit your double taxation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your double taxation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing double taxation online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit double taxation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out double taxation

How to fill out double taxation

01

Determine your tax residency status: Before filling out double taxation forms, it is crucial to establish your tax residency status. This is usually based on your physical presence and ties to a particular country.

02

Understand the tax laws of your home country and the country where you earn income: Double taxation agreements are designed to allocate taxing rights between two countries. Familiarize yourself with the tax laws and regulations of both countries involved to ensure accurate reporting and tax planning.

03

Determine the type of income subject to double taxation: Different types of income may be subject to double taxation, such as dividends, interest, royalties, or capital gains. Identify the specific income sources that may fall under double taxation.

04

Obtain necessary forms and documentation: Double taxation agreements often require specific forms to be filled out. Contact the tax authorities of both countries or consult a tax professional to obtain the required forms and ensure compliance.

05

Complete the relevant forms accurately: Fill out the forms with accurate information, ensuring that you report the income subject to double taxation correctly and claim any applicable exemptions or deductions.

06

Submit the forms to the respective tax authorities: Once the forms are completed, submit them to the tax authorities of both countries as per their guidelines. Keep copies of all documents and records for future reference.

07

Seek professional advice if needed: Double taxation can be complex, especially when dealing with international tax laws. If you are unsure or need assistance, consider consulting a tax professional who specializes in double taxation to ensure compliance and optimize tax outcomes.

Who needs double taxation?

01

Individuals or entities who earn income in more than one country may encounter double taxation. Double taxation occurs when both the country of residence and the country where the income is sourced claim the right to tax the same income. To mitigate this, double taxation agreements are established between countries to prevent or minimize double taxation for individuals and entities engaged in cross-border activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send double taxation to be eSigned by others?

Once your double taxation is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get double taxation?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the double taxation in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I execute double taxation online?

Easy online double taxation completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is double taxation?

Double taxation refers to the taxation of the same income or financial transaction in more than one jurisdiction, resulting in the taxpayer paying tax on the same income or profit twice.

Who is required to file double taxation?

Individuals or entities that have income sourced from multiple jurisdictions and are subject to taxation in more than one country are typically required to file for double taxation relief.

How to fill out double taxation?

To fill out double taxation forms, taxpayers need to report their foreign income, claim any foreign tax credits, and follow specific instructions provided by the tax authority relevant to their jurisdiction.

What is the purpose of double taxation?

The purpose of double taxation is to ensure that income generated in one jurisdiction is taxed fairly without being unduly burdened by taxes from another jurisdiction, promoting international trade and investment.

What information must be reported on double taxation?

Taxpayers must report details such as the amount of foreign income, taxes paid to foreign governments, and any applicable tax treaties that may reduce or eliminate double taxation.

Fill out your double taxation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Double Taxation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.