IRS 9465 Instructions 2018 free printable template

Show details

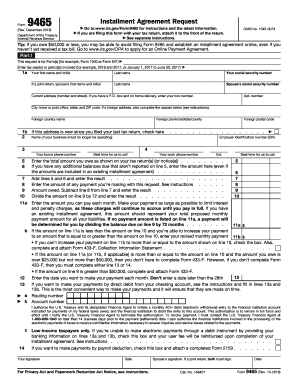

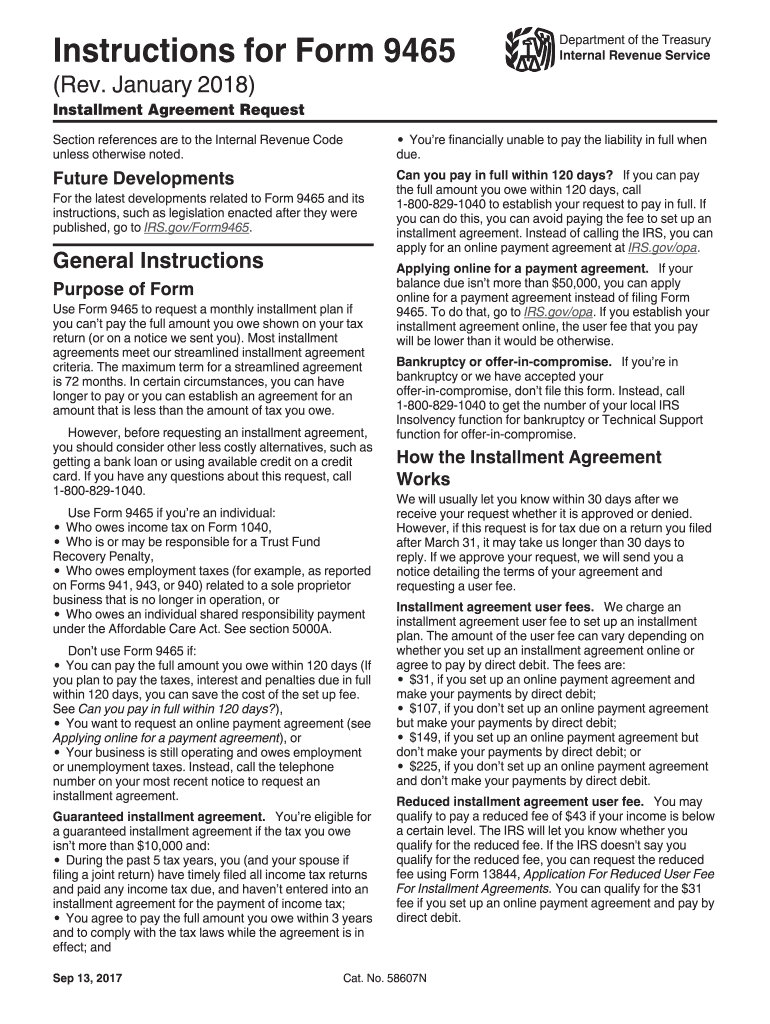

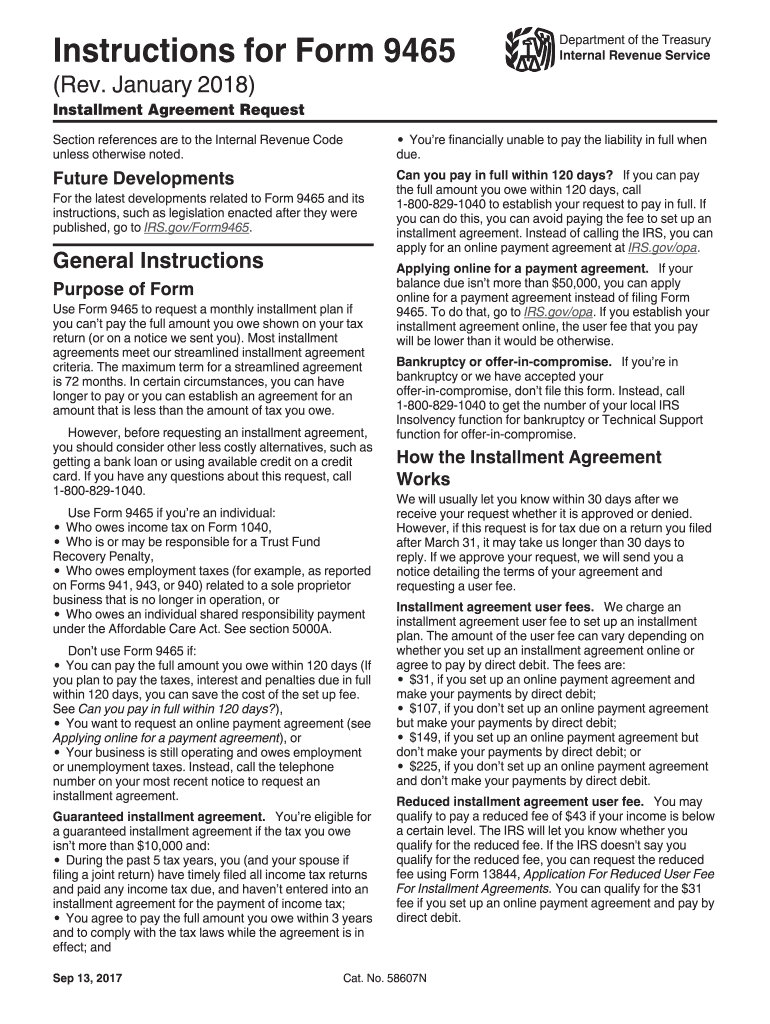

Instructions for Form 9465Department of the Treasury

Internal Revenue Service(Rev. January 2018)Installment Agreement Request

Section references are to the Internal Revenue Code

unless otherwise noted.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 9465 Instructions

Edit your IRS 9465 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 9465 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 9465 Instructions online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS 9465 Instructions. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 9465 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 9465 Instructions

How to fill out IRS 9465 Instructions

01

Obtain Form 9465 from the IRS website or your tax professional.

02

Fill in your name, address, and Social Security number at the top of the form.

03

Specify the amount you owe on your tax return in the relevant section.

04

Choose your preferred payment plan (monthly payment amount and duration).

05

Complete any necessary bank information if you want to set up direct debit.

06

Sign and date the form.

07

Attach the completed Form 9465 to your tax return or send it separately to the IRS.

Who needs IRS 9465 Instructions?

01

Individuals who owe taxes and need an installment agreement to pay off their tax debt.

02

Taxpayers who cannot pay their tax liability in full by the due date.

03

Anyone seeking to formally request a payment plan with the IRS.

Fill

form

: Try Risk Free

People Also Ask about

What is the income limit for M1PR in Minnesota?

Who can claim the credit? Homeowners with household income less than $128,280 can claim a refund up to $3,140. Homeowners and mobile home owners: must have owned and lived in your home on January 2, 2023.

Do I qualify for MN property tax refund?

You are a Minnesota resident or spent at least 183 days in the state. You lived in and paid rent on a Minnesota building where the owner was assessed property tax or made payments in lieu of property tax. Your household income for 2022 was less than $69,520.

Who qualifies for M1PR?

If you are a renter, you must have lived in a building where either: — Property taxes were payable in 2022, or — Payments in lieu of property taxes (such as special assessments) were payable in 2022 If you are not sure if either of these apply, check with your building manager or county treasurer's office.

What is Minnesota Form M1PR?

2022 Form M1PR, Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund.

Where do I mail my MN M1PR form?

Mail to: Minnesota Property Tax Refund St. Paul, MN 55145-0020 Renters — Include your 2020 CRP(s).

What is mn form M1PR?

If you are not a U.S. citizen or permanent resident, you may qualify for a property tax refund if you owned a home or rented a property in Minnesota. Claim this refund by filing Form M1PR, Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 9465 Instructions in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your IRS 9465 Instructions and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send IRS 9465 Instructions to be eSigned by others?

To distribute your IRS 9465 Instructions, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make edits in IRS 9465 Instructions without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your IRS 9465 Instructions, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is IRS 9465 Instructions?

IRS 9465 Instructions provide guidance on how to complete Form 9465, which is used to request a monthly installment plan for paying tax debts owed to the IRS.

Who is required to file IRS 9465 Instructions?

Taxpayers who owe federal taxes and cannot pay the full amount by the due date may file IRS Form 9465 to request an installment agreement.

How to fill out IRS 9465 Instructions?

To fill out IRS 9465 Instructions, you need to provide your personal information, the amount you owe, and the proposed monthly payment you can afford to make towards your tax debt.

What is the purpose of IRS 9465 Instructions?

The purpose of IRS 9465 Instructions is to help taxpayers understand the process of applying for an installment agreement with the IRS, allowing them to pay off their tax debts over time.

What information must be reported on IRS 9465 Instructions?

The information required on IRS 9465 includes the taxpayer's name, address, Social Security number, the amount of tax owed, and the proposed monthly payment amount.

Fill out your IRS 9465 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 9465 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.