UK HMRC SA106 2018 free printable template

Show details

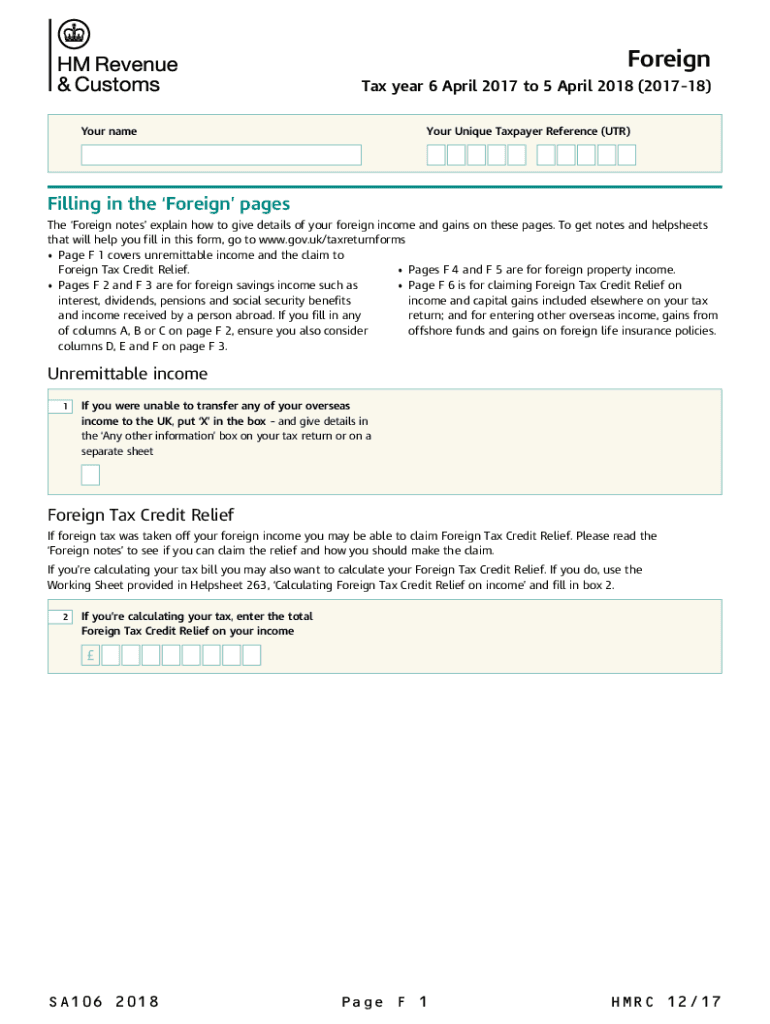

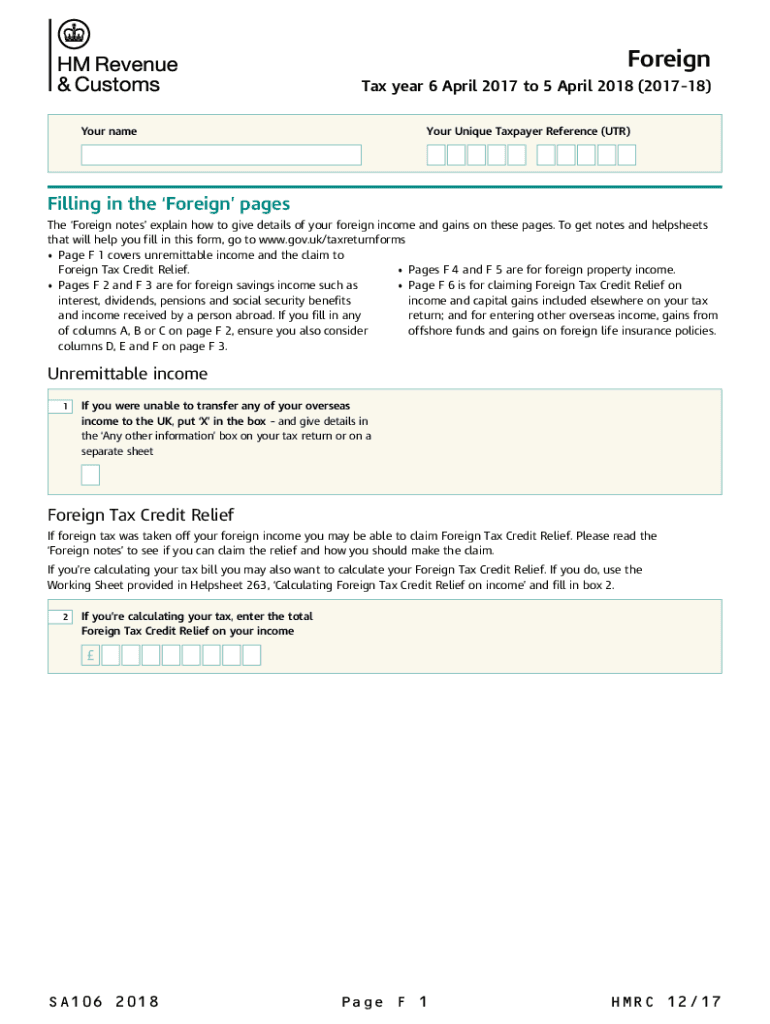

Foreign Tax year 6 April 2017 to 5 April 2018 (201718)Your numerous Unique Taxpayer Reference (UTC)Filling in the Foreign pages The Foreign notes explain how to give details of your foreign income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK HMRC SA106

Edit your UK HMRC SA106 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC SA106 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK HMRC SA106 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UK HMRC SA106. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC SA106 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC SA106

How to fill out UK HMRC SA106

01

Gather necessary documents like income statements and records of foreign income.

02

Start filling in personal details in the 'Your personal information' section.

03

Complete the 'Income' section by specifying all sources of income, including overseas income.

04

Fill out the 'Tax reliefs' section, if applicable, to claim any foreign tax relief.

05

Provide information in the 'Other information' section, if required.

06

Review all entered information for accuracy and completeness.

07

Sign and date the declaration at the end of the form.

Who needs UK HMRC SA106?

01

Individuals who are non-residents or have foreign income that is taxable in the UK.

02

Workers who live abroad but have income in the UK.

03

Those claiming relief on foreign tax paid.

Fill

form

: Try Risk Free

People Also Ask about

Who needs to fill in SA106?

You need to fill out the SA106 if you receive: interest from overseas savings. income from land and property abroad. income from overseas pensions.

How much foreign tax credit can I claim without filing form 1116?

Form 1116. You must prepare Form 1116 if your qualified foreign taxes are more than $300 for a single filer ($600 for married couples filing jointly), the income is non-passive, or your gross foreign income and taxes were not reported on a payee statement (such as a 1099).

Can I skip form 1116?

General Instructions You may be able to claim the foreign tax credit without filing Form 1116. By making this election, the foreign tax credit limitation (lines 15 through 23 of the form) won't apply to you. This election is available only if you meet all of the following conditions.

Can you claim foreign tax credit without filing form 1116?

To choose the foreign tax credit, you generally must complete Form 1116 and attach it to your Form 1040, Form 1040-SR or Form 1040-NR.

How do I report foreign earned income on my US tax return?

Reporting requirement for foreign accounts and assets Schedule B (Form 1040), Interest and Ordinary Dividends – In most cases, affected taxpayers attach Schedule B to their federal return to report foreign assets.

How do I claim foreign tax credit relief?

You can claim Foreign Tax Credit Relief when you report your overseas income in your Self Assessment tax return. You must register for Self Assessment before the 5th of October in any given year, and pay by 31st January the year after the tax year you're paying for.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get UK HMRC SA106?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the UK HMRC SA106 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the UK HMRC SA106 in Gmail?

Create your eSignature using pdfFiller and then eSign your UK HMRC SA106 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out UK HMRC SA106 on an Android device?

Use the pdfFiller Android app to finish your UK HMRC SA106 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is UK HMRC SA106?

UK HMRC SA106 is a supplementary income form used for reporting additional income or losses that are not included in the main tax return.

Who is required to file UK HMRC SA106?

Individuals who receive income from sources outside of employment or pension, such as rental income, self-employment, or other supplementary income, are required to file UK HMRC SA106.

How to fill out UK HMRC SA106?

To fill out UK HMRC SA106, you need to provide your personal details, report the supplementary income and expenses, and ensure that you accurately calculate any tax due. You may need guidance from HMRC or a tax professional.

What is the purpose of UK HMRC SA106?

The purpose of UK HMRC SA106 is to allow taxpayers to declare additional income and calculate their tax obligations accurately, ensuring compliance with tax laws.

What information must be reported on UK HMRC SA106?

The information that must be reported on UK HMRC SA106 includes details of the supplementary income received, any allowable expenses, and any tax adjustments or losses that are relevant to that income.

Fill out your UK HMRC SA106 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC sa106 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.