Get the free Australian Regulated Trusts include self-managed super funds,

Show details

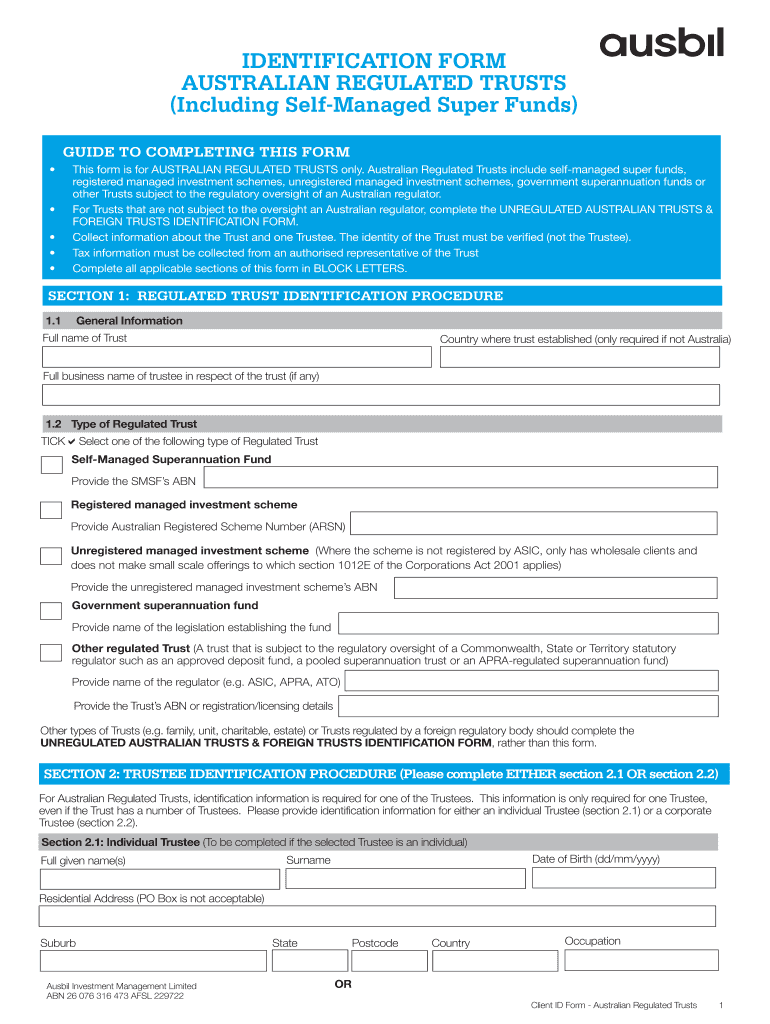

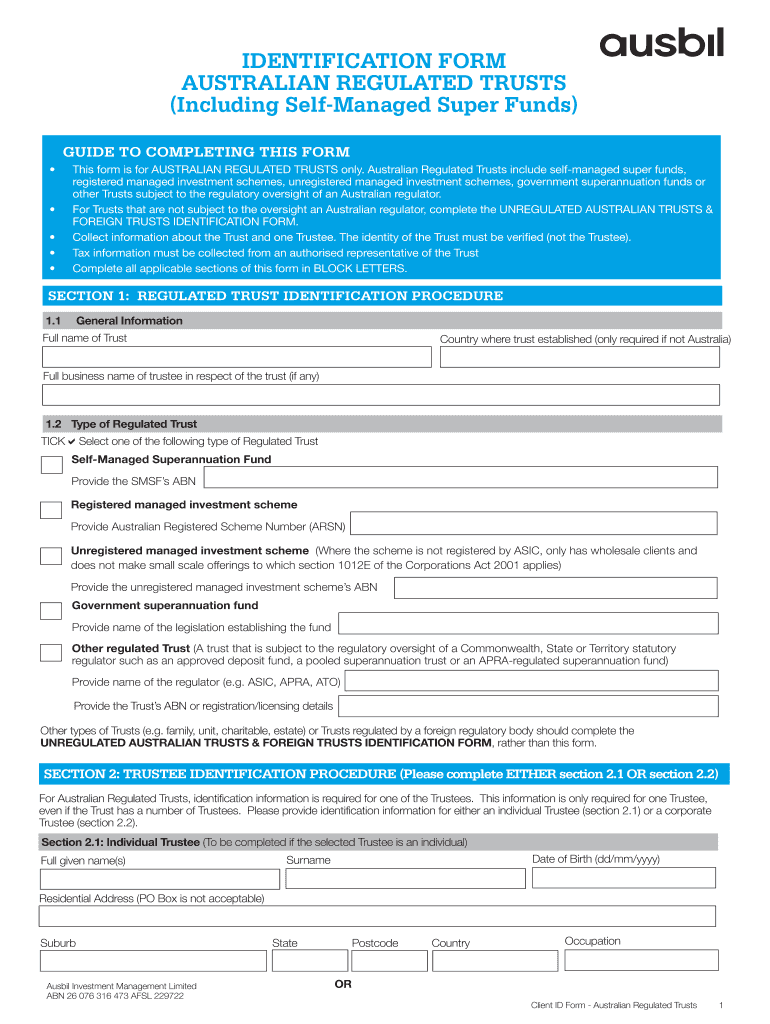

IDENTIFICATION FORM

AUSTRALIAN REGULATED TRUSTS

(Including Self-managed Super Funds)

GUIDE TO COMPLETING THIS FORM is for AUSTRALIAN REGULATED TRUSTS only. Australian Regulated Trusts include self-managed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign australian regulated trusts include

Edit your australian regulated trusts include form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your australian regulated trusts include form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing australian regulated trusts include online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit australian regulated trusts include. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out australian regulated trusts include

How to fill out australian regulated trusts include

01

To fill out an Australian regulated trust, follow these steps:

02

Obtain the necessary trust deed: A trust deed is a legal document that outlines the terms and conditions of the trust. It is important to have a properly drafted trust deed that complies with Australian regulations.

03

Identify the settlor and trustee: The settlor is the person who establishes the trust, while the trustee is responsible for managing the trust assets and carrying out the trust's objectives.

04

Settle the trust property: The settlor must transfer assets into the trust, which will become the trust property. This can include cash, real estate, or other valuable assets.

05

Specify the beneficiaries: Identify the individuals or organizations who will benefit from the trust. This can include family members, charities, or any other designated beneficiaries.

06

Determine the trust terms: Outline the rules and conditions that govern the trust. This includes how the trust assets will be managed, distributed, and taxed.

07

Comply with legal and tax requirements: Ensure that the trust is registered with the appropriate authorities and meets all tax obligations. Seek professional advice if necessary.

08

Maintain proper records: Keep accurate records of all trust transactions, including income, expenses, and distributions. This is essential for compliance and accountability.

09

Regularly review and update the trust: As circumstances change, it is important to review and update the trust to ensure it remains relevant and effective.

Who needs australian regulated trusts include?

01

Australian regulated trusts can be beneficial for various individuals and entities including:

02

- High-net-worth individuals: Trusts can provide asset protection, tax planning, and estate planning benefits for individuals with significant wealth.

03

- Business owners: Trusts can be useful for structuring business ownership, succession planning, and separating personal and business assets.

04

- Families: Trusts can help preserve family wealth, provide for future generations, and protect assets from potential risks or disputes.

05

- Charities and non-profit organizations: Trusts can be used to manage and distribute funds for charitable purposes in a structured and transparent manner.

06

- Investors: Trusts can offer investment opportunities and tax advantages for investors looking to diversify their portfolios.

07

- Estate planners: Trusts can be an effective tool for managing and distributing assets in accordance with an individual's wishes after their passing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get australian regulated trusts include?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific australian regulated trusts include and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I edit australian regulated trusts include on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign australian regulated trusts include on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Can I edit australian regulated trusts include on an Android device?

You can make any changes to PDF files, like australian regulated trusts include, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is australian regulated trusts include?

Australian regulated trusts include various trusts that are governed by specific regulatory frameworks, often related to superannuation, managed investment schemes, and other forms of collective investment vehicles.

Who is required to file australian regulated trusts include?

Trustees of regulated trusts, fund managers, and entities that manage investments on behalf of beneficiaries are typically required to file Australian regulated trusts.

How to fill out australian regulated trusts include?

To fill out Australian regulated trusts, practitioners must provide comprehensive information on trust operations, including financial statements, asset details, and beneficiaries' distributions as required by the relevant authorities.

What is the purpose of australian regulated trusts include?

The purpose of Australian regulated trusts includes ensuring compliance with financial regulations, protecting investors' interests, and promoting transparency in the management of trusts.

What information must be reported on australian regulated trusts include?

Information required to be reported includes trust details, financial performance, distribution reports to beneficiaries, and compliance with tax obligations.

Fill out your australian regulated trusts include online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Australian Regulated Trusts Include is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.