IRS 941 2020 free printable template

Show details

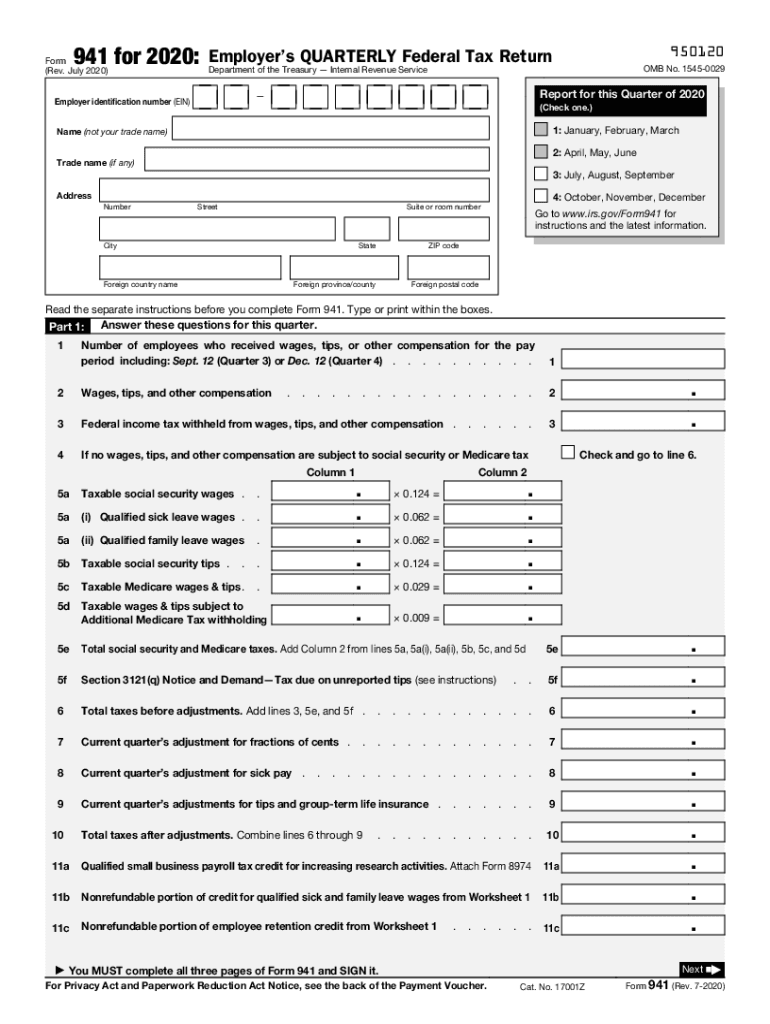

Don t use Form 941-V to make federal tax deposits. Use Form 941-V when making any payment with Form 941. Don t send cash. Don t staple Form 941-V or your payment to Form 941 or to each other. Detach Form 941-V and send it with your payment and Form 941 to the address in the Instructions for Note You must also complete the entity information above Part 1 on Form 941. Complete Schedule B Form 941 Report of Tax Liability for Semiweekly Schedule Depositors and attach it to Form 941. NW IR-6526...Washington DC 20224. Don t send Form 941 to this address. Instead see Where Should You File in the Instructions for Form 941. See Deposit Penalties in section 11 of Pub. 15. Detach Here and Mail With Your Payment and Form 941. 941-V Internal Revenue Service Don t staple this voucher or your payment to Form 941. Enter your employer identification number EIN. Cat. No. 17001Z Form 941 Rev. 1-2018 Part 2 Tell us about your deposit schedule and tax liability for this quarter. However if you pay an...amount with CAUTION Form 941 that should ve been deposited you may be subject to a penalty. Type or print within the boxes. Part 1 Answer these questions for this quarter. Number of employees who received wages tips or other compensation for the pay period including Mar* 12 Quarter 1 June 12 Quarter 2 Sept. 12 Quarter 3 or Dec* 12 Quarter 4 Wages tips and other compensation. Federal income tax withheld from wages tips and other compensation. If no wages tips and other compensation are subject to...social security or Medicare tax Column 1 5a Taxable social security wages. 5b 5c Taxable Medicare wages tips. 5d Taxable wages tips subject to Additional Medicare Tax withholding 5e Add Column 2 from lines 5a 5b 5c and 5d 5f Section 3121 q Notice and Demand Tax due on unreported tips see instructions Total taxes before adjustments. Add lines 3 5e and 5f. Current quarter s adjustment for fractions of cents. 0124 0. 029 0. 009 Check and go to line 6. Total taxes after adjustments. Combine lines 6...through 9 Qualified small business payroll tax credit for increasing research activities. For Privacy Act and Paperwork Reduction Act Notice see the back of the Payment Voucher. Send a refund. If you are unsure about whether you are a monthly schedule depositor or a semiweekly schedule depositor see section 11 of Pub. 15. Line 12 on this return is less than 2 500 or line 12 on the return for the prior quarter was less than 2 500 and you didn t incur a 100 000 next-day deposit obligation during...the current quarter. Go to Part 3. You were a monthly schedule depositor for the entire quarter. Enter your tax liability for each month and total liability for the quarter then go to Part 3. Tax liability Month 1 Total must equal line 12. You were a semiweekly schedule depositor for any part of this quarter. 17 If your business has closed or you stopped paying wages. enter the final date you paid wages / Check here and 18 If you are a seasonal employer and you don t have to file a return for...every quarter of the year Part 4 May we speak with your third-party designee Do you want to allow an employee a paid tax preparer or another person to discuss this return with the IRS See the instructions for details.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 941

How to edit IRS 941

How to fill out IRS 941

Instructions and Help about IRS 941

How to edit IRS 941

To edit the IRS 941 form, you can use pdfFiller’s editing tools. Upload your form to the platform, and use the editing features to make necessary changes. Ensure that all information is accurate and reflects your current employment data before submission.

How to fill out IRS 941

To fill out the IRS 941 form, follow these steps:

01

Gather your payroll records and employment tax information.

02

Start with your business's identifying information in Part 1 of the form.

03

Complete Parts 1 and 2 by reporting the number of employees and total wages paid.

04

In Part 3, calculate the taxes withheld from employees’ paychecks.

05

Review all sections for accuracy before filing.

About IRS previous version

What is IRS 941?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS previous version

What is IRS 941?

IRS 941, officially known as the "Employer's Quarterly Federal Tax Return," is a tax form used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks. The form helps the IRS track payroll tax compliance throughout the year.

What is the purpose of this form?

The purpose of the IRS 941 form is to ensure that employers report the correct amount of federal taxes withheld and to pay the appropriate amounts to the IRS on a quarterly basis. Proper reporting helps maintain compliance with federal tax laws.

Who needs the form?

Employers who pay wages to employees must file Form 941. This includes corporations, partnerships, and sole proprietors. Nonprofits that hire employees are also required to complete this form.

When am I exempt from filling out this form?

Employers are exempt from filling out IRS 941 if they have no wages subject to tax or have not paid any employees during the quarter. Additionally, some seasonal employers may only need to file for the quarters in which they actively payroll employees.

Components of the form

The IRS 941 form consists of several key components: Part 1 includes basic identifying information about the employer; Part 2 covers reconciliation of tax calculations; and Part 3 pertains to the verification of payments made. Each section must be completed accurately to avoid discrepancies.

What are the penalties for not issuing the form?

Filing IRS 941 late or failing to file can result in penalties. The IRS may impose a late filing penalty of 5% of the unpaid tax for each month the tax remains unpaid. Additional interest may accrue on unpaid amounts. Consistent non-compliance could also lead to more severe penalties and legal actions.

What information do you need when you file the form?

When filing IRS 941, gather the following information:

01

Your Employer Identification Number (EIN).

02

Total wages paid during the quarter.

03

The amount of federal tax withheld.

04

Number of employees reported.

05

Any adjustments from previous quarters.

Is the form accompanied by other forms?

IRS 941 may need to be accompanied by other forms such as Form 940, which is used for reporting Federal Unemployment Tax Act (FUTA) taxes. Employers should check if additional documents are required based on their specific financial situations.

Where do I send the form?

Where to send IRS 941 depends on your location and whether you're making a payment. If no payment accompanies the form, it can typically be submitted electronically or mailed to the appropriate IRS processing center for your state. Refer to the IRS website for the most updated mailing addresses.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Great software simple to use

Great software simple to useMakes my work a lot easier

Excellent

Excellent! Eliminates the concern of properly providing the essential information on documents. Takes a large load of concern off the mind. Highly recommended.

See what our users say