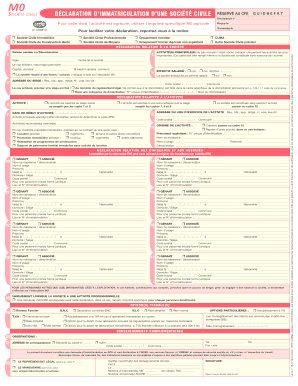

Get the free X C Corporation

Show details

W9Form

(Rev. October 2018)

Department of the Treasury

Internal Revenue ServiceRequest for Taxpayer

Identification Number and Certification

give Form to the

requester. Do not

send to the IRS. Go to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign x c corporation

Edit your x c corporation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your x c corporation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit x c corporation online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit x c corporation. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out x c corporation

How to fill out x c corporation

01

To fill out an x c corporation, follow these steps:

02

Obtain the necessary forms from the respective state's secretary of state office or website

03

Provide the required information such as the corporation's name, address, and registered agent

04

Determine the corporation's shares and share classes, if applicable

05

Fill out the articles of incorporation and ensure all required details are included

06

Prepare the bylaws, which outline the internal rules and procedures for the corporation

07

File the completed forms, articles of incorporation, and bylaws with the secretary of state

08

Pay the required filing fee

09

Keep copies of all the filed documents for future reference

10

Obtain an employer identification number (EIN) from the Internal Revenue Service (IRS)

11

Comply with any additional state-specific requirements or regulations

12

Consult with an attorney or tax professional to ensure compliance with all legal obligations.

Who needs x c corporation?

01

The following entities or individuals may need an x c corporation:

02

Small businesses looking for liability protection: Incorporating as a corporation can help separate personal and business liabilities, providing added protection for the owners.

03

Companies planning to raise capital: Corporations can issue different classes of shares, making it easier to attract investors and raise funds for expansion.

04

Businesses aiming for perpetual existence: Corporations can continue to exist even if the owners or shareholders change, making it a suitable choice for long-term ventures.

05

Entities seeking tax advantages: C corporations have the potential for more favorable tax treatment and may offer certain deductions and benefits.

06

Startups and high-growth companies: Incorporating as a corporation can help attract investors, facilitate equity-based compensation plans, and provide a scalable structure.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my x c corporation directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your x c corporation along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send x c corporation for eSignature?

When you're ready to share your x c corporation, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in x c corporation without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing x c corporation and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is x c corporation?

An X C Corporation, also known simply as a C Corporation, is a type of legal structure for a corporation in the United States that is taxed separately from its owners under Subchapter C of the Internal Revenue Code.

Who is required to file x c corporation?

Any corporation that elects to be treated as a C Corporation under the Internal Revenue Code is required to file Form 1120 to report its income, gains, losses, deductions, and credits.

How to fill out x c corporation?

To fill out an X C Corporation, you must complete Form 1120, including sections on income, deductions, and tax credits, and provide the required information about the corporation's business activities, shareholders, and any other tax-related information.

What is the purpose of x c corporation?

The purpose of a C Corporation is to conduct business, generate profits, and protect the owners (shareholders) from personal liability for the corporation’s debts and obligations, while also providing potential tax advantages.

What information must be reported on x c corporation?

Information to be reported on Form 1120 includes corporate income, business expenses, tax credits, dividends received, and details about shareholders, as well as any capital gains and losses.

Fill out your x c corporation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

X C Corporation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.