IRS 9465 Instructions 2020 free printable template

Show details

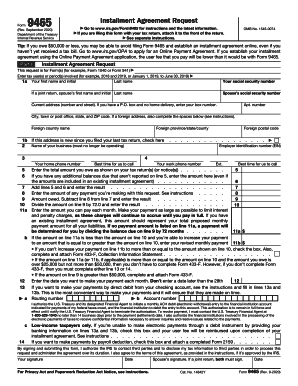

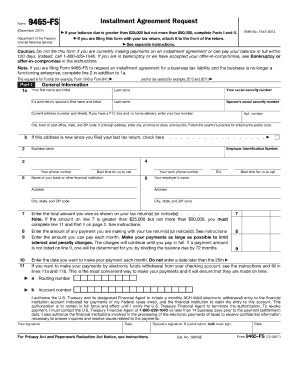

Instructions for Form 9465Department of the Treasury

Internal Revenue Service(Rev. October 2020)Installment Agreement Request

(For use with Form 9465 (Rev. September 2020))

Section references are

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your irs instructions form 9465 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs instructions form 9465 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs instructions form 9465 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit for 9465 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

IRS 9465 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs instructions form 9465

How to fill out IRS instructions form 9465?

01

Gather necessary information: Before filling out form 9465, make sure you have all the required information at hand. This includes your name, social security number, address, phone number, and the amount you owe to the IRS.

02

Complete the personal information section: Begin by filling out your personal information on the form. This includes your name, address, and social security number. Ensure that all information is accurate and up-to-date.

03

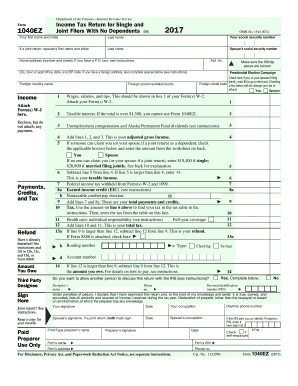

Provide your tax information: Next, you'll need to enter your tax information. This includes the tax year for which you owe, the type of tax you owe (e.g., income tax), and the total amount owed. Double-check your calculations to avoid any errors.

04

Determine your monthly payment: In this section, you'll calculate the maximum monthly amount you can afford to pay towards your tax debt. You have the option to propose a monthly payment amount, but the IRS may adjust it based on their guidelines. Make sure you are realistic in your proposed amount.

05

Choose your payment method: Indicate your preferred method of payment, whether by direct debit, check, or money order. Provide the necessary details, such as your bank account information, if you opt for direct debit.

06

Consider additional options: If you require additional time to pay your debt or if you're experiencing financial hardship, you may want to consider other IRS programs like an installment agreement or an offer in compromise. The form provides options to indicate your interest in such programs.

Who needs IRS instructions form 9465?

01

Taxpayers with outstanding tax balances: Individuals who owe money to the IRS for unpaid taxes may need to use form 9465 to set up a payment plan. This form is for taxpayers who are unable to pay their tax debt in full immediately.

02

Those who cannot pay their tax debt in full: If you cannot afford to pay your entire tax debt at once, form 9465 allows you to propose a monthly payment plan to the IRS. This form helps individuals in financial hardship to manage their tax obligations.

03

Individuals seeking to avoid collection actions: Form 9465 provides an avenue for taxpayers to arrange a payment plan with the IRS voluntarily. By filling out this form, you may be able to avoid more severe collection actions, such as levies or garnishments.

Overall, form 9465 serves as a tool for individuals who owe taxes and need to establish a payment plan with the IRS. It helps taxpayers fulfill their tax obligations while considering their financial circumstances.

Fill instructions 9465 : Try Risk Free

People Also Ask about irs instructions form 9465

In which situation should an individual not use form 9465 to file?

When should I file form 9465?

Who can use form 9465?

Can I file IRS form 9465 electronically?

What is IRS form 9465 used for?

Do I need to fill out form 9465?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file irs instructions form 9465?

Anyone who is unable to pay their taxes in full and is requesting an installment agreement with the IRS is required to file Form 9465.

What information must be reported on irs instructions form 9465?

The IRS instructions form 9465 requires taxpayers to provide information about their filing status, income, assets, and liabilities. Additionally, taxpayers must provide information about any payment plan they are requesting, as well as their estimated tax liability and any additional information that is needed to complete the form.

What is the penalty for the late filing of irs instructions form 9465?

The penalty is 5% of the total amount of the taxes due for each month or part of a month that a tax return is late, up to a maximum of 25%. Additionally, there may be a minimum late filing penalty of $135 or 100% of the unpaid taxes, whichever is less.

What is irs instructions form 9465?

IRS form 9465 is used by individuals to request a monthly installment plan when they are unable to pay their tax bill in full. The form provides instructions on how to complete it and submit it to the IRS. It includes information about the taxpayer's financial situation, proposed monthly payment amount, and a signature to authorize the direct debit of funds from a bank account. The instructions also include details on the penalties and interest charges that may apply to unpaid tax balances and steps to take if the taxpayer is unable to pay their taxes.

How to fill out irs instructions form 9465?

To correctly fill out Form 9465, Installment Agreement Request, follow these steps:

1. Provide your personal information at the top of the form. Include your name, address, and Social Security Number or Employer Identification Number.

2. Indicate the type of return you are requesting an installment agreement for on Line 1.

3. Determine the amount of tax you owe and enter it on Line 2. If you are unsure of the exact amount, refer to your tax return or contact the IRS.

4. Calculate the amount you can afford to pay each month in your installment agreement proposal. Enter this amount on Line 4a and the day of the month you wish to make your payment on Line 4b.

5. If you are unable to complete payments within a specific time frame or have ongoing financial difficulties, check the box on Line 5 and provide an explanation for your situation.

6. On Line 6, indicate if you currently have any outstanding balances or installment agreements with the IRS.

7. If you want to make your payments through a Direct Debit from your bank account, check the appropriate box on Line 7.

8. If you are requesting a Partial Payment Installment Agreement, check the box on Line 8 and include your proposed monthly payment amount and information about your assets and income on Form 433-A or 433-F.

9. Provide your signature and date on Line 11. If someone else helped you prepare the form, they should complete the "Paid Preparer's Use Only" section at the bottom.

10. Make a copy of the completed form for your records before mailing it to the address provided in the instructions.

Note: Make sure to read the instructions thoroughly as they provide additional guidance and details that may be specific to your situation. It's always recommended to consult a tax professional if you have any doubts or need further assistance.

What is the purpose of irs instructions form 9465?

IRS instructions form 9465 is used to provide guidance and instructions on how to complete form 9465, which is the Installment Agreement Request. The purpose of form 9465 is to request a monthly payment plan if an individual or business is unable to pay their full tax liability by the due date. The form provides instructions on how to complete the necessary information, including the taxpayer's personal and financial details, the amount of taxes owed, proposed monthly payment amount, and other necessary information. The instructions inform taxpayers on how to calculate and propose a reasonable payment plan to the IRS, along with any additional documentation or requirements that may be needed.

When is the deadline to file irs instructions form 9465 in 2023?

The specific deadline to file IRS Form 9465 in 2023 can vary depending on different factors such as your tax filing status and the tax year for which you are requesting the installment agreement. However, the general deadline to file IRS Form 9465 is typically the same as the regular tax filing deadline, which is April 15th. If April 15th falls on a weekend or a holiday, the deadline is typically extended to the next business day.

How can I get irs instructions form 9465?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific for 9465 form and other forms. Find the template you need and change it using powerful tools.

How do I edit instructions 9465 in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing 9465 sample and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the 9465 template electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your for 9465 form in seconds.

Fill out your irs instructions form 9465 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instructions 9465 is not the form you're looking for?Search for another form here.

Keywords relevant to irs instructions form 9465

Related to instructions for 9465

If you believe that this page should be taken down, please follow our DMCA take down process

here

.