Get the free Unlimited Tax General Obligation Bonds (Parks) and Limited Tax - cosweb ci shoreline wa

Show details

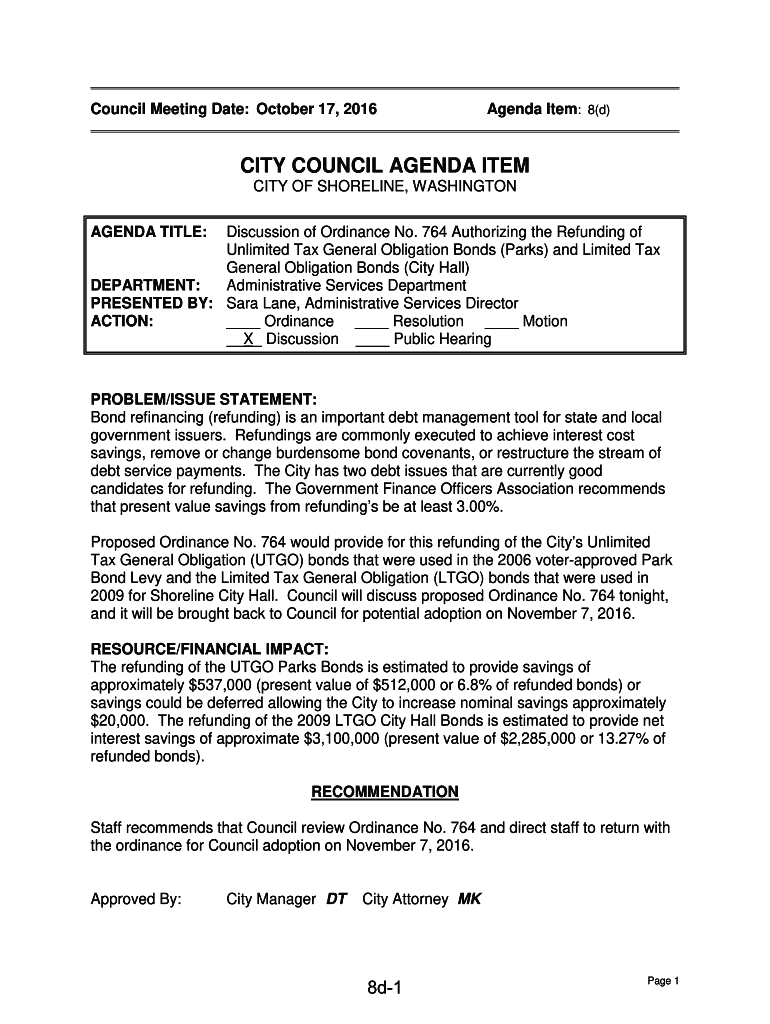

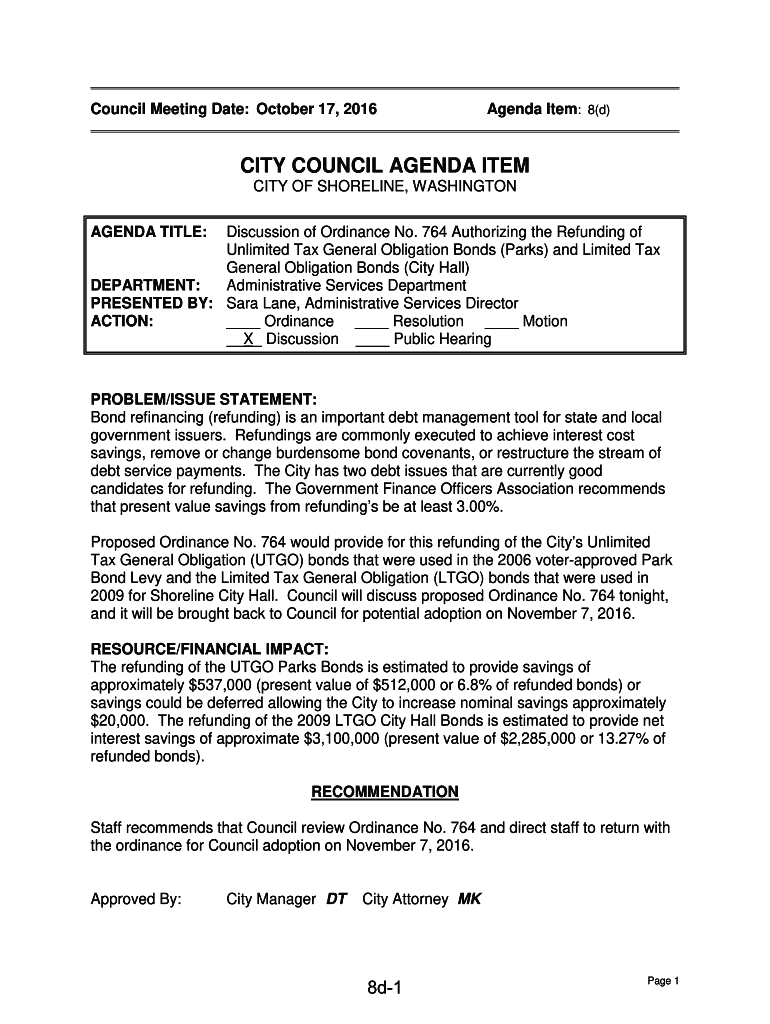

Council Meeting Date: October 17, 2016Agenda Item: 8(d)CITY COUNCIL AGENDA ITEM CITY OF SHORELINE, WASHINGTON AGENDA TITLE:Discussion of Ordinance No. 764 Authorizing the Refunding of Unlimited Tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unlimited tax general obligation

Edit your unlimited tax general obligation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unlimited tax general obligation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing unlimited tax general obligation online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit unlimited tax general obligation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out unlimited tax general obligation

How to fill out unlimited tax general obligation

01

To fill out an unlimited tax general obligation, follow these steps:

02

Obtain the necessary forms from your local tax authority or download them from their website.

03

Read the instructions carefully to understand the information required and any specific guidelines for your jurisdiction.

04

Gather all the necessary financial and tax-related documents, such as income statements, balance sheets, and tax returns.

05

Start filling out the form by providing your personal or business information as requested. This may include your name, address, social security number, or employer identification number.

06

Proceed to complete the sections related to your income, assets, liabilities, and any other relevant financial information. Be accurate and thorough in providing this information.

07

If there are any specific sections or questions that you are unsure about, consult with a tax professional or seek guidance from the tax authority.

08

Double-check all the entered information for accuracy and completeness before submitting the form.

09

Attach any supporting documents as required, such as proof of income or proof of ownership of assets.

10

Submit the completed form to the designated tax authority by the specified deadline. Make sure to keep a copy for your records.

11

Follow up with the tax authority if you have any questions or if there are any further steps or documents required to complete the process.

Who needs unlimited tax general obligation?

01

Unlimited tax general obligation is typically needed by governmental entities or public agencies that require funds to finance public projects or services.

02

It is commonly used by municipalities, counties, school districts, or other government bodies to secure funding for infrastructure improvements, construction projects, education initiatives, or public services.

03

By issuing unlimited tax general obligations, these entities can levy property taxes without statutory limitations to repay the borrowed funds.

04

Investors, such as bondholders or financial institutions, who seek low-risk investments backed by the taxing power of these entities may also be interested in unlimited tax general obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in unlimited tax general obligation?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your unlimited tax general obligation to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out unlimited tax general obligation using my mobile device?

Use the pdfFiller mobile app to fill out and sign unlimited tax general obligation on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit unlimited tax general obligation on an Android device?

You can edit, sign, and distribute unlimited tax general obligation on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is unlimited tax general obligation?

Unlimited tax general obligation refers to a type of municipal bond where the issuer pledges to raise taxes without limitation to repay the bondholders. This ensures a high level of security for investors as the issuer commits to meet its debt obligations through taxation.

Who is required to file unlimited tax general obligation?

Entities that issue unlimited tax general obligation bonds are required to file the appropriate documentation, which typically includes local government units, school districts, and other public agencies.

How to fill out unlimited tax general obligation?

To fill out unlimited tax general obligation forms, one must provide specific information about the bond issuance, including the purpose of the bonds, amount to be raised, interest rates, repayment schedule, and any relevant financial data regarding the issuing entity.

What is the purpose of unlimited tax general obligation?

The purpose of unlimited tax general obligation bonds is to finance public projects such as school construction, infrastructure improvements, and other vital community needs, backed by the issuer's commitment to raise taxes as necessary to cover repayments.

What information must be reported on unlimited tax general obligation?

The information that must be reported includes the issuer's financial condition, bond details (amount, interest rate, maturity), project descriptions funded by the bonds, and a plan for tax levies to ensure bond repayment.

Fill out your unlimited tax general obligation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Unlimited Tax General Obligation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.