Get the free CHAPTER 13 DEBTORS REQUEST TO INCUR DEBT

Show details

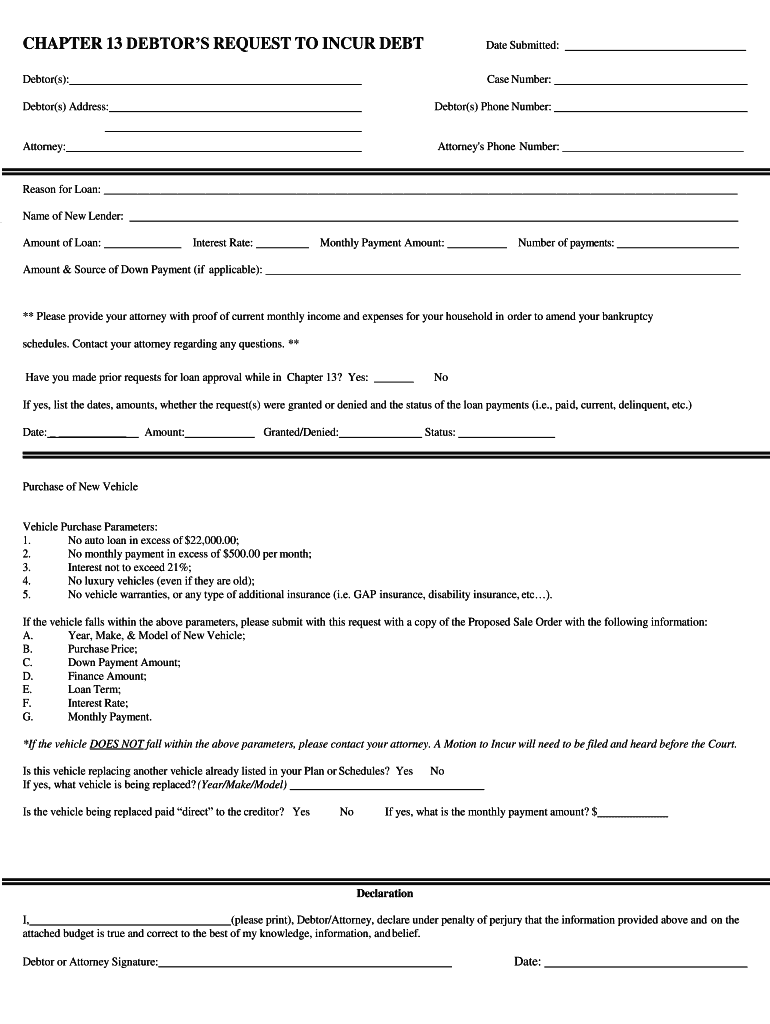

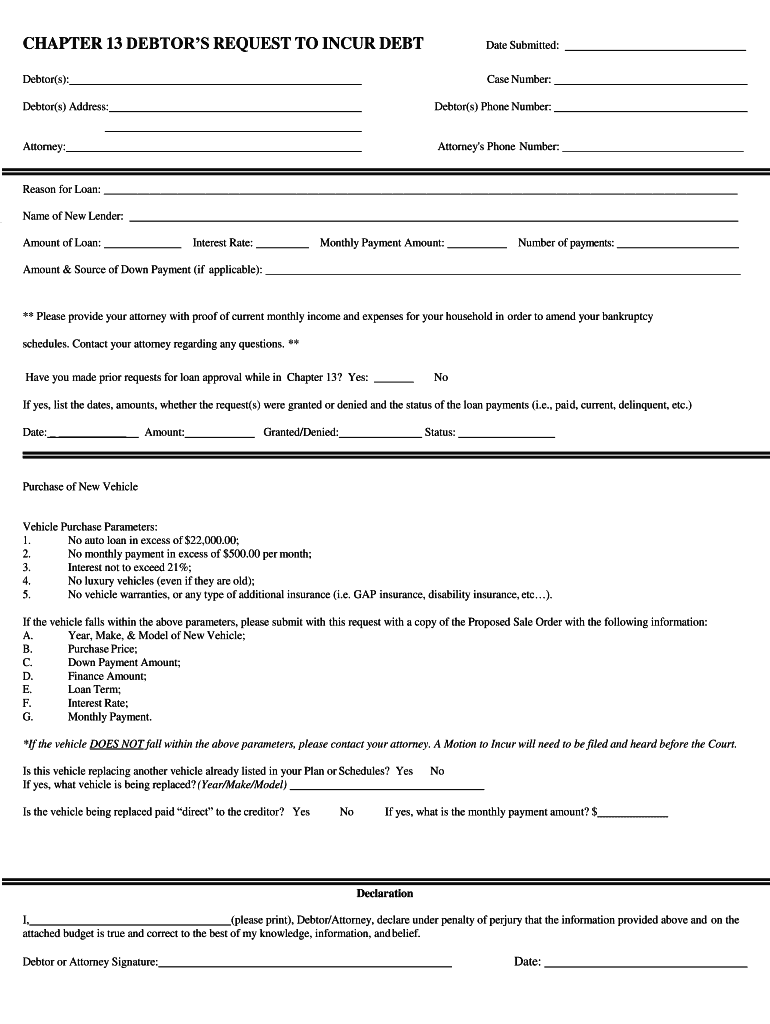

CHAPTER 13 DEBTORS REQUEST TO INCUR Debate Submitted:Debtor(s):Case Number:Debtor(s) Address:Debtor(s) Phone Number:Attorney:Attorney's Phone Number: Reason for Loan: Name of New Lender: Amount of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chapter 13 debtors request

Edit your chapter 13 debtors request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chapter 13 debtors request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chapter 13 debtors request online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit chapter 13 debtors request. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chapter 13 debtors request

How to fill out chapter 13 debtors request

01

Begin by gathering all the necessary financial information, including your income, expenses, assets, and debts.

02

Complete the official Chapter 13 Debtors Request form, which can be obtained from the bankruptcy court or their website.

03

Provide accurate and detailed information about your financial situation, including your monthly income, expenses, and any assets you own.

04

Include a proposed repayment plan, outlining how you intend to repay your debts over a period of three to five years.

05

Attach supporting documents, such as pay stubs, tax returns, and bank statements, to verify your income and financial status.

06

Review the completed form and supporting documents for accuracy before submitting them to the bankruptcy court.

07

File the Chapter 13 Debtors Request form with the appropriate bankruptcy court and pay the required filing fee.

08

Attend the mandatory creditors' meeting, where you will discuss your proposed repayment plan with your creditors and the bankruptcy trustee.

09

Adhere to the repayment plan approved by the court, making timely payments according to the schedule outlined in the plan.

10

Comply with all other requirements and obligations set forth by the bankruptcy court throughout the duration of your Chapter 13 bankruptcy.

Who needs chapter 13 debtors request?

01

Chapter 13 debtors request is needed by individuals who are struggling with overwhelming debt and wish to reorganize their finances through a court-approved repayment plan.

02

It is typically useful for individuals who have a regular income and want to avoid liquidating their assets or surrendering their property, as Chapter 13 allows them to retain their assets while repaying their debts over time.

03

Chapter 13 can be a viable option for those whose debts exceed the limits set for Chapter 7 bankruptcy or for individuals who have substantial non-exempt assets they wish to protect.

04

Ultimately, anyone facing significant debt and seeking a structured repayment plan under the supervision of the bankruptcy court may benefit from filing a Chapter 13 debtors request.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my chapter 13 debtors request in Gmail?

chapter 13 debtors request and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I complete chapter 13 debtors request online?

Completing and signing chapter 13 debtors request online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I sign the chapter 13 debtors request electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your chapter 13 debtors request in minutes.

What is chapter 13 debtors request?

Chapter 13 debtors request refers to the formal application submitted by individuals seeking to reorganize their debts under Chapter 13 of the U.S. Bankruptcy Code. It allows debtors to create a plan to repay all or part of their debts over a specified period.

Who is required to file chapter 13 debtors request?

Individuals with a regular income who wish to restructure their debts are required to file a Chapter 13 debtors request. This is typically for those who do not qualify for Chapter 7 bankruptcy or prefer to keep their assets while repaying creditors.

How to fill out chapter 13 debtors request?

Filling out a Chapter 13 debtors request involves completing various forms, including the voluntary petition for bankruptcy, schedules of assets and liabilities, and a proposed repayment plan. It is advisable to seek assistance from a bankruptcy attorney or a financial advisor.

What is the purpose of chapter 13 debtors request?

The purpose of a Chapter 13 debtors request is to provide a mechanism for individuals to propose a repayment plan to pay back their debts over three to five years, enabling them to retain ownership of their assets while addressing their financial obligations.

What information must be reported on chapter 13 debtors request?

The Chapter 13 debtors request must include personal information, a list of all creditors, the amount and nature of debts, income sources, monthly expenses, and a detailed repayment plan outlining how debts will be repaid.

Fill out your chapter 13 debtors request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chapter 13 Debtors Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.